- United States

- /

- Personal Products

- /

- NasdaqCM:UPXI

Upexi's (NASDAQ:UPXI) Earnings Might Be Weaker Than You Think

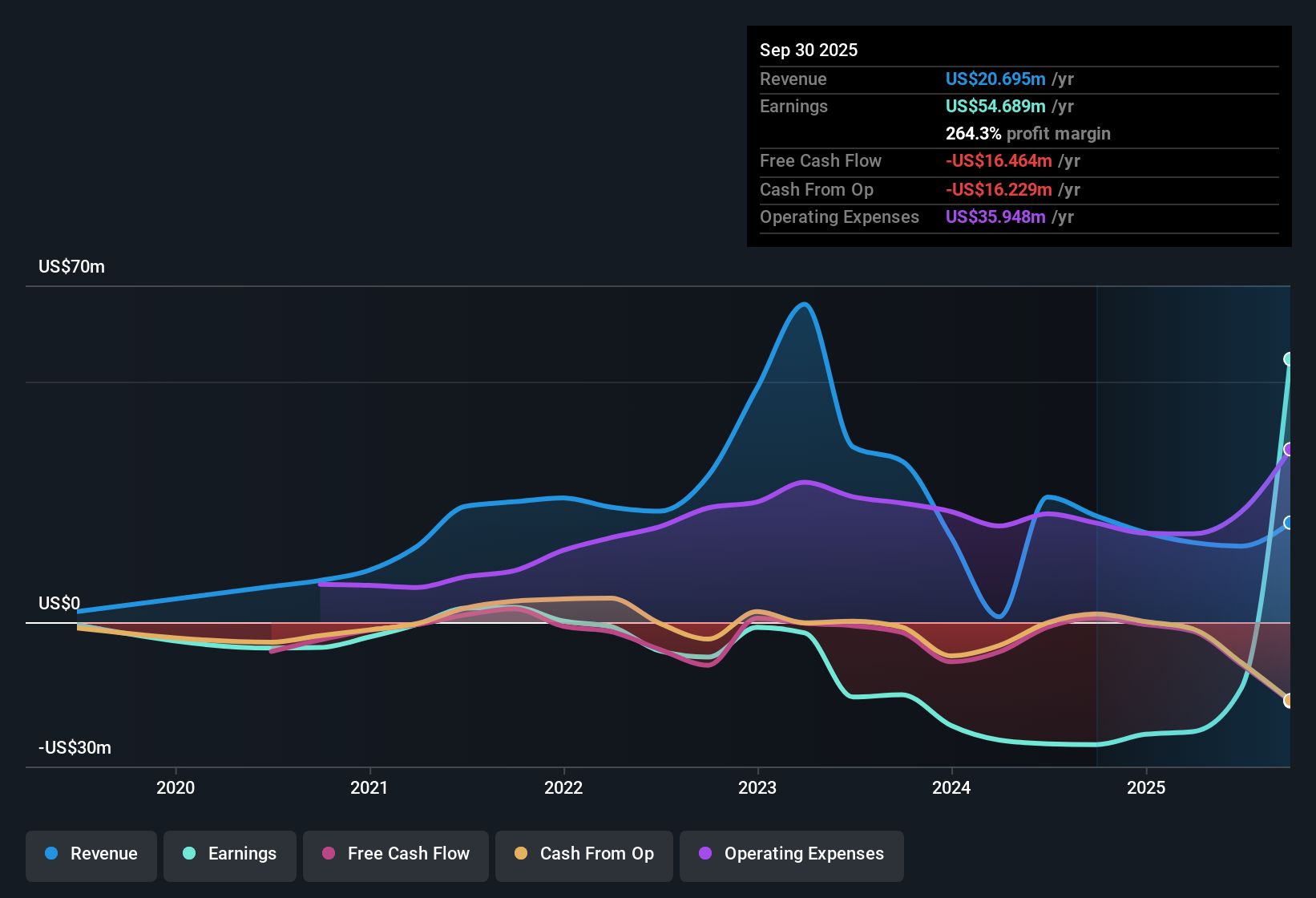

Upexi, Inc.'s (NASDAQ:UPXI) solid earnings report last week was underwhelming to investors. We did some digging and found some worrying factors that they might be paying attention to.

Zooming In On Upexi's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. This ratio tells us how much of a company's profit is not backed by free cashflow.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

For the year to September 2025, Upexi had an accrual ratio of 0.34. Therefore, we know that it's free cashflow was significantly lower than its statutory profit, raising questions about how useful that profit figure really is. Even though it reported a profit of US$54.7m, a look at free cash flow indicates it actually burnt through US$16m in the last year. It's worth noting that Upexi generated positive FCF of US$911k a year ago, so at least they've done it in the past. Unfortunately for shareholders, the company has also been issuing new shares, diluting their share of future earnings. The good news for shareholders is that Upexi's accrual ratio was much better last year, so this year's poor reading might simply be a case of a short term mismatch between profit and FCF. Shareholders should look for improved cashflow relative to profit in the current year, if that is indeed the case.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. As it happens, Upexi issued 5,637% more new shares over the last year. Therefore, each share now receives a smaller portion of profit. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. Check out Upexi's historical EPS growth by clicking on this link.

A Look At The Impact Of Upexi's Dilution On Its Earnings Per Share (EPS)

Three years ago, Upexi lost money. And even focusing only on the last twelve months, we don't have a meaningful growth rate because it made a loss a year ago, too. But mathematics aside, it is always good to see when a formerly unprofitable business come good (though we accept profit would have been higher if dilution had not been required). And so, you can see quite clearly that dilution is having a rather significant impact on shareholders.

In the long term, if Upexi's earnings per share can increase, then the share price should too. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Our Take On Upexi's Profit Performance

As it turns out, Upexi couldn't match its profit with cashflow and its dilution means that shareholders own less of the company than the did before (unless they bought more shares). For the reasons mentioned above, we think that a perfunctory glance at Upexi's statutory profits might make it look better than it really is on an underlying level. If you want to do dive deeper into Upexi, you'd also look into what risks it is currently facing. Every company has risks, and we've spotted 4 warning signs for Upexi (of which 3 are significant!) you should know about.

Our examination of Upexi has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:UPXI

Upexi

Engages in the development, manufacture, and distribution of consumer products.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives