- United States

- /

- Household Products

- /

- NYSE:PG

The Procter & Gamble Company (NYSE:PG) is Attractive to Institutions in the Inflationary Market

Key Takeaways:

- P&G delivered results in-line with expectations

- Management doesn't fear the recession but is unsure about inflationary pressures

- Ray Dalio is buying the stock, which seems to be cheaper than its category peers

It is not a secret that Consumer Staples do better than average in market downturns, especially when inflation is added to the mix. Currently, this sector is still down for the year (-5.2%) but doing much better than the broad market.

As the earnings season reaches its peak, we’ll look into the latest results from The Procter & Gamble Company ( NYSE: PG ) , a company that trades at a cheaper valuation than the sector’s average.

See our latest analysis for Procter & Gamble

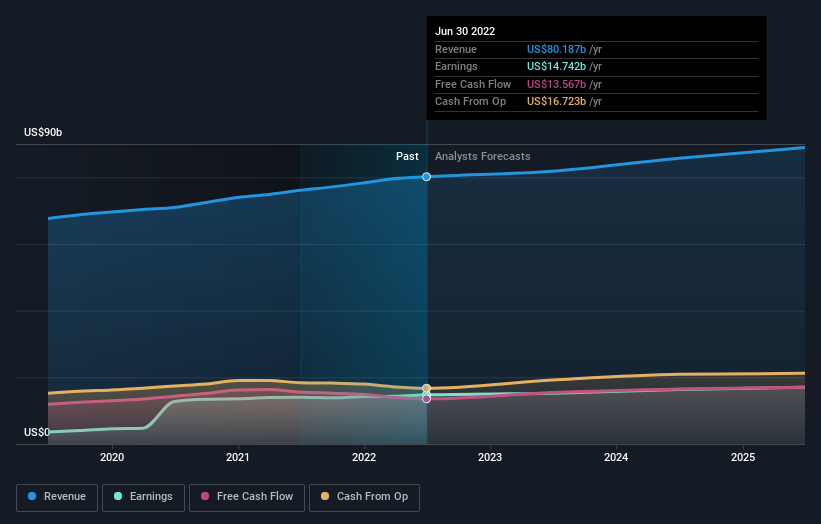

Procter & Gamble Earnings results

- EPS: US$6.00 (up from US$5.69 in FY 2021).

- Revenue: US$80.2b (up 5.3% from FY 2021).

- Net income: US$14.7b (up 5.0% from FY 2021).

- Profit margin: 18% (in line with FY 2021).

Over the next year, revenue is forecast to grow 2.1%, compared to a 2.7% growth forecast for the industry in the US. Over the last 3 years, on average, earnings per share have increased by 39% per year, but the company’s share price has only increased by 6% per year, which means it is significantly lagging behind earnings growth.

The company delivered earnings broadly in line with expectations, although management noted that rising costs caused gross margins to shrink. A loss attributed to commodity costs is approx. 450 basis points while freight costs shed an additional 80.

CEO Jon Moeller noted that persisting inflation is worrisome and that they’re unsure about its peak , but he brushed off the recession based on the insight within their category.

Ray Dalio Increases the Stake

Ray Dalio's Bridgewater Associates boosted positions in Consumer Staples, most notably in Procter & Gamble - now their largest stake, representing 4.4% of the total portfolio . According to the latest 13F filing, the total increase is 31%. Institutional investors seem to be trying to dampen the blow from inflation by rotating into a more resilient sector.

Let's examine the ownership structure to discover more about Procter & Gamble.

What Does The Institutional Ownership Tell Us About Procter & Gamble?

Institutional investors compare their returns to the returns of a commonly followed index. So they generally consider buying larger companies included in the relevant benchmark index.

Procter & Gamble already has institutions on the share registry. Indeed, they own a good stake in the company. This implies the analysts working for those institutions have looked at the stock, and they like it. But just like anyone else, they could be wrong. When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'. When such a trade goes wrong, multiple parties may compete to sell stock fast. One such example is Netflix, earlier this year when multiple institutions caused a rather severe sell-off.

Institutional investors own over 50% of the company, so together, they can probably strongly influence board decisions. Hedge funds don't have many shares in Procter & Gamble. Looking at our data, we can see that the largest shareholder is The Vanguard Group, Inc., with 9.1% of shares outstanding. With 6.5% and 4.4% of the shares outstanding, BlackRock, Inc. and State Street Global Advisors, Inc. are the second and third largest shareholders.

A deeper look at our ownership data shows that the top 25 shareholders collectively hold less than half of the register, suggesting a large group of small holders where no single shareholder has a majority.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to understand a stock's expected performance better. There are a reasonable number of analysts covering the stock, so it might be helpful to find out their aggregate view on the future.

Insider Ownership Of Procter & Gamble

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are founders or CEOs.

Our data suggest that insiders own under 1% of The Procter & Gamble Company in their own names. As it is a large company, we'd only expect insiders to own a small percentage of it. But it's worth noting that they own US$219m worth of shares. In this situation, it can be more interesting to see if those insiders have been buying or selling.

General Public Ownership

With a 35% ownership, the general public, mostly comprised of individual investors, has some degree of sway over Procter & Gamble. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Factors to Keep in Mind

Procter & Gamble has been receiving increased interest from institutional investors, but we have to note that SEC filings have a lagging factor. However, PG trades at 22.6x earnings, much below the market average of 31x, which makes it an exciting prospect for investors who need exposure to this market segment, especially given its stable dividend yield. Yet, we have to note that these valuations are still above the long-term averages and that the investment that creates seemingly best return will be one into an above-average company at a below-average price.

It's always worth considering the different groups who own shares in a company. But to understand Procter & Gamble better, we must consider many other factors. Take risks; for example - Procter & Gamble has 2 warning signs we think you should be aware of.

But ultimately, it is the future , not the past, that will determine how well the owners of this business will do. Therefore we think it advisable to take a look at this free report showing whether analysts are predicting a brighter future .

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full-year annual report figures.

If you're looking to trade Procter & Gamble, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:PG

Procter & Gamble

Engages in the provision of branded consumer packaged goods worldwide.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives