- United States

- /

- Insurance

- /

- NasdaqGS:ESGR

I Ran A Stock Scan For Earnings Growth And Enstar Group (NASDAQ:ESGR) Passed With Ease

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Enstar Group (NASDAQ:ESGR). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Enstar Group

Enstar Group's Improving Profits

In the last three years Enstar Group's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Like the last firework on New Year's Eve accelerating into the sky, Enstar Group's EPS shot from US$27.31 to US$51.13, over the last year. You don't see 87% year-on-year growth like that, very often. That could be a sign that the business has reached a true inflection point.

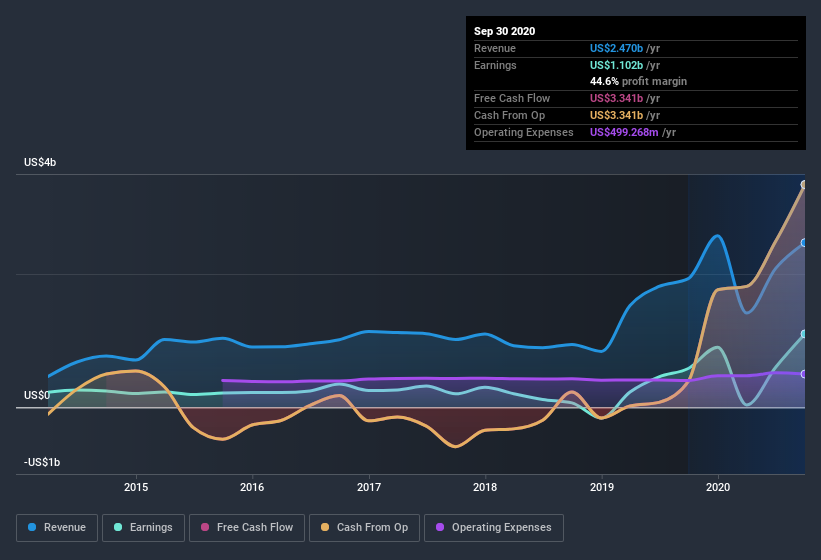

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. I note that Enstar Group's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Enstar Group shareholders can take confidence from the fact that EBIT margins are up from 29% to 42%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Enstar Group's balance sheet strength, before getting too excited.

Are Enstar Group Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The first bit of good news is that no Enstar Group insiders reported share sales in the last twelve months. But the really good news is that Independent Director Hans-Peter Gerhardt spent US$494k buying stock stock, at an average price of around US$124. Big buys like that give me a sense of opportunity; actions speak louder than words.

On top of the insider buying, it's good to see that Enstar Group insiders have a valuable investment in the business. Indeed, they have a glittering mountain of wealth invested in it, currently valued at US$212m. I would find that kind of skin in the game quite encouraging, if I owned shares, since it would ensure that the leaders of the company would also experience my success, or failure, with the stock.

Is Enstar Group Worth Keeping An Eye On?

Enstar Group's earnings per share have taken off like a rocket aimed right at the moon. The incing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Enstar Group deserves timely attention. Don't forget that there may still be risks. For instance, we've identified 1 warning sign for Enstar Group that you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Enstar Group, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Enstar Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Enstar Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:ESGR

Enstar Group

Acquires and manages insurance and reinsurance companies and portfolios in run-off in the United States, the United Kingdom, Europe, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives