- United States

- /

- Personal Products

- /

- NYSE:COTY

Is Bearish Analyst Sentiment Shifting the Investment Case for Coty (COTY)?

Reviewed by Sasha Jovanovic

- Wall Street expected Coty to report flat earnings with lower revenues for the quarter ended September 2025, amid downward revisions to earnings estimates and persistent analyst caution.

- Analysts highlighted Coty's ongoing struggles to exceed EPS expectations over the past year, reflecting widespread concern about its ability to achieve improved operational results.

- Given the recent wave of downward EPS revisions, we'll examine how this bearish analyst sentiment could impact Coty's longer-term investment narrative.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Coty Investment Narrative Recap

To be a Coty shareholder right now, you need faith that recent restructuring, brand innovation, and market expansion efforts will eventually outweigh near-term earnings pressure and weak revenue momentum. The news of downward EPS revisions and ongoing earnings misses has heightened concerns around Coty’s short-term ability to stabilize margins, but it does not significantly alter the main catalysts of inventory realignment or the material risk of persistent top-line weakness from continued inventory destocking. Among Coty’s recent announcements, the completion of a US$900 million senior notes offering directly relates to the current news cycle. By refinancing near-term debt maturities, Coty looks to shore up its financial position, which could prove essential if margin recovery or revenue growth take longer to materialize. However, investors should be mindful that ongoing U.S. inventory destocking could still delay any sustained rebound...

Read the full narrative on Coty (it's free!)

Coty's outlook anticipates $6.1 billion in revenue and $302.1 million in earnings by 2028. This projection is based on a yearly revenue growth rate of 1.3% and a $683.2 million increase in earnings from the current level of -$381.1 million.

Uncover how Coty's forecasts yield a $5.04 fair value, a 29% upside to its current price.

Exploring Other Perspectives

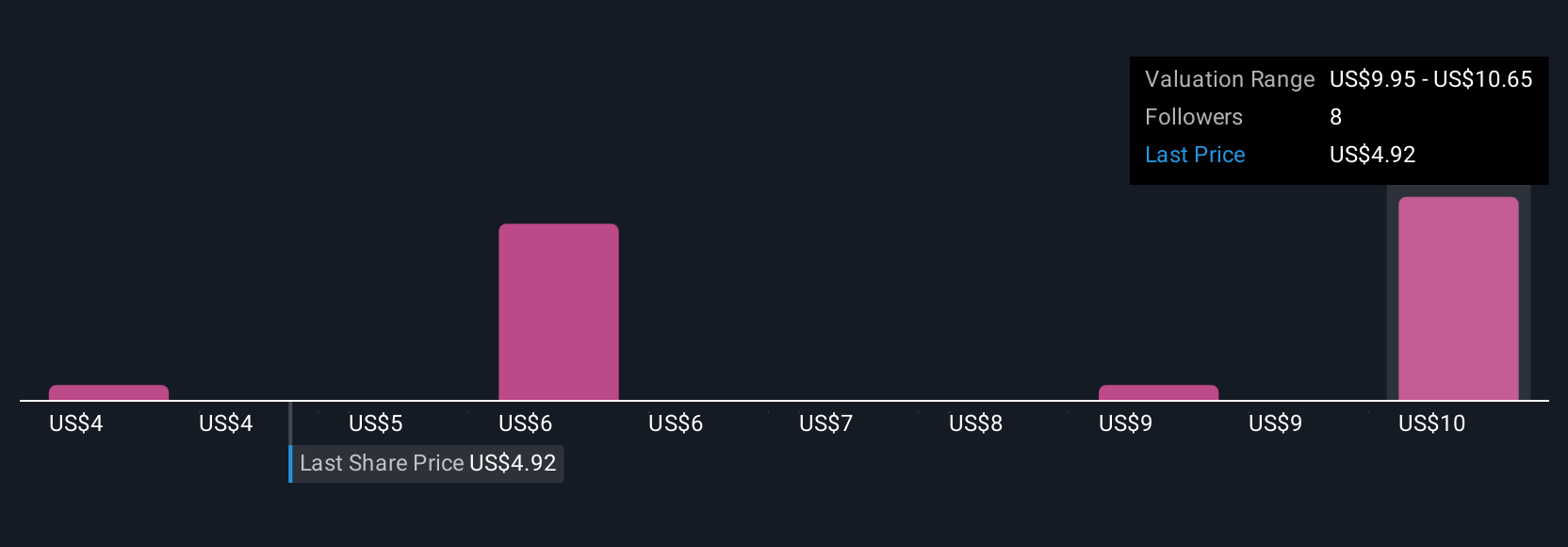

Fair value estimates for Coty from the Simply Wall St Community range widely, from US$3.69 to US$10.89, with five individual perspectives included. Against this diversity, persistent inventory challenges may remain front of mind for many market participants with implications for both value and timing of a turnaround.

Explore 5 other fair value estimates on Coty - why the stock might be worth over 2x more than the current price!

Build Your Own Coty Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Coty research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Coty research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Coty's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COTY

Coty

Manufactures, markets, distributes, and sells branded beauty products worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives