- United States

- /

- Personal Products

- /

- NYSE:EL

Estée Lauder (EL): Evaluating Valuation After Recent Share Price Fluctuations

Reviewed by Simply Wall St

See our latest analysis for Estée Lauder Companies.

Estée Lauder’s share price has gained more than 21% so far this year, marking a strong comeback after years of losses. A 1-year total shareholder return of 41% reflects solid value for those holding through the recent volatility. Although there has been a pullback over the last month, sentiment seems to be slowly improving as investors weigh the company’s long-term recovery story.

If you’re curious about what else is picking up momentum in today’s market, it’s a great time to broaden your search and discover fast growing stocks with high insider ownership

Against the backdrop of steady gains and lingering uncertainty, the central question emerges: Is Estée Lauder’s recent rally just the beginning of a larger recovery, or is the market already accounting for its potential earnings rebound?

Most Popular Narrative: 11.7% Undervalued

With Estée Lauder’s most popular narrative estimating fair value at $101.87, the last close of $89.92 suggests meaningful upside remains if future performance aligns with expectations. The narrative’s assumptions stretch well beyond simple momentum, focusing on the tangible drivers behind today’s valuation.

Significant investment is being allocated to product innovation across prestige price tiers, with a focus on clinically-backed and trend-driven skincare, makeup, and luxury fragrance launches. Innovation is targeted to exceed 25% of sales in fiscal '26, and faster time-to-market is being emphasized, which could enhance premium pricing power, brand equity, and gross margins.

Want the full story behind this target? The narrative hints at bold product launches, margin leaps, and a premium that rivals top luxury brands, all packed into one ambitious forecast. Find out which strategic bets are fueling this eye-catching valuation. Ready to see the numbers that could reshuffle Estée Lauder’s global standing?

Result: Fair Value of $101.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent challenges in travel retail or renewed weakness in key Asian markets could disrupt Estée Lauder’s expected momentum and put pressure on its recovery story.

Find out about the key risks to this Estée Lauder Companies narrative.

Another View: Comparing Sales Multiples

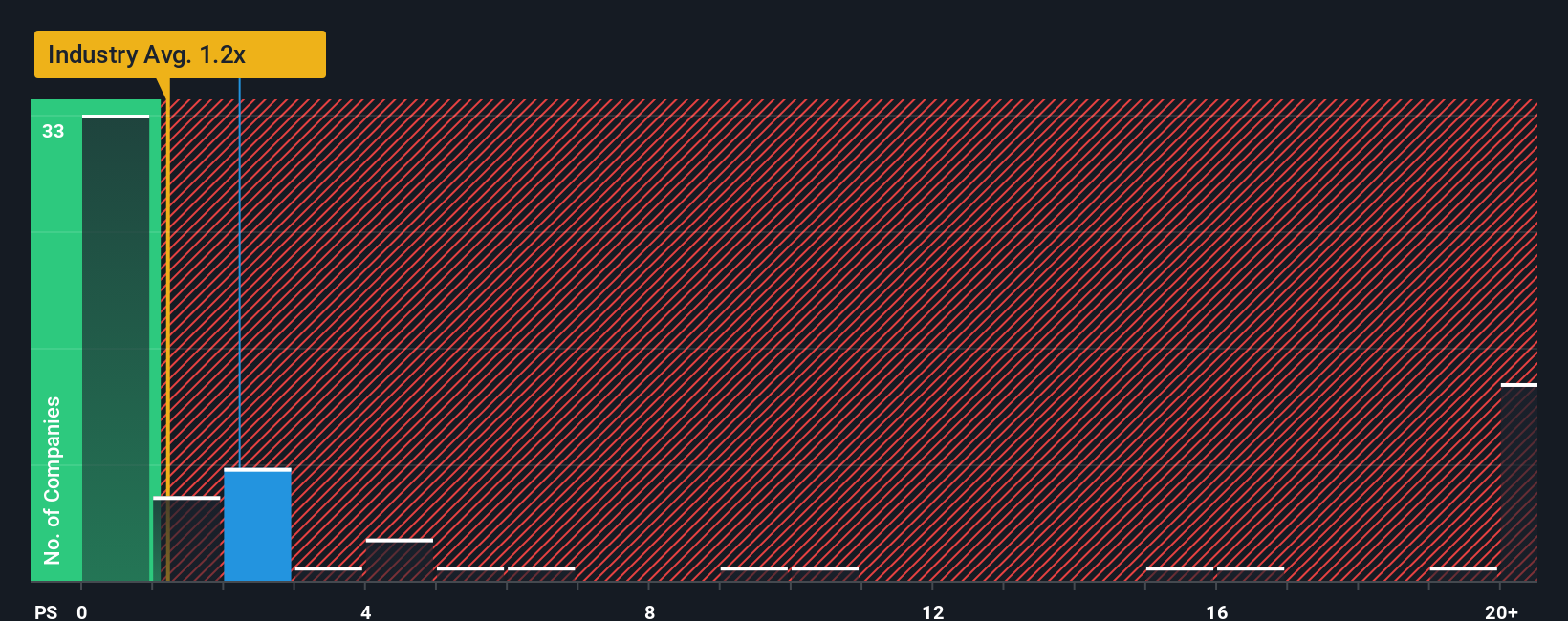

Not all valuation models see Estée Lauder as attractively priced. Looking at the price-to-sales ratio, the company trades at 2.2x sales, which is a steeper mark than both its industry peers and the fair ratio of 2.1x. This signals potential valuation risk if the broader market shifts. Are investors ready for a possible re-rating?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Estée Lauder Companies Narrative

Feel differently about the numbers or want to see things from a new angle? You can explore the data firsthand and draft your own view in just a few minutes, all at your own pace: Do it your way

A great starting point for your Estée Lauder Companies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Smart Investment Opportunities?

Put yourself ahead of the market by seeking out high-potential stocks that fit your goals. Let the right opportunities come to you effortlessly.

- Capitalize on artificial intelligence breakthroughs by checking out these 27 AI penny stocks that are driving advances in automation, data analytics, and smart infrastructure.

- Enhance your search for real value with these 874 undervalued stocks based on cash flows, which features promising financial fundamentals and untapped potential based on cash flow analysis.

- Increase your returns with regular income by browsing these 15 dividend stocks with yields > 3%, which offers yields above 3 percent and strong balance sheets to support long-term payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Estée Lauder Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EL

Estée Lauder Companies

Manufactures, markets, and sells skin care, makeup, fragrance, and hair care products worldwide.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives