- United States

- /

- Personal Products

- /

- NYSE:MED

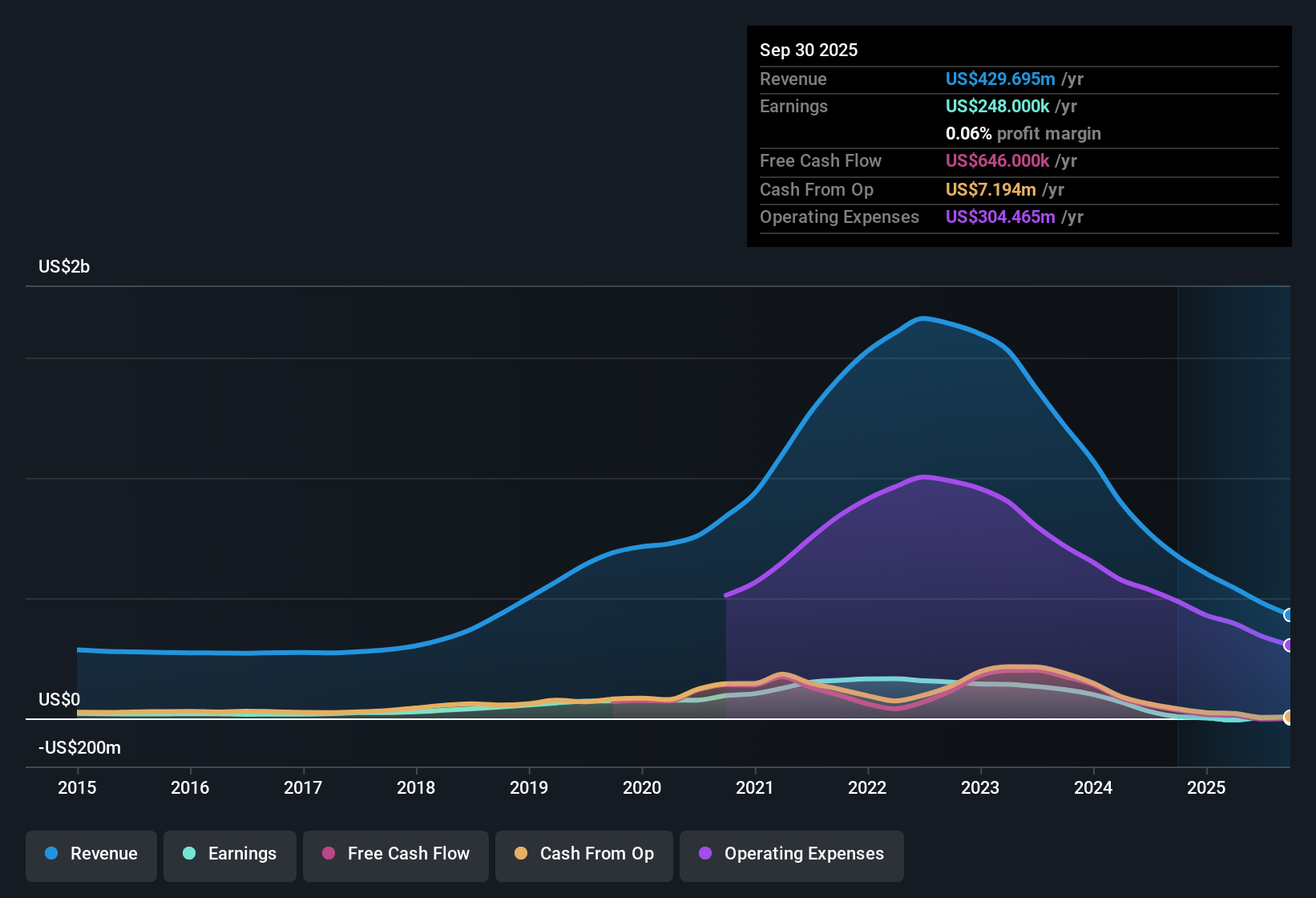

Medifast (MED) Profit Margin Plunges to 0.06%, Undermining Recovery Narratives

Reviewed by Simply Wall St

Medifast (MED) is facing a tough outlook, with both revenue and earnings forecast to decline sharply over the next three years. Revenue is expected to decrease by 12.5% per year, and earnings are projected to fall by 146.7% annually, following a recent year in which net profit margins slipped to just 0.06%, down from 1.1% last year. The company also recorded a one-off loss of $12.5 million in the last twelve months, adding extra pressure to already weakening earnings. In fact, average annual earnings have dropped 33.2% over the past five years. With no clear rewards on the horizon, investors seem preoccupied with these persistent declines and margin compression.

See our full analysis for Medifast.Next, we’ll see how these results compare with the narratives widely discussed by the community and analysts. We will also explore where the market’s story might get rewritten.

See what the community is saying about Medifast

Valuation Screens Cheap Against Peers

- Medifast’s Price-To-Sales Ratio is lower than both the US Personal Products industry average and its peer average. This suggests the stock screens as good value on this metric compared to others in its sector.

- Analysts’ consensus view notes that, despite the attractive sales-based valuation, persistent revenue decline (an expected 15.7% annual drop over the next three years) raises doubts about the stock's ability to sustain or reverse this apparent value.

- Even with a lower Price-To-Sales Ratio, analysts do not anticipate profitability within three years. This highlights that a cheap valuation alone may not outweigh weak fundamentals.

- The consensus price target of $15.00 is only 25% above today’s $11.98 share price. However, this is set against forecasts that earnings will remain extremely compressed absent meaningful margin recovery.

- See how analysts' consensus narrative ties the valuation puzzle together and what it reveals about industry outlook. 📊 Read the full Medifast Consensus Narrative.

Coach Network Shrinks Dramatically

- The number of active earning OPTAVIA coaches dropped by more than 32% year-over-year, with new coach sign-ups also declining. This puts direct pressure on Medifast’s most important revenue driver.

- Consensus narrative highlights that a shrinking and less productive coach base undermines the effectiveness of recent product launches and loyalty programs.

- With average revenue per coach and total sales both decreasing, this contraction challenges the company’s pivot toward expanding its customer pool or maintaining stable margins.

- Heavier reliance on remaining coaches amplifies risks if coach acquisition or engagement efforts do not reverse current trends. This may further accelerate topline declines if market competition intensifies.

Non-Recurring Losses Hit Reported Earnings

- The one-off $12.5 million loss recorded in the past twelve months has been a major drag on reported net income, further flattening already slim profit margins from 1.1% to 0.06%.

- Consensus view notes that the impact of these non-recurring costs, alongside ongoing margin compression, poses a challenge for Medifast’s planned margin recovery.

- Plans for digital investments and portfolio expansion may stretch resources if such unexpected hits recur, especially with existing profit margins at multiyear lows.

- This signals that even as the company seeks to expand through new customer segments and programs, unpredictable cost events could undermine progress toward profitability and stability.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Medifast on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think the figures tell a different story? Take just a few minutes to frame your own view and bring new insights to the table. Do it your way

A great starting point for your Medifast research is our analysis highlighting 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Medifast faces tumbling earnings, shrinking sales, and relentless margin pressure, with little indication of consistent growth or profitability in the near term.

If you want stocks that sidestep these kinds of setbacks, check out stable growth stocks screener (2077 results) to find companies delivering robust and reliable growth through changing markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MED

Medifast

Through its subsidiaries, operates as a health and wellness company that provides habit-based and coach-guided lifestyle solutions to address obesity and support a healthy life in the United States.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives