- United States

- /

- Household Products

- /

- NYSE:CL

Colgate-Palmolive (CL): A Fresh Look at Valuation as Shares Lag Recent Benchmarks

Reviewed by Simply Wall St

Colgate-Palmolive (CL) shares have seen modest movement lately as the company continues to navigate changing consumer habits and competitive dynamics in the household and personal care space. Investors are watching closely for indicators of underlying strength or new catalysts.

See our latest analysis for Colgate-Palmolive.

Shares of Colgate-Palmolive have struggled to find their footing this year, with a year-to-date share price return of -11.61%. While the brand remains a stalwart in its category, momentum has faded and the 1-year total shareholder return of -15.28% reinforces some caution about near-term upside, especially as consumers weigh options in a highly competitive market.

If shifts in well-known brands have you rethinking your approach, this is an opportune moment to broaden your search and discover fast growing stocks with high insider ownership

With shares lagging recent benchmarks but trading below analyst price targets, Colgate-Palmolive may look attractive to value seekers. Is there real upside here, or has the market already factored in the company’s growth prospects?

Most Popular Narrative: 8.3% Undervalued

Colgate-Palmolive’s most widely followed narrative values the company above its recent closing price, suggesting room for upside as company fundamentals evolve and recent market softness is absorbed.

Expansion and premiumization of core oral care lines like Colgate Total, combined with the roll-out of complementary products across 75 markets, are set to capture increased value from emerging middle-class consumers and rising health and hygiene awareness globally. These factors support top-line organic sales acceleration and improved pricing power.

Curious what’s powering this bullish view? There is a notable revenue jump, margin momentum, and future profit scaling behind that headline figure. Want a peek at the specific critical ingredients fueling this fair value? Click to see the full story and uncover the key projections that drive the narrative’s confidence.

Result: Fair Value of $87.26 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost pressures and ongoing competition in key markets could slow Colgate-Palmolive’s momentum and challenge the case for near-term upside.

Find out about the key risks to this Colgate-Palmolive narrative.

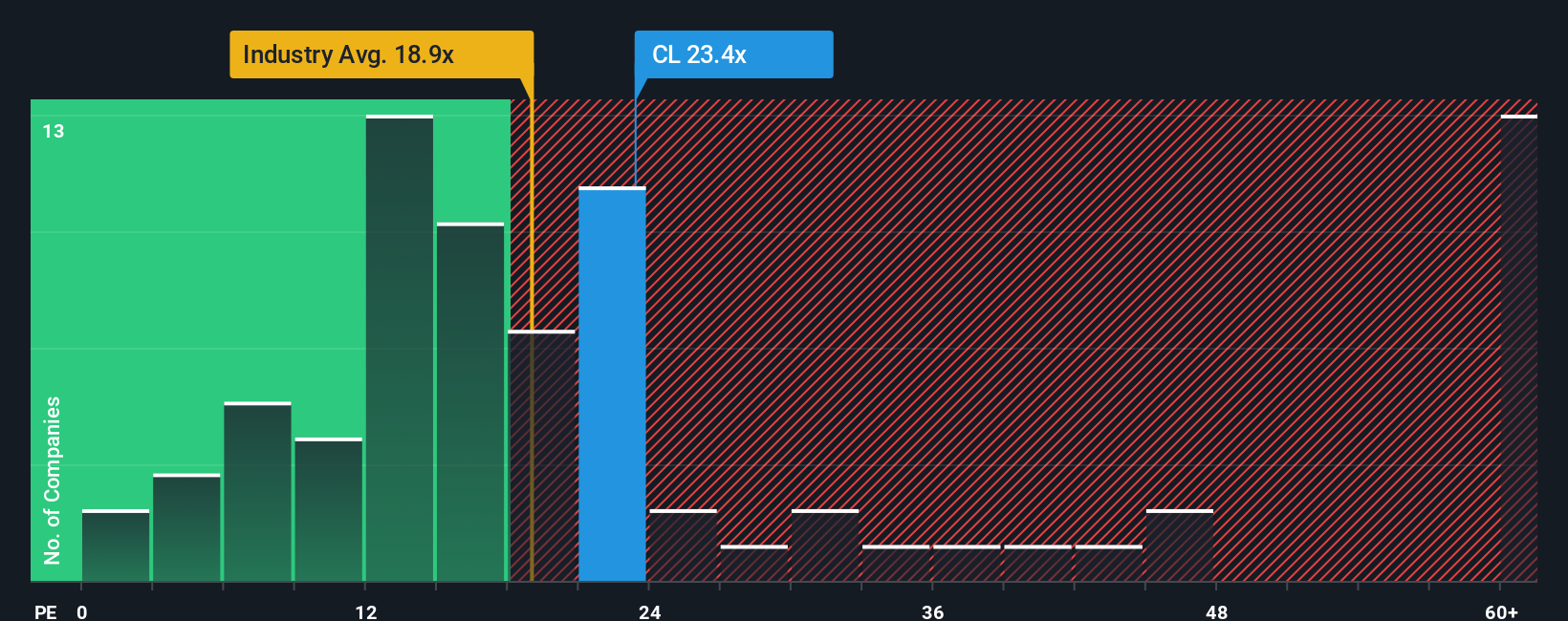

Another View: Looking Through the Multiples Lens

Switching gears to a multiples-based approach, Colgate-Palmolive’s price-to-earnings ratio stands at 22.2x. That's notably higher than the global household products industry average of 17.4x and above its peer group at 20.5x. It also closely aligns with a calculated fair ratio of 22.5x. This gap signals that while the market may be demanding a premium for the brand’s perceived stability, it leaves less room for upside if sentiment sours. Could a shift in industry dynamics narrow this premium, or is it justified by Colgate-Palmolive’s enduring strengths?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Colgate-Palmolive Narrative

If you have your own perspective or want to see how differently the numbers can add up, you can build a personalized take in just a few minutes. Do it your way

A great starting point for your Colgate-Palmolive research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't let fresh opportunities pass you by. Make your next smart move by checking out standout stocks and innovative trends tailored to your investing goals below.

- Unlock the potential of tomorrow’s technology leaders when you browse these 25 AI penny stocks, set to transform entire industries with advancements in artificial intelligence.

- Collect reliable income streams by adding strong-yielding picks to your portfolio. See these 15 dividend stocks with yields > 3% delivering attractive payouts above 3%.

- Shape your strategy around long-term value by targeting these 926 undervalued stocks based on cash flows, carefully selected using cash flow analysis and value-focused fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CL

Colgate-Palmolive

Manufactures and sells consumer products in the United States and internationally.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success