- United States

- /

- Pharma

- /

- NasdaqCM:VERU

The Price Is Right For Veru Inc. (NASDAQ:VERU) Even After Diving 52%

Veru Inc. (NASDAQ:VERU) shareholders won't be pleased to see that the share price has had a very rough month, dropping 52% and undoing the prior period's positive performance. For any long-term shareholders, the last month ends a year to forget by locking in a 89% share price decline.

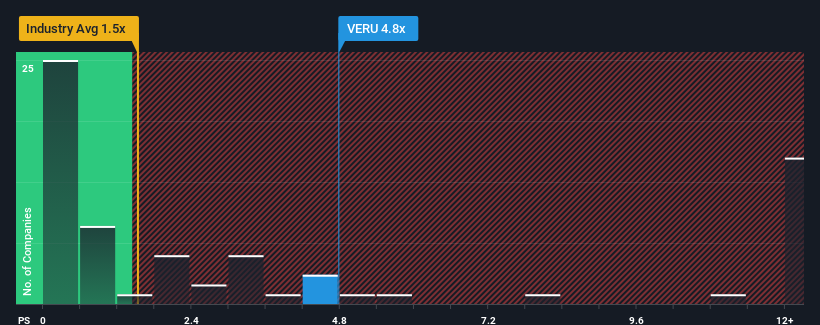

In spite of the heavy fall in price, you could still be forgiven for thinking Veru is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 4.8x, considering almost half the companies in the United States' Personal Products industry have P/S ratios below 1.5x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Veru

How Has Veru Performed Recently?

Veru hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Veru.How Is Veru's Revenue Growth Trending?

Veru's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered a frustrating 59% decrease to the company's top line. As a result, revenue from three years ago have also fallen 62% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 116% per year over the next three years. With the industry only predicted to deliver 5.6% per annum, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Veru's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Veru's P/S?

Veru's shares may have suffered, but its P/S remains high. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into Veru shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

You need to take note of risks, for example - Veru has 4 warning signs (and 1 which is a bit unpleasant) we think you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:VERU

Veru

A late clinical stage biopharmaceutical company, focuses on developing medicines for treatment of metabolic diseases, oncology, and viral-induced acute respiratory distress syndrome (ARDS).

Adequate balance sheet slight.

Similar Companies

Market Insights

Community Narratives