- United States

- /

- Household Products

- /

- NYSE:PG

Procter & Gamble (PG): A Fresh Look at Valuation Following Recent Share Price Trend

Reviewed by Kshitija Bhandaru

Procter & Gamble (PG) shares are in focus among investors this week as the company’s stock trends modestly lower. Traders are weighing recent performance and looking for potential entry points as the broader consumer goods sector has moved sideways.

See our latest analysis for Procter & Gamble.

This week’s slight move lower in Procter & Gamble’s share price is part of a bigger pattern we have been seeing for most of the year, as momentum has faded after a run of steady long-term gains. While the short-term share price return has been quiet, the company's three-year total shareholder return of nearly 30% reminds investors that consistent cash flows and dividends have delivered solid value over time, even if recent months have felt subdued.

If you’re curious about stocks with standout management or growth stories, this is a great moment to discover fast growing stocks with high insider ownership

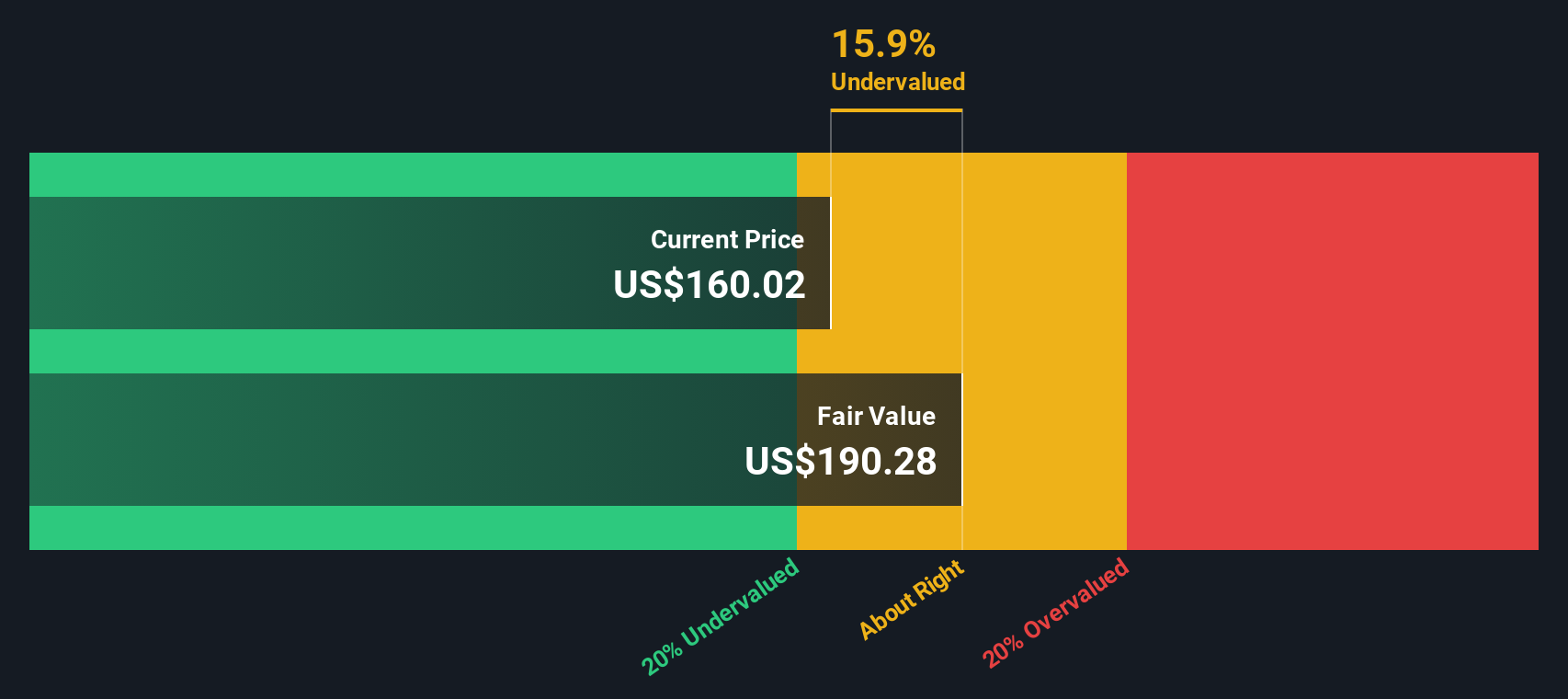

With shares currently trading at a notable discount compared to analyst price targets, the real question for investors is whether Procter & Gamble’s future growth is already factored in or if there is genuine value to unlock at this time.

Most Popular Narrative: 27% Overvalued

According to andre_santos, Procter & Gamble’s latest close at $152.05 significantly exceeds the most popular narrative’s estimated fair value. This sets up a complex debate over stretched valuations for a company renowned for reliable returns.

Discounted Cash Flow (DCF): Intrinsic value is estimated by projecting Procter & Gamble's free cash flows over the next 10 years and discounting them to present value.

This valuation is built on assumptions about how long the company can keep growing and what happens to its margins as competition heats up. Want to know the bold financial scenarios andre_santos uses to justify the fair value? The levers behind this price may surprise you.

Result: Fair Value of $119.81 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unexpected shifts in consumer demand or successful new product innovation could boost future growth and challenge the current overvalued thesis.

Find out about the key risks to this Procter & Gamble narrative.

Another View: Our SWS DCF Model Says Undervalued

While the narrative-led valuation signals that Procter & Gamble is trading above its fair value, our SWS DCF model presents a different perspective. It estimates a fair value of $195.60, which is well above the current price and suggests the shares are undervalued. With a significant divide between thoughtful narrative assumptions and modeled cash flows, which perspective should investors trust most?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Procter & Gamble for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Procter & Gamble Narrative

If you have your own perspective or want to analyze the numbers yourself, it’s easy to build and share your take: Do it your way

A great starting point for your Procter & Gamble research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stand still. The next great opportunity could be just a click away, so now is the perfect time to explore what else is out there.

- Unlock high yields and steady cash flow with these 19 dividend stocks with yields > 3% for companies offering strong dividends and financial resilience.

- Tap into explosive growth potential and cutting-edge innovation by checking out these 24 AI penny stocks in the artificial intelligence sector.

- Access undervalued gems that may be flying under the radar through these 909 undervalued stocks based on cash flows, and seize your chance before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PG

Outstanding track record established dividend payer.

Similar Companies

Market Insights

Community Narratives