- United States

- /

- Household Products

- /

- NYSE:ENR

Energizer Holdings (ENR): Evaluating the Stock’s Value After Strategic Debt Refinancing Moves

Reviewed by Simply Wall St

If you have been keeping an eye on Energizer Holdings (ENR), the latest round of financial maneuvering is worth your attention. The company recently announced and priced a $400 million Senior Notes offering, increased from the initially planned $300 million, and completed a $100 million add-on to its Term Loan. The primary aims are to extend its debt maturity, redeem outstanding notes due in 2027, pay down its revolving credit, and cut interest expenses. It is a clear move to tidy up the balance sheet and keep operations running efficiently, without taking on more net leverage.

This debt refinancing news comes after a year with mixed signals for Energizer Holdings. The company’s shares have grown 6% over the past year, though they are still down about 15% year to date. Momentum has picked up recently, with a rapid 44% jump in the past three months and positive returns over the month and week as well. These short-term gains suggest changing sentiment around the company, potentially tied to management’s more proactive financial strategy.

With the stock regaining some ground, especially after this refinancing effort, is Energizer Holdings now trading at a discount, or has the market already priced in future growth and efficiency gains?

Price-to-Earnings of 8x: Is it justified?

Based on the preferred price-to-earnings (P/E) multiple, Energizer Holdings is currently trading well below both its industry peers and the broader household products sector averages. This suggests the stock may be undervalued by the market.

The price-to-earnings ratio is a common valuation tool that compares a company's share price to its earnings per share. For consumer goods companies like Energizer, it helps investors gauge how much they are paying for each dollar of earnings, especially relative to competitors.

With a P/E ratio of 8x, compared to an industry average of 18.7x and a peer average of 21.7x, Energizer appears to offer more earnings for each dollar invested in its shares. This discount could indicate market skepticism of future growth or the presence of company-specific concerns. However, it also may present an opportunity for value-focused investors if the company's fundamentals remain robust.

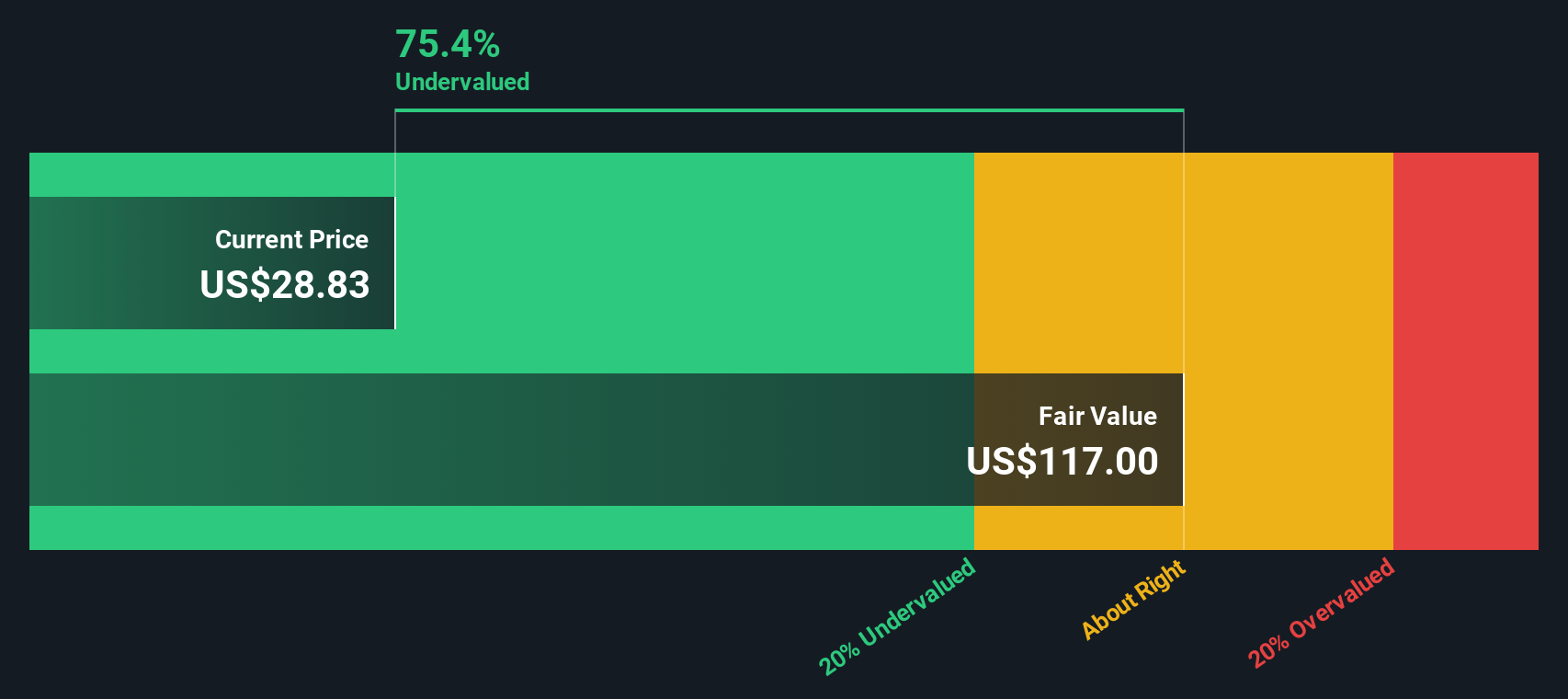

Result: Fair Value of $117.9 (UNDERVALUED)

See our latest analysis for Energizer Holdings.However, weak long-term returns and modest revenue growth could challenge the case for undervaluation if operational improvements do not materialize consistently.

Find out about the key risks to this Energizer Holdings narrative.Another View: What Does Our DCF Model Say?

Taking a different approach, our DCF model also points to undervaluation and backs up what we found earlier. But every model has its own assumptions. Do both really capture where Energizer could be headed?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Energizer Holdings Narrative

If you want to form your own opinion or dig deeper into the numbers, you can build your own narrative in just a few minutes. Do it your way.

A great starting point for your Energizer Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take charge of your portfolio and uncover new opportunities before they hit the mainstream. Move beyond Energizer Holdings and give yourself a bigger edge in today’s market.

- Uncover hidden gems with strong growth potential among established market leaders when you check out penny stocks with strong financials driving results through financial strength and innovation.

- Catch the next wave of intelligent automation by targeting companies transforming industries with breakthroughs in machine learning and powerful algorithms. See what's possible with AI penny stocks.

- Maximize your future returns by zeroing in on top picks trading below their true worth. Quickly spot fresh opportunities with our tool for undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Energizer Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ENR

Energizer Holdings

Manufactures, markets, and distributes household batteries, specialty batteries, and lighting products worldwide.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives