- United States

- /

- Personal Products

- /

- NYSE:ELF

e.l.f. Beauty (ELF): Is the Stock’s Multi-Year Runway Still Underappreciated by the Market?

Reviewed by Simply Wall St

e.l.f. Beauty (ELF) shares have drawn attention after recent trading activity, with the stock showing a dip of nearly 2% in the latest session. Investors are watching to see if this movement signals a longer-term trend or presents an opportunity.

See our latest analysis for e.l.f. Beauty.

While e.l.f. Beauty’s share price has cooled off recently, dipping 5.4% over the past month, it is worth noting that the stock remains up a remarkable 11.6% on a total return basis over the past year and a staggering 493% across five years. That kind of long-term momentum suggests underlying investor confidence, even as short-term price moves reflect shifting expectations or brief market nerves.

If you are on the lookout for fresh growth stories or want to broaden your investing radar, now is a great moment to discover fast growing stocks with high insider ownership

With shares off their recent highs but still sporting an impressive multi-year run, the question remains: is e.l.f. Beauty undervalued at current levels, or is the market already reflecting all its growth potential?

Most Popular Narrative: 18.6% Undervalued

With the latest narrative estimating a fair value notably above e.l.f. Beauty’s closing price of $122.81, there is a clear disconnect between what the consensus sees ahead and where the market currently stands. The scene is set for a debate about whether growth can outrun present doubts.

The expansion into new international markets and rapid growth in existing ones (e.g., 30% international net sales growth, top rankings in new geographies, global Sephora rollout) provides significant runway for future revenue growth and increased diversification, which is likely under-appreciated by the market.

Want to know what is fueling this aggressive price target? There is one factor—the future revenue engine—that could be the gamechanger. Find out how bold growth assumptions and a high-powered expansion narrative collide to shape this valuation logic.

Result: Fair Value of $150.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing exposure to tariff risks and intense competition from both established and emerging beauty brands could quickly shift the outlook for e.l.f. Beauty.

Find out about the key risks to this e.l.f. Beauty narrative.

Another View: What Do Multiples Indicate?

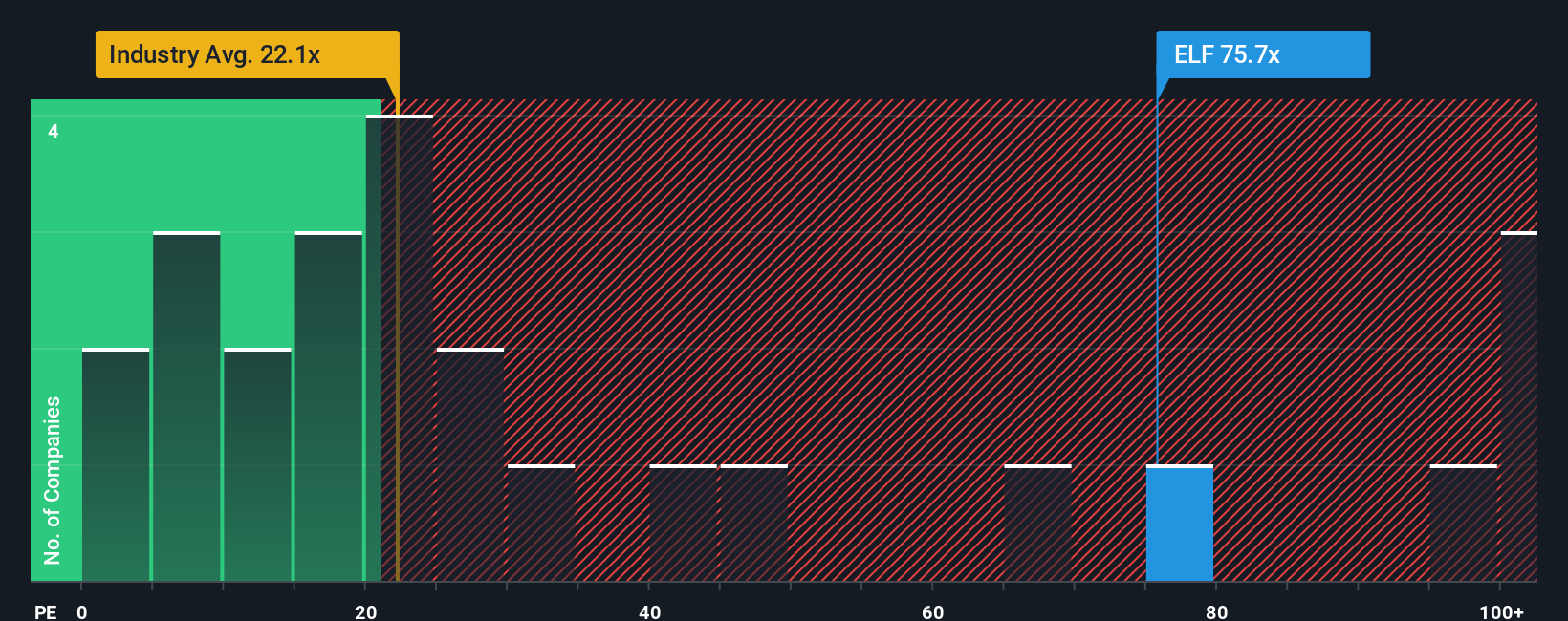

While analyst forecasts and growth stories paint an optimistic picture, looking at e.l.f. Beauty’s price-to-earnings ratio tells a different story. The company is trading at 74.5 times earnings, much higher than both the industry average of 20.3 and the estimated fair ratio of 30.8. This sizable gap may signal valuation risk if market sentiment changes. Is this momentum priced for perfection, or will strong fundamentals catch up in time?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own e.l.f. Beauty Narrative

If you have your own take on e.l.f. Beauty’s story or want to investigate the numbers yourself, you can build and share your own view. Do it your way Do it your way

A great starting point for your e.l.f. Beauty research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Get Ahead With Even More Smart Investment Ideas

Never limit your opportunities. Amplify your portfolio by tapping unique market trends and finding exceptional stocks using these targeted screeners on Simply Wall St.

- Unlock growth potential by checking out these 27 AI penny stocks designed to capitalize on the rapidly advancing world of artificial intelligence and machine learning innovation.

- Pursue reliable income streams by reviewing these 17 dividend stocks with yields > 3% with above-average yield to help boost your portfolio’s potential returns through substantial dividend payouts.

- Act early on emerging opportunities by searching these 3556 penny stocks with strong financials, where undervalued companies could become tomorrow’s high-flyers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ELF

e.l.f. Beauty

A beauty company, provides cosmetics and skin care products worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives