- United States

- /

- Household Products

- /

- NYSE:PG

Procter & Gamble (NYSE:PG) Unveils Innovative Scent Boosters And Compact Cleaning Solutions

Reviewed by Simply Wall St

Procter & Gamble (NYSE:PG) introduced new offerings including Gain® Tango Scent Boosters and Swiffer Sweep + Mop Deluxe, aimed at enhancing consumer experiences. Despite these innovative product launches, the company's share price decreased by 1.9% over the last week. This downward move contrasts with broader market trends where major indices have risen, driven by strong earnings from tech companies like Microsoft and Meta. While the new product announcements reflect P&G's commitment to product innovation, they did not counterbalance the prevailing upward market momentum.

Procter & Gamble has 2 risks we think you should know about.

The recent product launches by Procter & Gamble (P&G) highlight its focus on innovation to bolster consumer engagement. However, the 1.9% decline in P&G’s share price over the past week reflects investor concerns, possibly linked to broader market trends. Looking at the longer-term context, P&G shares have delivered a total return, including dividends, of 62.57% over five years. This performance provides a more optimistic narrative compared to the company's recent underperformance against the US market's 9.6% return over the past year. Notably, the performance of P&G shares over the past year exceeded the US Household Products industry's return of 1.5% decline, demonstrating some resilience within its sector.

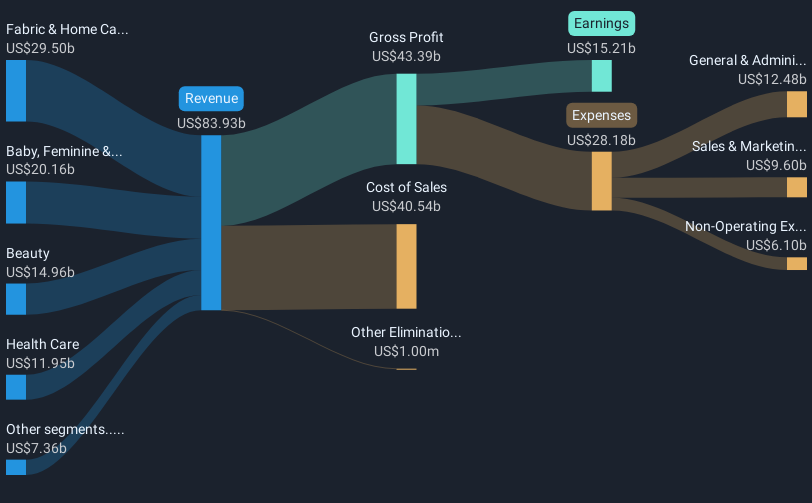

The new product offerings may impact P&G's future revenue and earnings positively, aligning with analyst expectations of a 3.1% annual revenue growth and an increase in profit margins to 19.5%. These initiatives support the company’s investment in enhancing product lines and potentially expanding market share, despite prevailing geopolitical and economic uncertainties that could impact margins and revenue growth. Currently, P&G is trading at US$162.26, which is approximately 5.4% below the analyst consensus price target of US$171.53. This relatively narrow gap suggests that the share price may reflect near-fair valuation, assuming forecasts are met. Stakeholders could keep an eye on consumer confidence and cost management, as these could significantly influence ongoing market performance and justify the analyst projections.

Dive into the specifics of Procter & Gamble here with our thorough balance sheet health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PG

Outstanding track record established dividend payer.

Similar Companies

Market Insights

Community Narratives