- United States

- /

- Personal Products

- /

- NasdaqGM:ODD

Is Oddity’s (ODD) METHODIQ Telehealth Launch Changing Its Long-Term Growth Strategy?

Reviewed by Sasha Jovanovic

- Oddity Tech Ltd. recently reported third quarter results with sales rising to US$147.9 million and net income of US$17.75 million, alongside the launch of METHODIQ, a telehealth platform targeting dermatology care.

- In addition to delivering solid earnings growth and raising its full-year revenue outlook, Oddity is signaling a significant move into digital healthcare with METHODIQ, potentially widening its long-term addressable market.

- We'll take a look at how the METHODIQ launch creates new growth potential and impacts Oddity Tech's investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Oddity Tech Investment Narrative Recap

To be an Oddity Tech shareholder, you need to believe in the company’s ability to innovate through AI-driven personalization and successfully expand into new verticals like digital dermatology, while growing international presence. The recent METHODIQ launch and solid Q3 update reinforce Oddity’s diversification into healthcare, a key short-term catalyst, but margin pressure and execution risk in new markets remain material concerns right now.

Among recent developments, Oddity’s raised full-year revenue guidance to US$806 million to US$809 million stands out, showing confidence from management on top-line momentum. However, diversifying into telehealth, while expanding revenue potential, could magnify risks linked to customer acquisition costs and intensifying competition for online attention as Oddity enters new sectors.

By contrast, investors should be aware that Oddity’s heavy reliance on digital channels brings exposure to rising acquisition costs and...

Read the full narrative on Oddity Tech (it's free!)

Oddity Tech's outlook projects $1.3 billion in revenue and $177.0 million in earnings by 2028. This requires 19.0% annual revenue growth and a $66.9 million earnings increase from the current $110.1 million.

Uncover how Oddity Tech's forecasts yield a $70.27 fair value, a 78% upside to its current price.

Exploring Other Perspectives

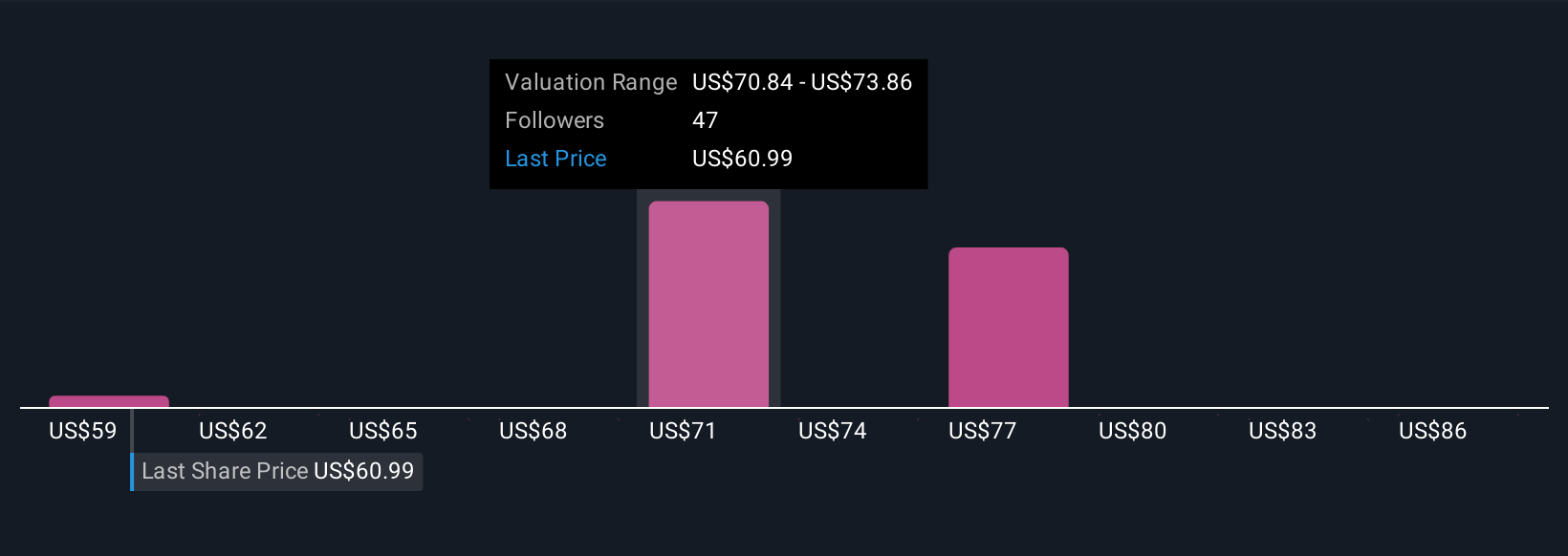

Fair value estimates from seven Simply Wall St Community perspectives span US$58.79 to as high as US$90 per share. While optimism around growth catalysts in telehealth is high, these wide-ranging valuations reflect differing views on Oddity’s reliance on digital marketing and the hurdles it may face as it broadens its portfolio.

Explore 7 other fair value estimates on Oddity Tech - why the stock might be worth over 2x more than the current price!

Build Your Own Oddity Tech Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oddity Tech research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Oddity Tech research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oddity Tech's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ODD

Oddity Tech

Operates as a consumer tech company that builds digital-first brands for the beauty and wellness industries in the United States and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives