- United States

- /

- Household Products

- /

- NYSE:PG

Procter & Gamble (PG) Valuation Check After 7,000-Job Restructuring Plan and 2026 CEO Transition

Reviewed by Simply Wall St

Procter & Gamble (PG) just put several big variables on the table at once, from a sweeping 7,000 job restructuring plan to a January 2026 CEO handoff, all while reaffirming cautious 2026 guidance.

See our latest analysis for Procter & Gamble.

Those restructuring plans and the 2026 CEO transition are landing against a weaker tape, with a roughly 10% three month share price return and a one year total shareholder return of about negative 15% suggesting momentum has been fading rather than building recently.

If P&G's shake up has you reassessing your defensives, it could be a good moment to explore healthcare stocks for other resilient, essentials driven businesses with different risk and growth profiles.

With shares down double digits over the past year but still trading at a premium to slower growth, the key question now is simple: is Procter & Gamble quietly undervalued, or is the market already pricing in its next chapter of growth?

Most Popular Narrative Narrative: 19.7% Overvalued

According to andre_santos, the narrative fair value of $119.81 sits meaningfully below Procter & Gamble's last close at $143.45, which frames the stock as richly priced even after its recent pullback.

Given the company maturity and stage of its lifecycle, growth is expected to remain modest at the rate of inflation and the risk free rate, so it will float around 2-4% over the next years. Despite a strong last year, long-term FCF growth is expected to normalize, as with the revenues, around the risk free rate of 2-4%.

Want to see how slow growth assumptions alone still justify a premium brand valuation? The narrative combines modest sales, stable margins, and disciplined cash returns into a concise fair value story.

Result: Fair Value of $119.81 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, disciplined cost cuts or stronger than expected emerging market growth could support higher margins and earnings, challenging the current overvaluation narrative.

Find out about the key risks to this Procter & Gamble narrative.

Another View: Market Signals Tell a Different Story

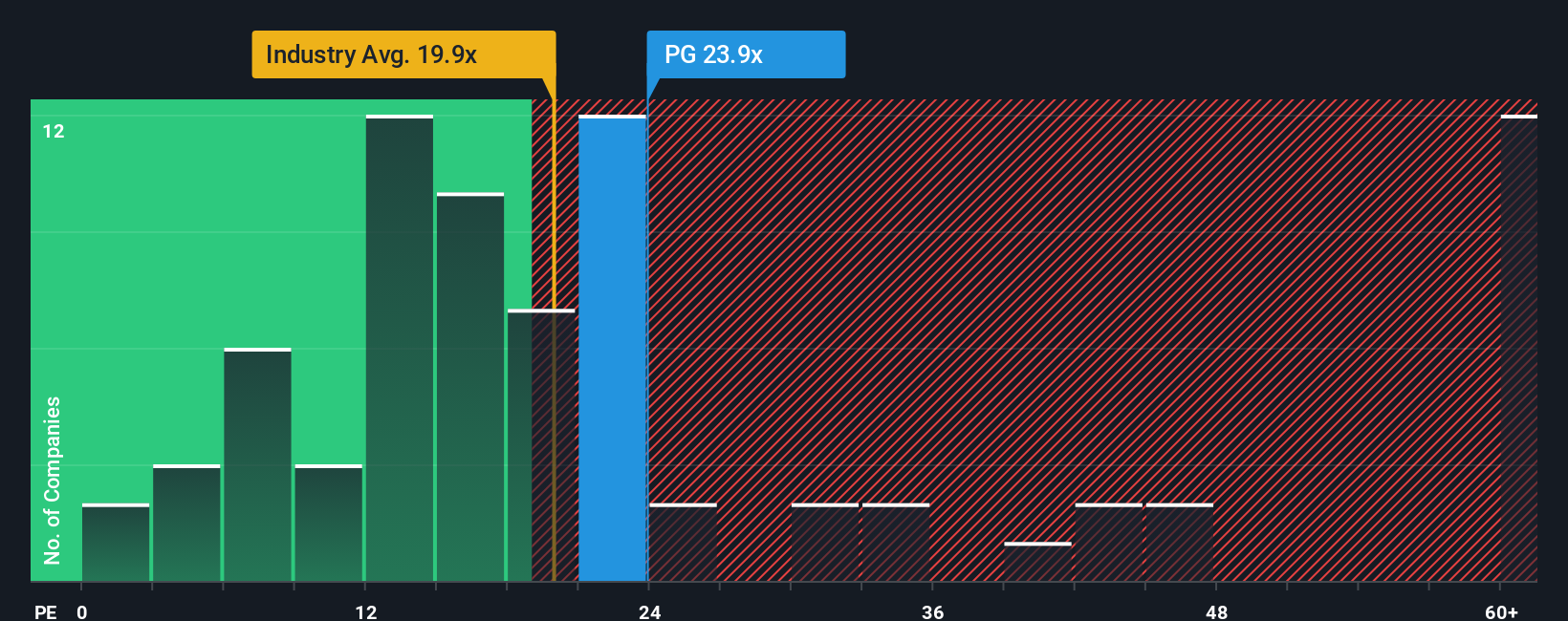

While the narrative model flags Procter & Gamble as nearly 20% overvalued, our valuation checks using the price to earnings ratio paint a softer picture. The current 20.3x multiple sits above the global household products average of 17.4x but below a fair ratio of 22x, which could limit downside if sentiment stabilizes.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Procter & Gamble for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Procter & Gamble Narrative

If you would rather dig into the numbers yourself or challenge these assumptions, you can craft a personalized Procter & Gamble view in minutes: Do it your way.

A great starting point for your Procter & Gamble research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before the market prices in the next wave of opportunity, sharpen your edge with focused stock ideas from our smartest screeners tailored to different investing styles.

- Capture potential mispricings by targeting companies trading below intrinsic value with these 906 undervalued stocks based on cash flows grounded in cash flow fundamentals rather than short term noise.

- Ride structural tailwinds in digital assets by scanning these 81 cryptocurrency and blockchain stocks positioned to benefit from blockchain adoption and evolving financial infrastructure.

- Identify income opportunities by filtering for these 15 dividend stocks with yields > 3% that balance current yields with underlying business quality and sustainability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PG

Solid track record established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026