- United States

- /

- Household Products

- /

- NYSE:CLX

Clorox (CLX) Net Margin More Than Doubles, Undercuts Bearish Views on Earnings Quality

Reviewed by Simply Wall St

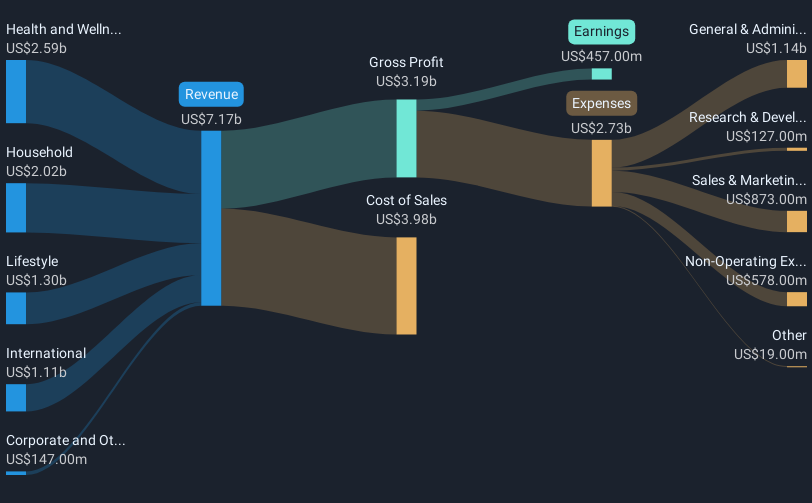

Clorox (CLX) delivered standout results this year, posting 121.6% earnings growth that sharply reverses its five-year trend of -14.8% per year. The company’s net profit margin jumped to 11.7% from 4.8% last year, underlining a significant rise in profitability. While forecasts show earnings growing at 5.6% per year and revenue at 2.2% per year, both below the US market, investors will note the current 17x Price-to-Earnings ratio sits under peer and industry averages, and shares trade well below an estimated fair value. Sentiment is buoyed by high-quality earnings and a rebound in profits, even as minor caution flags around financial position and dividend sustainability linger.

See our full analysis for Clorox.Next, we will size up these results against the most widely followed narratives to see where the numbers back up the market story and where opinions might start to shift.

See what the community is saying about Clorox

Margins Expand on ERP and Cost Control

- The company's net profit margin rose to 11.7% this year from 4.8% last year, reflecting a sharp lift in profitability beyond the headline growth rate.

- Analysts' consensus view is that ongoing investment in a modern ERP system and digital transformation could continue driving sustained margin gains over the next several years.

- Consensus narrative notes these changes should support margin expansion and earnings growth, with analysts forecasting margins rising to 12.6% in three years.

- However, they caution that near-term noise from the transition could impact results before longer-term benefits are fully realized.

- The surge in profit margins prompts analysts to suggest Clorox is successfully offsetting inflationary and input cost pressure, but supply chain volatility could still pose challenges for future improvement.

Revenue Growth Remains Subdued Despite Product Innovation

- Revenue is forecast to rise by just 2.2% per year, which analysts note is below the US market average. Consensus also suggests there could be a revenue decrease of 0.4% annually over the next three years, highlighting sluggish top-line expectations even with new product launches.

- According to the consensus narrative, upcoming product innovation, especially premium and wellness platforms, aims to regain market share and drive organic growth.

- Yet Clorox's heavy reliance on a few core brands and ongoing category weakness means these efforts may only modestly offset intensifying competition and changing consumer trends.

- The consensus emphasizes that regaining sustained revenue momentum will require accelerating differentiation to counter value-seeking behavior and the rise of private label alternatives.

Shares Trade at a Discount to Fair Value and Peers

- Clorox’s current share price of $110.42 is not only under the peer average but also well below its DCF fair value estimate of $215.56. The stock’s 17x Price-to-Earnings ratio is lower than both the peer average of 20.4x and the industry at 17.5x.

- Analysts’ consensus view is that this valuation gap reflects both the recent rebound in high-quality profits and tempered growth expectations.

- With analysts' consensus price target at $125.06, just 5.9% above the current price, they largely see the stock as fairly priced for near-term expectations. However, the substantial DCF fair value premium signals opportunity if growth outpaces projections.

- Investors are encouraged to compare their own expectations for margins and innovation-driven growth with analyst forecasts to decide whether the market is underestimating Clorox's long-term value.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Clorox on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the data from a different angle? Take a moment to quickly craft and share your own narrative so your unique perspective stands out. Do it your way

A great starting point for your Clorox research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

While Clorox’s margins have rebounded, its revenue growth remains sluggish, and forecasts trail the market even with new product launches.

If you want to focus on companies that consistently deliver reliable top-line and earnings expansion, even in competitive landscapes, use stable growth stocks screener (2077 results) to find those rare performers now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CLX

Clorox

Manufactures and markets consumer and professional products worldwide.

Undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives