- United States

- /

- Household Products

- /

- NasdaqGS:KMB

Reassessing Kimberly-Clark (KMB) Valuation After Recent Share Price Pullback

Reviewed by Simply Wall St

Kimberly-Clark (KMB) has been quietly drifting lower this year, even as revenue and net income keep climbing. That disconnect between share price and fundamentals is exactly what makes the stock interesting now.

See our latest analysis for Kimberly-Clark.

The recent pullback, including a 1 month share price return of 4.27% after a much steeper 90 day share price decline of 19.21%, suggests sentiment is stabilising even as the 1 year total shareholder return of 21.18% remains under pressure.

If Kimberly-Clark has you rethinking where defensive names fit in your portfolio, it might be worth scanning fast growing stocks with high insider ownership for more dynamic opportunities with owners who have real skin in the game.

With earnings still advancing and the share price lagging both analysts targets and historical returns, investors face a crucial question: is Kimberly-Clark now a defensive bargain, or is the market already pricing in its future growth?

Most Popular Narrative: 18.6% Undervalued

With Kimberly-Clark last closing at $104.94 and the most followed narrative pointing to a fair value of $128.87, the gap between price and projections is hard to ignore.

Disciplined cost management (including targeted SG&A savings, productivity initiatives delivering 5% to 6% of COGS, and digital/automation investments) is enhancing operating efficiency, providing earnings and margin tailwinds that support attainment of multi-year gross margin and operating profit milestones.

Curious how flat headline earnings can still justify a richer future multiple and higher fair value? The narrative leans heavily on expanding margins and a sharper portfolio mix. Want to see how those moving parts add up in the model? Read on to unpack the full valuation story.

Result: Fair Value of $128.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising private-label competition and weaker consumer purchasing power could erode pricing power, squeezing margins and undermining the margin-driven upside case.

Find out about the key risks to this Kimberly-Clark narrative.

Another Way to Look at Value

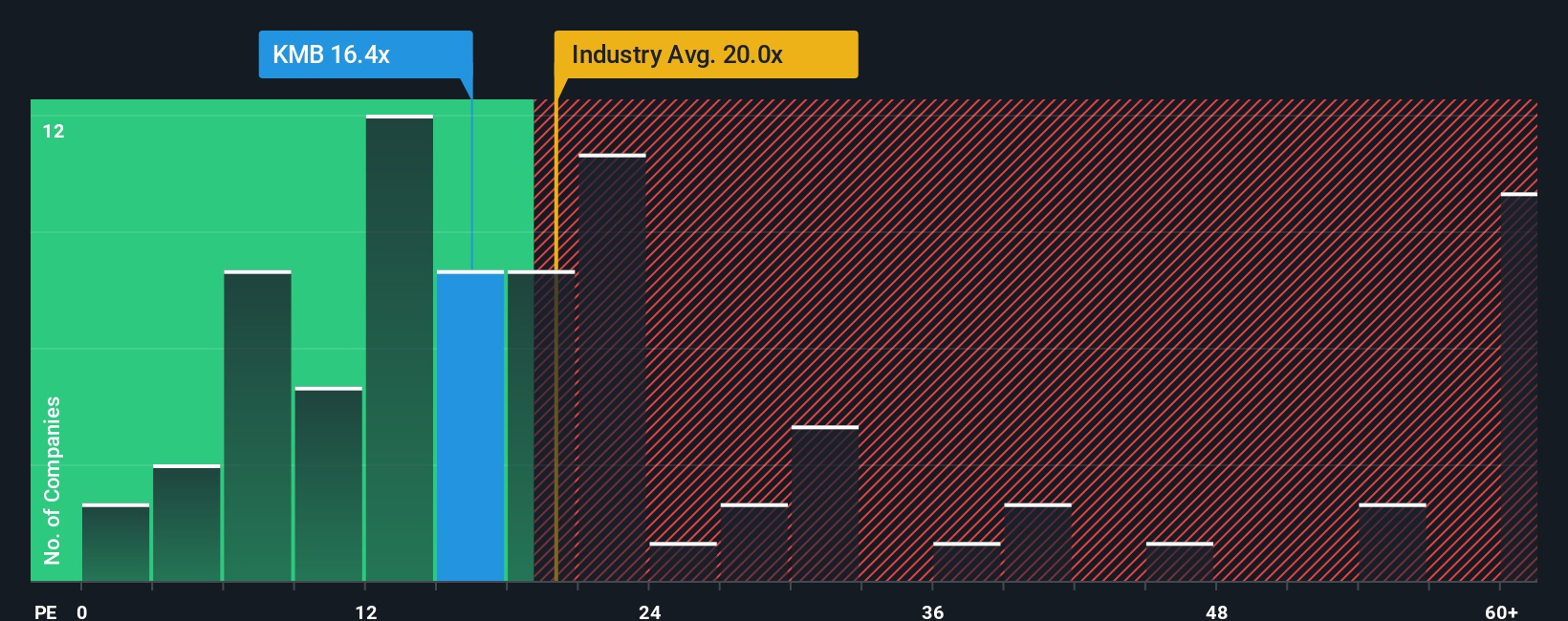

On simple earnings math, Kimberly-Clark looks inexpensive, trading on a 17.7x P/E compared with a fair ratio of 28.2x and a peer average of 20x. That spread suggests potential upside, but it also raises a tougher question: what if the market is discounting its slower growth and higher debt for a reason?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kimberly-Clark Narrative

If you have a different view or prefer to dig into the numbers yourself, you can build a custom narrative in just minutes: Do it your way.

A great starting point for your Kimberly-Clark research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before the next move in Kimberly-Clark plays out, consider preparing by lining up your watchlist with fresh, high conviction stock ideas from our screeners.

- Capture potential mispricings by targeting quality companies trading below their intrinsic worth through these 908 undervalued stocks based on cash flows.

- Explore structural growth trends with innovators at the intersection of medicine and machine learning using these 30 healthcare AI stocks.

- Focus on income and stability by concentrating on reliable payers screened via these 15 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kimberly-Clark might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KMB

Kimberly-Clark

Manufactures and markets personal care products in the United States.

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026