- United States

- /

- Personal Products

- /

- NYSE:EL

Estée Lauder Companies (NYSE:EL) Exits Multiple Russell Growth Indices

Reviewed by Simply Wall St

Estée Lauder Companies (NYSE:EL) has experienced a dynamic period, marked by a 21% price decline in the last quarter. A notable event affecting this shift was the company's removal from several growth-oriented indices like the Russell 3000 Growth Index, signaling possible reevaluation of its growth prospects. Adding complexity, the company was added to the Russell Midcap Value Index, reflecting a potential shift in its investment appeal. Concurrently, broader market trends show rising indices like the S&P 500 and Nasdaq reaching new highs, buoyed by optimistic trade developments and potential interest rate cuts, offering an interesting context for Estée Lauder's contrasting performance.

We've identified 2 warning signs for Estée Lauder Companies that you should be aware of.

Find companies with promising cash flow potential yet trading below their fair value.

The recent removal of Estée Lauder from growth indices, alongside its addition to the Russell Midcap Value Index, suggests a shift in how the market perceives its growth trajectory. This change could impact revenue and earnings forecasts as the company realigns its strategies. Over the past year, Estée Lauder's total shareholder return, including dividends, was a 23.05% decline. This performance starkly contrasts with broader market trends where indices like the S&P 500 and Nasdaq registered gains. Compared to its industry, the company underperformed the US Personal Products sector, which saw a 14.1% decline.

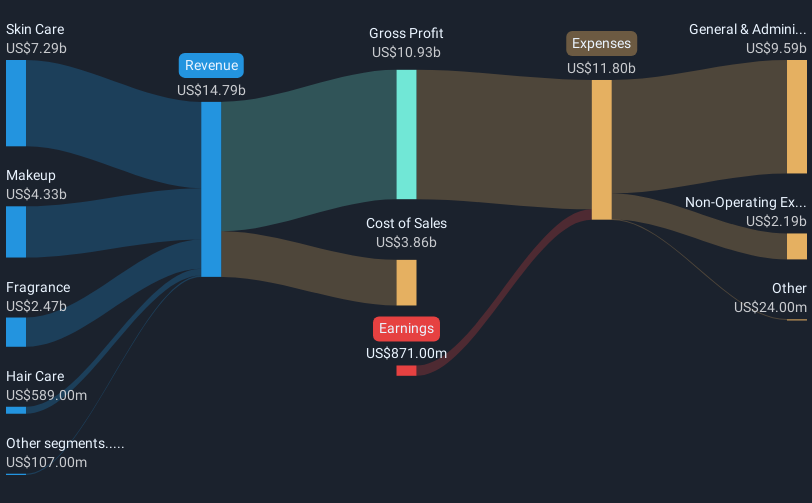

As the company shifts focus towards digital expansion and operational restructuring, analysts forecast a gradual recovery with expected revenue growth of 2.8% per year and improved profit margins. Earnings are estimated to rise from a loss of US$871 million to US$1.4 billion by June 2028. Estée Lauder's current share price of US$77.05 sits below the consensus price target of US$70.04. This suggests that analysts view the stock as potentially overvalued based on current performance metrics. Investors should consider whether the forthcoming operational efficiencies and market expansions will align with these forecasts.

Review our historical performance report to gain insights into Estée Lauder Companies' track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Estée Lauder Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EL

Estée Lauder Companies

Manufactures, markets, and sells skin care, makeup, fragrance, and hair care products worldwide.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives