- United States

- /

- Household Products

- /

- NYSE:KMB

Kimberly-Clark (NYSE:KMB) Elevates Russ Torres To President And COO

Reviewed by Simply Wall St

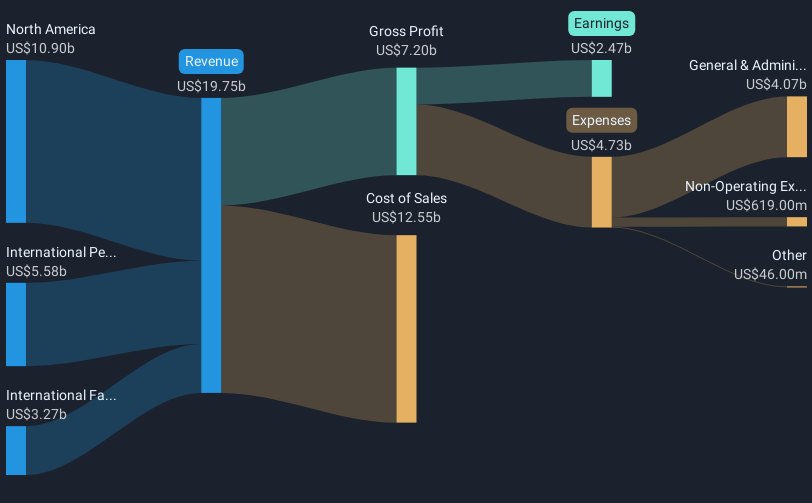

Kimberly-Clark (NYSE:KMB) recently appointed Russ Torres as President and Chief Operating Officer, a role entailing oversight of key business segments. During the last quarter, the company's stock moved 1.24%, closely paralleling broad market trends, which saw a modest gain driven by fluctuations in investor sentiment amidst tariff and Federal Reserve news. The company's significant $2 billion investment announcement for North America and steady dividends may have contributed weight to its stock performance amidst a backdrop of uncertain earnings reports from other market players.

We've discovered 2 risks for Kimberly-Clark that you should be aware of before investing here.

The appointment of Russ Torres as President and COO could enhance Kimberly-Clark's operational efficiency and product differentiation under its "Powering Care" strategy. This leadership change, combined with the company's recent US$2 billion investment commitment for North America, may bolster confidence in achieving revenue growth amidst economic pressures and international tariffs. These developments are likely to influence analysts' revenue and earnings forecasts positively by driving innovation and cost optimization, ultimately strengthening net margins.

Kimberly-Clark's long-term shareholder returns, including dividends, have yielded 12.41% over the past five years, showcasing consistent performance. However, in the last year, its share price movement was in line with the US Household Products industry, which saw a 4.2% decline. Currently, the share price stands at US$130.55, indicating a 8.8% discount compared to the consensus price target of US$143.1. This suggests limited upside potential as per analyst expectations, emphasizing the importance of reassessing potential risks and opportunities in the context of the company's projected earnings growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kimberly-Clark might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KMB

Kimberly-Clark

Manufactures and markets personal care products in the United States.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives