- United States

- /

- Pharma

- /

- NasdaqCM:VERU

Did Changing Sentiment Drive Veru's (NASDAQ:VERU) Share Price Down A Painful 81%?

Long term investing is the way to go, but that doesn't mean you should hold every stock forever. It hits us in the gut when we see fellow investors suffer a loss. Imagine if you held Veru Inc. (NASDAQ:VERU) for half a decade as the share price tanked 81%. Unfortunately the share price momentum is still quite negative, with prices down 11% in thirty days.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

View our latest analysis for Veru

Given that Veru didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last five years Veru saw its revenue shrink by 15% per year. That puts it in an unattractive cohort, to put it mildly. So it's not that strange that the share price dropped 28% per year in that period. This kind of price performance makes us very wary, especially when combined with falling revenue. Ironically, that behavior could create an opportunity for the contrarian investor - but only if there are good reasons to predict a brighter future.

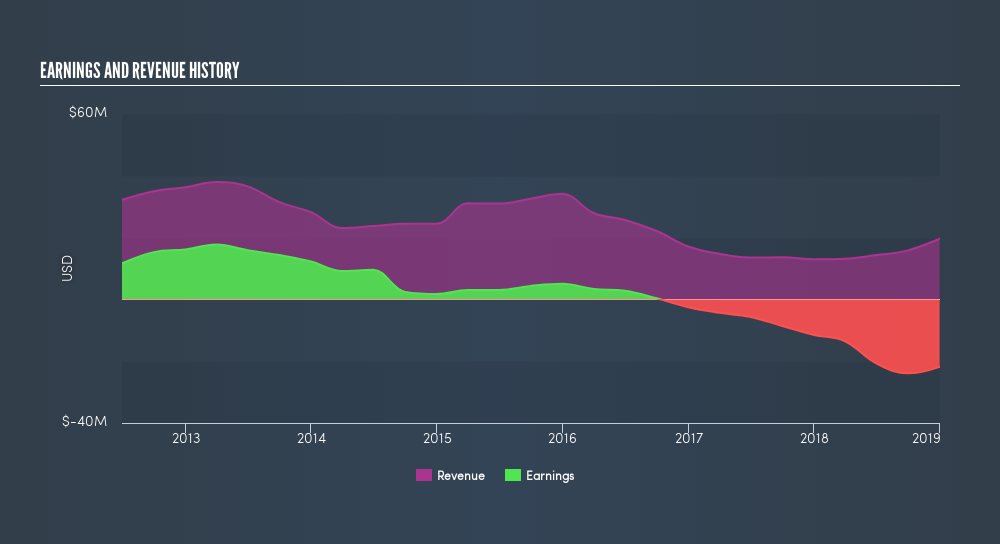

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So it makes a lot of sense to check out what analysts think Veru will earn in the future (free profit forecasts)

A Different Perspective

Investors in Veru had a tough year, with a total loss of 19%, against a market gain of about 12%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 28% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Veru by clicking this link.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this freelist of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqCM:VERU

Veru

A late clinical stage biopharmaceutical company, focuses on developing medicines for treatment of metabolic diseases, oncology, and viral-induced acute respiratory distress syndrome (ARDS).

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives