- United States

- /

- Personal Products

- /

- NasdaqCM:PAVS

Sentiment Still Eluding Paranovus Entertainment Technology Ltd. (NASDAQ:PAVS)

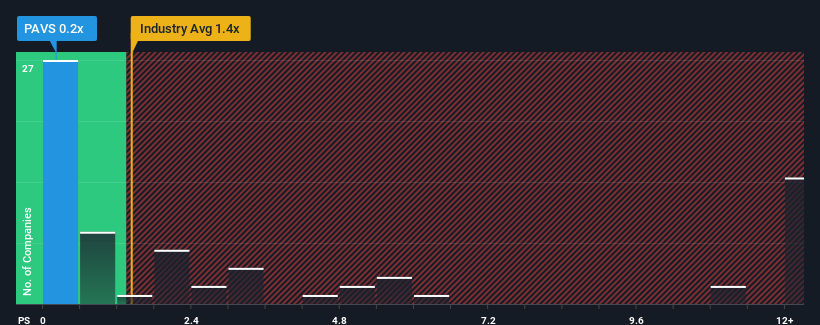

You may think that with a price-to-sales (or "P/S") ratio of 0.2x Paranovus Entertainment Technology Ltd. (NASDAQ:PAVS) is a stock worth checking out, seeing as almost half of all the Personal Products companies in the United States have P/S ratios greater than 1.4x and even P/S higher than 5x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Paranovus Entertainment Technology

What Does Paranovus Entertainment Technology's Recent Performance Look Like?

The revenue growth achieved at Paranovus Entertainment Technology over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Paranovus Entertainment Technology's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Paranovus Entertainment Technology's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 9.7% last year. This was backed up an excellent period prior to see revenue up by 51% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that to the industry, which is only predicted to deliver 5.7% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

In light of this, it's peculiar that Paranovus Entertainment Technology's P/S sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We're very surprised to see Paranovus Entertainment Technology currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

You need to take note of risks, for example - Paranovus Entertainment Technology has 5 warning signs (and 3 which can't be ignored) we think you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:PAVS

Paranovus Entertainment Technology

Operates in the artificial intelligence (AI)-powered entertainment industry.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives