- United States

- /

- Personal Products

- /

- NYSE:EL

A Fresh Look at Estée Lauder (EL) Valuation as Momentum Cools

Reviewed by Simply Wall St

Estée Lauder Companies (EL) has seen its stock edge slightly lower over the past week, even as the broader market has posted gains for the month. Investors are monitoring company results and any updates on recent strategies as the beauty sector shifts.

See our latest analysis for Estée Lauder Companies.

After a strong run earlier this year, Estée Lauder Companies’ momentum has cooled, with the stock slipping by 1.3% over the past week despite an impressive year-to-date share price return of nearly 32%. Total shareholder return for the past year sits at 13.8%, which helps offset much steeper losses stretching over the last three and five years. This pattern suggests that although recent optimism is still present, investors remain watchful as the company works through sector shifts and rediscovers its growth story.

If you’re curious about other market movers in consumer sectors, this could be an ideal time to broaden your search and discover fast growing stocks with high insider ownership

With shares trading below some analyst targets but outperforming the broader market year-to-date, the key question now is whether Estée Lauder is presenting genuine value or if investors have already caught up to the company’s growth outlook.

Most Popular Narrative: 2.4% Overvalued

With Estée Lauder Companies' fair value estimate at $95.09 and a recent close of $97.36, the market is currently pricing shares slightly above the consensus narrative's calculated value. This sets the stage for deeper debate, as investors weigh recent gains against future profitability catalysts.

Significant investment is being allocated to product innovation across prestige price tiers, with a focus on clinically-backed and trend-driven skincare, makeup, and luxury fragrance launches; innovation is targeted to exceed 25% of sales in fiscal '26, and faster time-to-market is being emphasized. This approach is likely to enhance premium pricing power, brand equity, and gross margins.

What's the real story behind this premium price tag? The secret sauce could be ambitious innovation targets and a margin expansion seldom seen in this sector. Want to know how these assumptions power such a close gap between current price and fair value? Only the full narrative reveals the numbers that fuel this debate.

Result: Fair Value of $95.09 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, as continued weakness in travel retail and elevated restructuring costs could challenge Estée Lauder’s recovery and prospects for long-term margin expansion.

Find out about the key risks to this Estée Lauder Companies narrative.

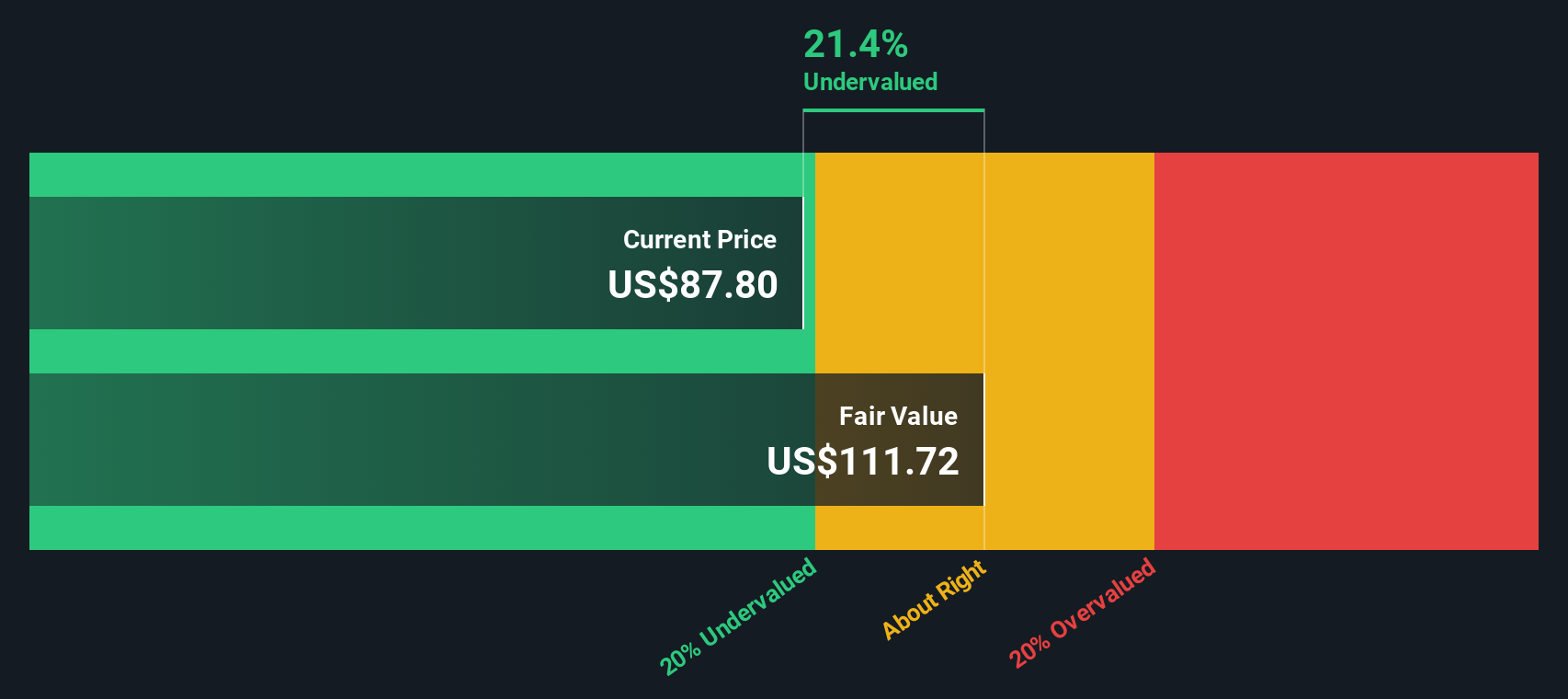

Another View: Discounted Cash Flow Says Undervalued

While analysts using multiples see Estée Lauder as somewhat overvalued, the SWS DCF model offers a different perspective. According to this approach, the stock is trading around 16% below its estimated fair value. This suggests there may be more upside than the latest price forecasts imply. Which perspective will shape investor sentiment next?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Estée Lauder Companies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 848 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Estée Lauder Companies Narrative

If you’re more hands-on or want to challenge the consensus, you can dive into the data yourself and shape your own view in just a few minutes. Do it your way

A great starting point for your Estée Lauder Companies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Skip the fear of missing out by checking out smart, trending investment options other investors are watching right now on Simply Wall Street.

- Unlock high-growth opportunities in the health sector by tracking these 34 healthcare AI stocks, which is set to transform diagnostics and patient care with advanced technology.

- Supercharge your portfolio’s income stream by targeting these 21 dividend stocks with yields > 3%, offering robust yields for steady, inflation-beating returns you can count on.

- Catch the next tech wave by sizing up these 26 AI penny stocks, which is powering breakthroughs in automation, analytics, and intelligent systems worldwide.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Estée Lauder Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EL

Estée Lauder Companies

Manufactures, markets, and sells skin care, makeup, fragrance, and hair care products worldwide.

Reasonable growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives