- United States

- /

- Household Products

- /

- NasdaqGS:WDFC

What WD-40 (WDFC)'s Strong Earnings and Share Buyback Mean For Shareholders

Reviewed by Sasha Jovanovic

- WD-40 Company recently announced its fourth quarter and full year earnings for the period ended August 31, 2025, reporting year-over-year increases in both sales and net income, with annual sales reaching US$619.99 million and annual net income at US$90.99 million.

- Alongside the earnings, WD-40 completed a share buyback program, repurchasing 84,500 shares for US$20.39 million, which may reflect confidence in the company’s longer-term outlook.

- We'll explore how WD-40’s significant earnings growth and completed buyback program shape its investment narrative and future prospects.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

WD-40 Investment Narrative Recap

To be a long-term shareholder in WD-40 Company, you need to believe in its ability to leverage global brand strength, efficient operations, and product premiumization, while continuing to grow sales and profits steadily. The recent strong earnings report confirms WD-40’s progress, but the most important short-term catalyst, expansion in newer regions, and the biggest risk, currency headwinds, remain largely unchanged in the immediate term as this news does not materially shift their impact.

Of the recent announcements, the completed share buyback stands out. This action coincides with WD-40’s commitment to shareholder returns and follows a period of higher profitability. While buybacks can bolster earnings per share, they do not address key operational risks such as foreign exchange effects or market softness in specific geographies.

By contrast, even with rising profits, currency headwinds remain a factor investors should be aware of if...

Read the full narrative on WD-40 (it's free!)

WD-40's outlook anticipates $721.1 million in revenue and $83.6 million in earnings by 2028. This scenario requires 5.6% annual revenue growth but reflects a $2.7 million decrease in earnings from the current $86.3 million.

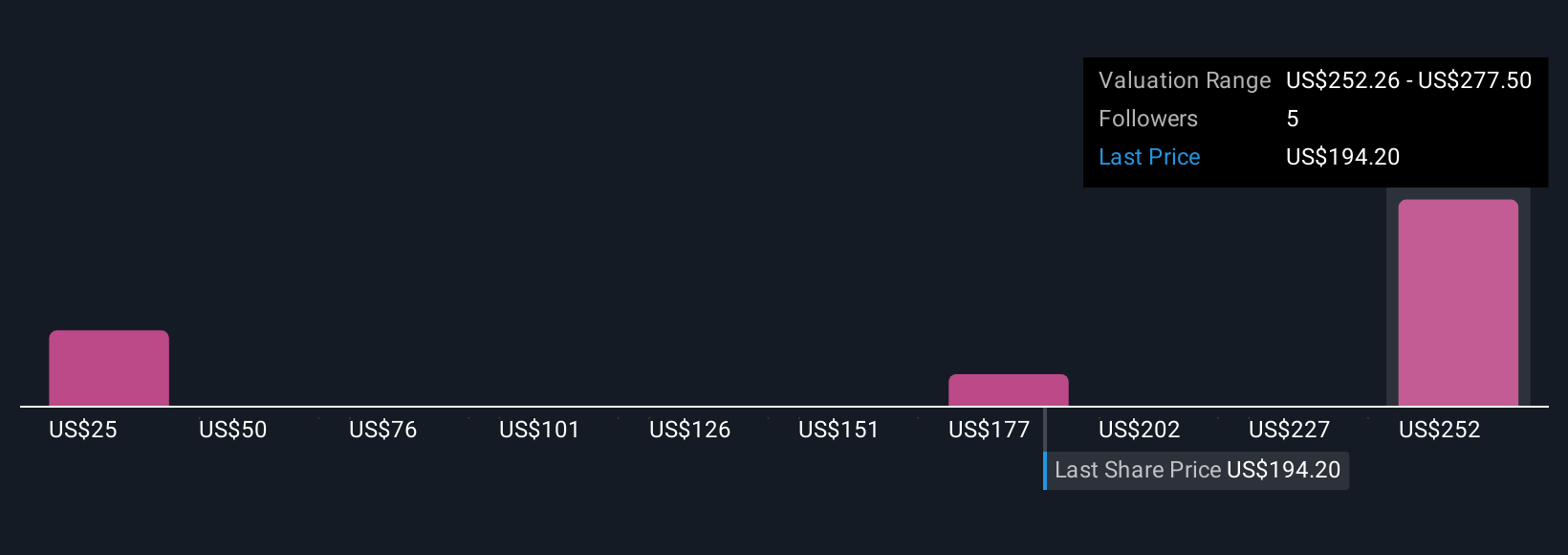

Uncover how WD-40's forecasts yield a $264.50 fair value, a 34% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community estimated fair values for WD-40 from just US$32 to US$264 per share. While you weigh this wide spread, keep in mind that currency fluctuations continue to influence WD-40’s revenue and earnings across international markets.

Explore 4 other fair value estimates on WD-40 - why the stock might be worth as much as 34% more than the current price!

Build Your Own WD-40 Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WD-40 research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free WD-40 research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WD-40's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WD-40 might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WDFC

WD-40

Engages in the provision of maintenance products and homecare and cleaning products in North America, Central and South America, Asia, Australia, Europe, India, the Middle East, and Africa.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives