- United States

- /

- Insurance

- /

- NasdaqGS:BWIN

Baldwin Insurance Group (BWIN): Valuation Insights Following Credit Agreement Changes and Raymond James Downgrade

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 26.1% Undervalued

According to the most widely followed narrative, Baldwin Insurance Group is trading well below the consensus fair value. This suggests meaningful upside if aggressive growth assumptions play out as expected.

Baldwin's rapid expansion of embedded insurance partnerships in mortgage and real estate channels, combined with exclusive agreements with major mortgage originators, is expected to unlock a multi-year pipeline of new distribution opportunities. This sets the stage for strong organic revenue growth as adoption and lead conversion rates scale.

Curious what makes this stock look so cheap to analysts? The story hinges on bold growth projections, margin recovery, and a steeply rising profit multiple. Find out what’s fueling these expectations and the exact assumptions behind this bullish price target. The full narrative reveals the audacious forecasts driving today’s valuation gap.

Result: Fair Value of $41.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent pricing pressure or unfavorable shifts in Baldwin’s key segments could quickly undermine these optimistic growth and valuation assumptions.

Find out about the key risks to this Baldwin Insurance Group narrative.Another View: What About Revenue Ratios?

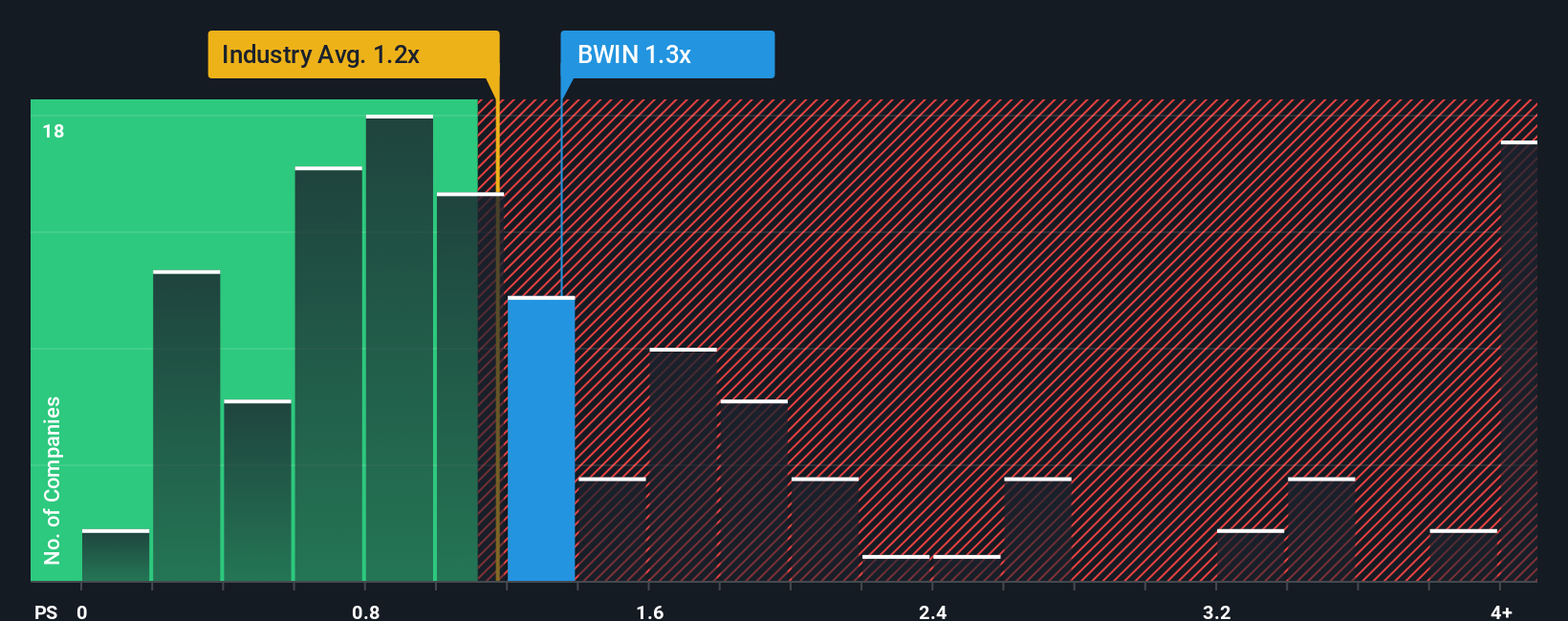

While analysts see upside based on future earnings, a different picture emerges when looking at the price-to-sales ratio. Compared to the industry average, Baldwin Insurance Group appears expensive. Could the premium be justified, or is caution needed?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Baldwin Insurance Group to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Baldwin Insurance Group Narrative

If this story doesn't sit right with you, or you'd like to dive into the numbers yourself, you can put together your own in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Baldwin Insurance Group.

Looking for More Investment Ideas?

Don’t let great opportunities pass you by. The market is full of hidden gems and cutting-edge trends you can act on today, all thanks to expert-powered screeners that take uncertainty out of your research.

- Unlock steady income streams and shield your portfolio from volatility by checking out dividend stocks with yields > 3%, which offers reliable yields above 3%.

- Seize the potential of tomorrow’s technology giants by pursuing AI penny stocks, featuring leaders in artificial intelligence, automation, and smart solutions.

- Spot undervalued gems with strong cash flow prospects and maximize your upside in today’s market by using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baldwin Insurance Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BWIN

Baldwin Insurance Group

Operates as an independent insurance distribution firm that delivers insurance and risk management solutions in the United States.

High growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives