- United States

- /

- Household Products

- /

- NYSE:ENR

A Closer Look at Energizer Holdings (ENR) Valuation Following Recent Share Price Rebound

Reviewed by Kshitija Bhandaru

Energizer Holdings (ENR) has seen its stock bounce nearly 5% in the past week, following a patchy few months that included a dip of 14% last month. Investors are watching to see whether this recent momentum signals a real turnaround for the company.

See our latest analysis for Energizer Holdings.

This bounce comes after a tough year for Energizer Holdings, with the 1-year total shareholder return down over 20%, though signs of life have emerged lately as the share price clawed back nearly 5% in the past week. Momentum is starting to build again as investors reassess the risks and potential for a recovery in sentiment.

If seeing Energizer’s recent shift has you wondering what else could show a turnaround, now is the perfect time to explore fast growing stocks with high insider ownership

But with shares still trading nearly 23% below the average analyst price target, the question remains: is the market underestimating Energizer Holdings’ potential, or is any upside already reflected in the current valuation?

Price-to-Earnings of 6.8x: Is it justified?

Energizer Holdings is currently trading at a price-to-earnings (P/E) ratio of just 6.8x, far below both its peers and the broader Household Products industry average. At a last close price of $24.89, investors are paying much less for each dollar of earnings than they would for most comparable stocks.

The price-to-earnings ratio measures how much investors are willing to pay for each dollar of a company's earnings. For consumer staples like Energizer Holdings, it is a widely watched gauge of whether the market sees future growth or values the company as a steady performer with limited upside.

This low P/E level indicates that the market could be underpricing Energizer's recent profit growth and strong net margins. The ratio is well below both the industry average (20x) and the estimated fair value P/E of 18.1x, which is a level the market could move toward if sentiment shifts.

Explore the SWS fair ratio for Energizer Holdings

Result: Price-to-Earnings of 6.8x (UNDERVALUED)

However, stagnant revenue growth and past underperformance still pose real risks that could challenge the potential for a sustained recovery in Energizer’s shares.

Find out about the key risks to this Energizer Holdings narrative.

Another View: What Does the SWS DCF Model Say?

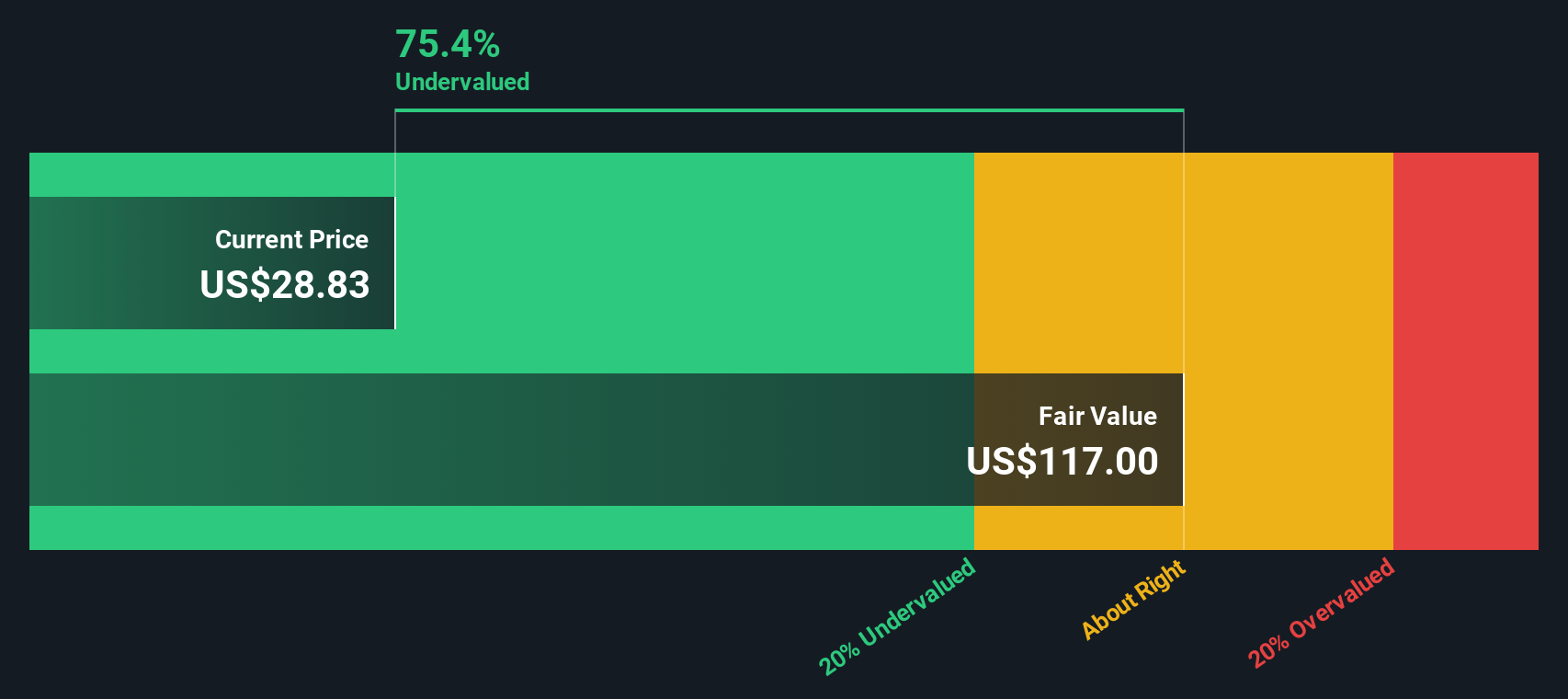

While the earnings multiple points to Energizer Holdings being undervalued, the SWS DCF model offers an even more dramatic perspective. According to our DCF model, the shares are trading nearly 78% below their calculated fair value. This suggests even more upside. The question remains whether the market agrees or if something is holding investors back.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Energizer Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Energizer Holdings Narrative

If you want to dig deeper, you can take a fresh look at the numbers and build your own case for Energizer Holdings in just a few minutes. Do it your way

A great starting point for your Energizer Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Stay a step ahead by searching for standout stocks and unique opportunities across different themes. Let these tools help you uncover your next winning pick today.

- Capture emerging opportunities by reviewing these 3596 penny stocks with strong financials with strong financials and untapped growth potential, waiting to be recognized.

- Enhance your income portfolio by targeting these 18 dividend stocks with yields > 3% offering attractive yields above 3% and the stability you seek.

- Position yourself at the cutting edge by browsing these 24 AI penny stocks that are fueling innovation in artificial intelligence and shaping the markets of tomorrow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Energizer Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ENR

Energizer Holdings

Manufactures, markets, and distributes household batteries, specialty batteries, and lighting products worldwide.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives