- United States

- /

- Household Products

- /

- NasdaqGS:KMB

Kimberly-Clark (KMB): Valuation Outlook After Leadership Change and Industry Conference Spotlight

Reviewed by Simply Wall St

Kimberly-Clark (KMB) just tapped Stacey Valy Panayiotou as its new Chief Human Resources Officer, a move that will put her at the helm of global talent strategy starting September 10th. Investors have also circled the date for the company’s presentation at the upcoming Piper Sandler Growth Frontiers Conference. Both developments have sparked questions about what leadership change might mean for the company’s next chapter. When a company known for its steady consumer staples business mixes up its executive team and steps onto the industry stage, it is understandable that shareholders are curious about the potential impact on performance and decision-making.

The stock’s performance over the past year reflects a mix of challenges and opportunities. While Kimberly-Clark’s shares are down about 7% in the past twelve months, long-term holders have fared better, enjoying a modest 17% total return over three years. It is not just about the numbers, though; the company has faced sluggish demand and changes in free cash flow margin, even as it looks to bolster leadership and public visibility. Recent moves suggest management wants to signal stability and refresh the story for investors watching momentum closely beyond just quarterly results.

After a year where sentiment has lagged but leadership signals are shifting, some investors are considering whether the current market discount reflects an opportunity, or if the risk of future growth is already factored in.

Most Popular Narrative: 9.9% Undervalued

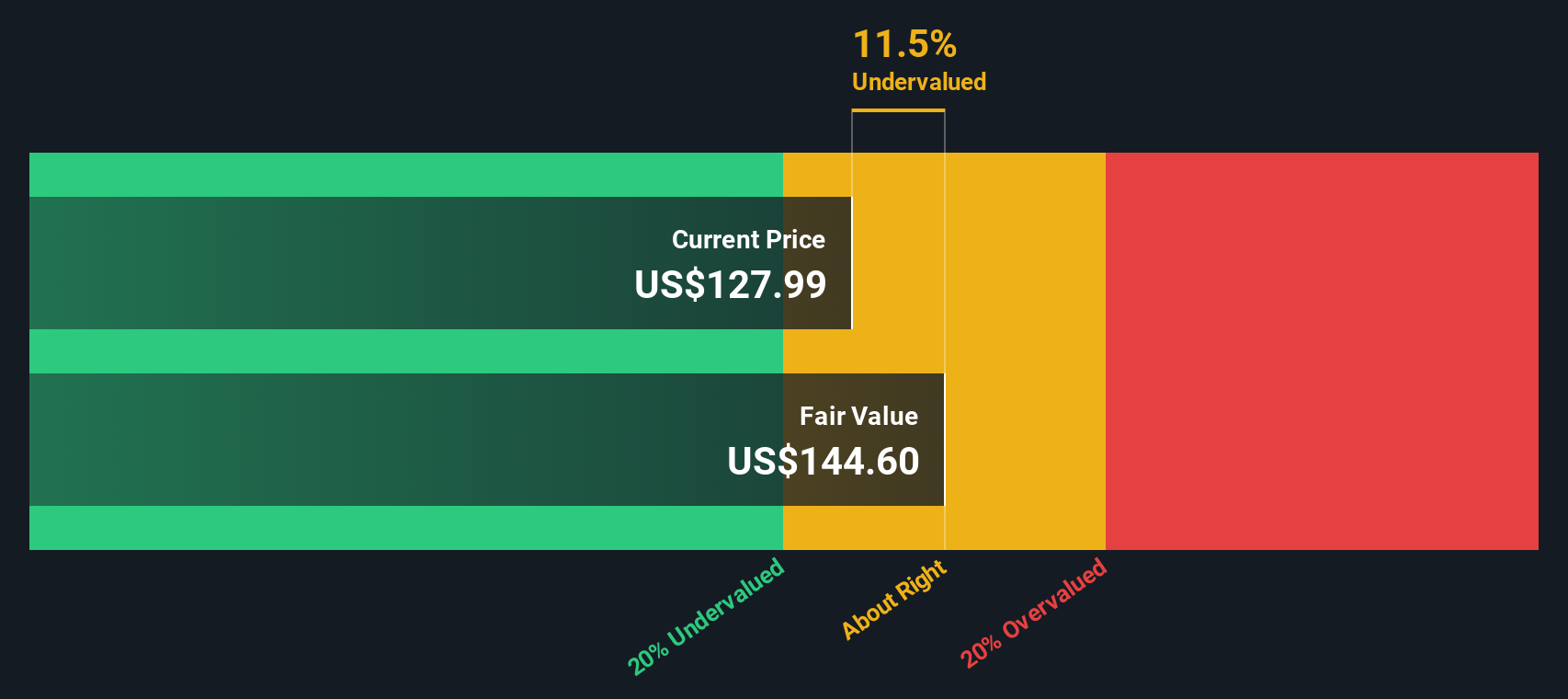

According to the most widely followed narrative, Kimberly-Clark is currently estimated to be trading at nearly 10% below its fair value. Analysts see lasting strengths beneath recent headwinds, with room for upside if key assumptions play out.

Strategic refocus on higher-growth, higher-margin North America and International Personal Care segments (post-Suzano JV) is expected to accelerate revenue and gross margin growth, aligned with long-term demographic shifts such as aging populations requiring more adult care and healthcare-related products.

Curious what is fueling this near double-digit undervaluation? The story hinges on forward-looking targets and bold, above-industry profit multiples. Want the real details behind the valuation math, such as which metrics must outperform and what is baking in a premium over peers? Uncover the projections and narrative that could change how you see Kimberly-Clark’s next chapter.

Result: Fair Value of $142.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, fierce private label competition and persistent pressure on consumer spending could quickly challenge Kimberly-Clark's margin expansion and undermine bullish forecasts.

Find out about the key risks to this Kimberly-Clark narrative.Another View: Does the SWS DCF Model Agree?

While analyst targets see upside ahead, our DCF model also suggests Kimberly-Clark is undervalued based on future cash flows. However, a key question is whether relying on discounted cash flows captures all of the risks and potential in this story.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Kimberly-Clark Narrative

Of course, if you have a different perspective or want to dive deeper into Kimberly-Clark's numbers, you can easily craft your own take in just a few minutes. Do it your way

A great starting point for your Kimberly-Clark research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep their options open. Secure your edge by checking out stocks with untapped upside and sectors you might overlook. Unique opportunities could be just a click away and you do not want to watch from the sidelines.

- Supercharge your portfolio with cash flow bargains by tapping into undervalued stocks based on cash flows and pinpointing companies poised for a rebound.

- Spot tomorrow’s breakthroughs as you scan AI penny stocks packed with firms pushing the frontier in artificial intelligence innovation and automation.

- Grow your passive income strategy by exploring dividend stocks with yields > 3%, finding companies delivering yields above 3% and rewarding shareholders year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kimberly-Clark might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KMB

Kimberly-Clark

Manufactures and markets personal care products in the United States.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives