- United States

- /

- Household Products

- /

- NYSE:PG

A Look at Procter & Gamble’s Valuation as It Expands U.S. Manufacturing With New Iowa City Facility

Reviewed by Kshitija Bhandaru

If you’ve been following Procter & Gamble (PG) lately, you’ve probably seen the fresh headlines about its $150 million expansion in Iowa City. The company is ramping up domestic production with a massive new facility and 100 new jobs, backed by both state and local incentives. For long-term shareholders and anyone considering a move on PG, this isn’t just a feel-good jobs story. It signals a real-time shift in how one of the world’s biggest consumer goods companies is positioning itself within changing supply chains.

The news comes at an interesting time for Procter & Gamble, which has been navigating a patchy stretch this past year. The stock’s momentum has softened, with a slide of about 8% over the past 12 months and a 6% dip year-to-date. Recent announcements, including restructuring plans and a steady dividend policy, underscore a company balancing transformation with stability. Still, the move to expand U.S. manufacturing could point to confidence in future demand and operational flexibility.

So, after a year where the stock has lagged, does this Iowa City expansion mark a real buying opportunity, or is the market already baking in all of the forward potential?

Most Popular Narrative: 30% Overvalued

According to andre_santos, the current narrative suggests Procter & Gamble is trading at a premium, despite its reputation as a stable dividend giant.

“Assuming a continuous emphasis on the payment of dividends and the slowing of the company revenues and growth over the following years, it justifies putting more weight on the historical dividend mean reversion and less on the historical PE reversion, given that a transition into higher PE ratios is not expected with slowing growth.”

Think you know why this household name is valued so high? The driving force behind this narrative is a blend of cautious optimism about dividends and a cool-headed approach to business growth. Curious how nuanced financial modeling and conservative growth expectations collide to shape this premium? Discover which business fundamentals tilt the scales in this fair value calculation.

Result: Fair Value of $119.81 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, unexpected acceleration in emerging market growth or successful new product innovation could shift Procter & Gamble’s outlook and challenge today’s premium valuation narrative.

Find out about the key risks to this Procter & Gamble narrative.Another View: SWS DCF Model Suggests Upside

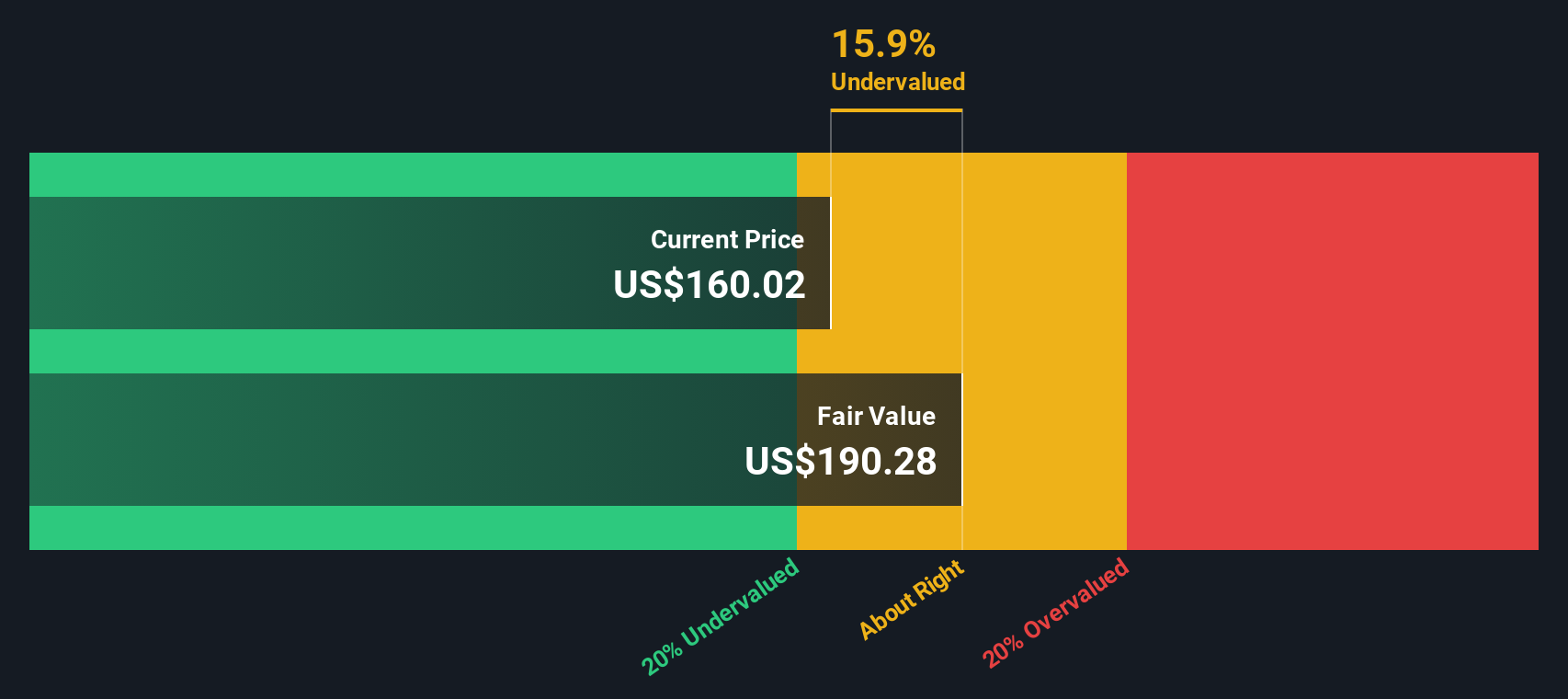

While the most popular view has Procter & Gamble trading at a premium, our DCF model comes to a different conclusion. It indicates the stock is actually undervalued in the current market. Does this challenge the narrative, or are there risks the model does not reveal?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Procter & Gamble for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Procter & Gamble Narrative

If you have your own perspective or want to dig through the numbers independently, it takes less than three minutes to craft your own view. Do it your way

A great starting point for your Procter & Gamble research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t wait for the perfect stock to land in your lap; use Simply Wall Street’s powerful tools to uncover standout opportunities that could give your portfolio an edge.

- Uncover untapped value by spotting underappreciated companies with strong future cash flows using our undervalued stocks based on cash flows.

- Catch the next wave in healthcare by seeing which businesses are harnessing artificial intelligence for medical breakthroughs through healthcare AI stocks.

- Tap into the future of finance and technology by following trailblazing stocks at the intersection of cryptocurrency and blockchain, all within cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PG

Outstanding track record established dividend payer.

Similar Companies

Market Insights

Community Narratives