- United States

- /

- Insurance

- /

- NasdaqGS:ACGL

Is Arch Capital Group's (ACGL) India Office Expansion Signaling a New Phase in Its Global Operating Model?

Reviewed by Sasha Jovanovic

- Arch Global Services India recently opened a new 26,000-square-foot office in Trivandrum's Technopark, strengthening Arch Capital Group's presence in India alongside its new Hyderabad technology hub.

- This expansion highlights Arch Capital Group's commitment to scaling global operations and investing in collaborative, innovation-driven workspaces to support business growth.

- We'll explore how Arch's focus on international expansion and investment in talent may influence its outlook and analyst assumptions.

AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Arch Capital Group Investment Narrative Recap

To be a shareholder in Arch Capital Group, you would need to believe in its ability to execute on global expansion and harness new talent to drive operational efficiency, particularly as competition and catastrophe losses remain challenging. The recent office openings in Trivandrum and Hyderabad reinforce Arch’s operational scale, but do not meaningfully alter key near-term catalysts like capital deployment and risk management, nor do they eliminate exposure to property and casualty market volatility.

Of the latest company announcements, Arch Capital Group’s ongoing share buyback program stands out as most relevant. It signals a continued focus on enhancing shareholder value, with over US$1.1 billion allocated to share repurchases even as the company invests in global growth initiatives, aligning with capital management as a primary short-term catalyst for the business.

By contrast, investors should also be mindful of Arch’s continued exposure to natural disaster risk in the property and casualty segment, especially as...

Read the full narrative on Arch Capital Group (it's free!)

Arch Capital Group's forecast points to $19.3 billion in revenue and $4.0 billion in earnings by 2028. This scenario assumes a -0.2% annual revenue decline and an increase in earnings of $0.3 billion from $3.7 billion.

Uncover how Arch Capital Group's forecasts yield a $108.31 fair value, a 25% upside to its current price.

Exploring Other Perspectives

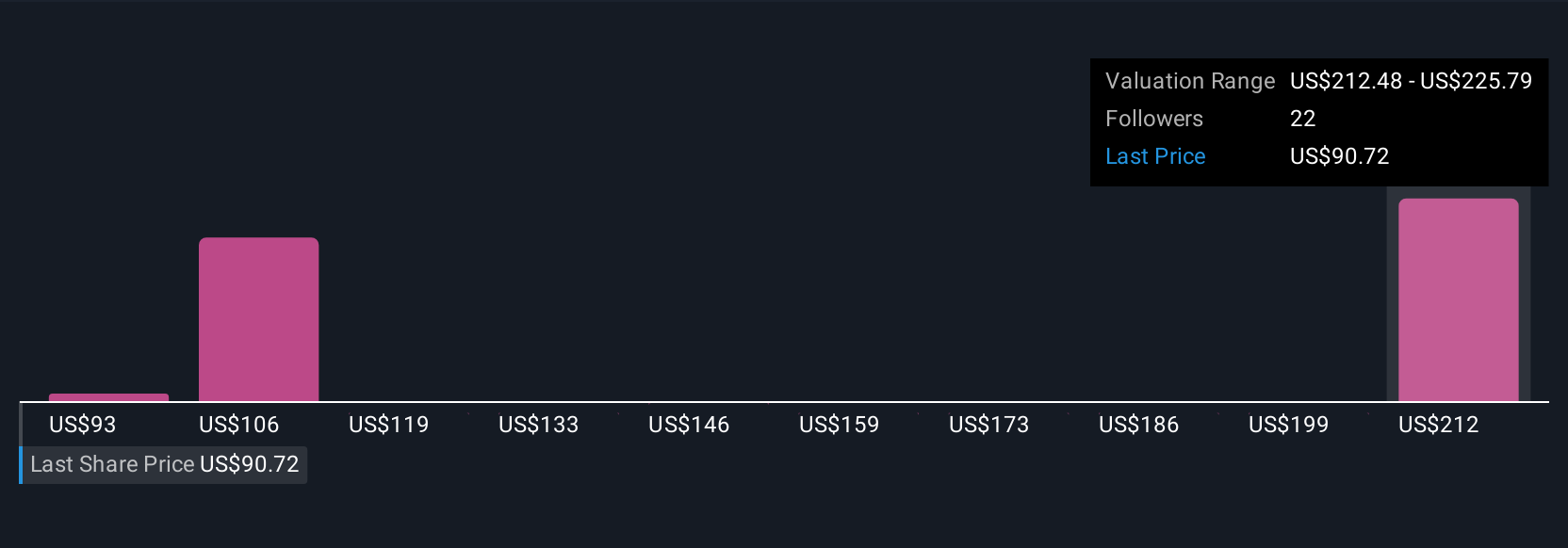

Four private investors in the Simply Wall St Community put Arch Capital Group’s fair value between US$92.76 and US$223.23. While capital allocation and share buyback activity shape market sentiment, property and casualty risk remains at the forefront of long-term performance, consider all these viewpoints when assessing opportunity.

Explore 4 other fair value estimates on Arch Capital Group - why the stock might be worth over 2x more than the current price!

Build Your Own Arch Capital Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Arch Capital Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Arch Capital Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Arch Capital Group's overall financial health at a glance.

No Opportunity In Arch Capital Group?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ACGL

Arch Capital Group

Provides insurance, reinsurance, and mortgage insurance products in the United States, Canada, Bermuda, the United Kingdom, Europe, and Australia.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives