- United States

- /

- Personal Products

- /

- NasdaqGS:IPAR

Will Interparfums' (IPAR) Investment in New Brands Reshape Its Long-Term Growth Trajectory?

Reviewed by Sasha Jovanovic

- In the past week, Interparfums issued preliminary 2026 earnings guidance, projecting net sales of US$1.48 billion and diluted EPS of US$4.85, while advising of modest growth and near-term pressures from expiring licenses and industry headwinds.

- An important insight is that the company expects earnings to dip in 2026, citing the impact of tariffs, one-time tax gains, and increased investments in new brands such as Off-White and Longchamp, with major distribution set to begin in 2027.

- We'll explore how the anticipated earnings decline and investment ramp-up in new brands could influence Interparfums' investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Interparfums Investment Narrative Recap

To be a shareholder in Interparfums, I need to believe in the company’s ability to grow through steady brand expansion and resilience in licensing partnerships, even as it faces near-term earnings pressure. The recent 2026 guidance points to lower earnings, primarily because of expiring licenses and heavier investment in new brands, which may affect short-term expectations but does not materially change the biggest near-term risk: successful integration and future performance of important new and existing licenses.

The announcement of incremental investments to build the Off-White and Longchamp brands is especially relevant here, as these launches are expected to become a key growth catalyst once their full distribution begins in 2027. This reinforces management’s emphasis on portfolio renewal and diversification as a counterbalance to any single brand exposure, underscoring the importance of execution on these upcoming launches in shaping the future trajectory. But on the flip side, it’s just as important for investors to keep in mind the heightened risk if a major license is lost or underperforms, since…

Read the full narrative on Interparfums (it's free!)

Interparfums' narrative projects $1.7 billion revenue and $206.2 million earnings by 2028. This requires 5.0% yearly revenue growth and a $45.2 million earnings increase from $161.0 million currently.

Uncover how Interparfums' forecasts yield a $136.67 fair value, a 70% upside to its current price.

Exploring Other Perspectives

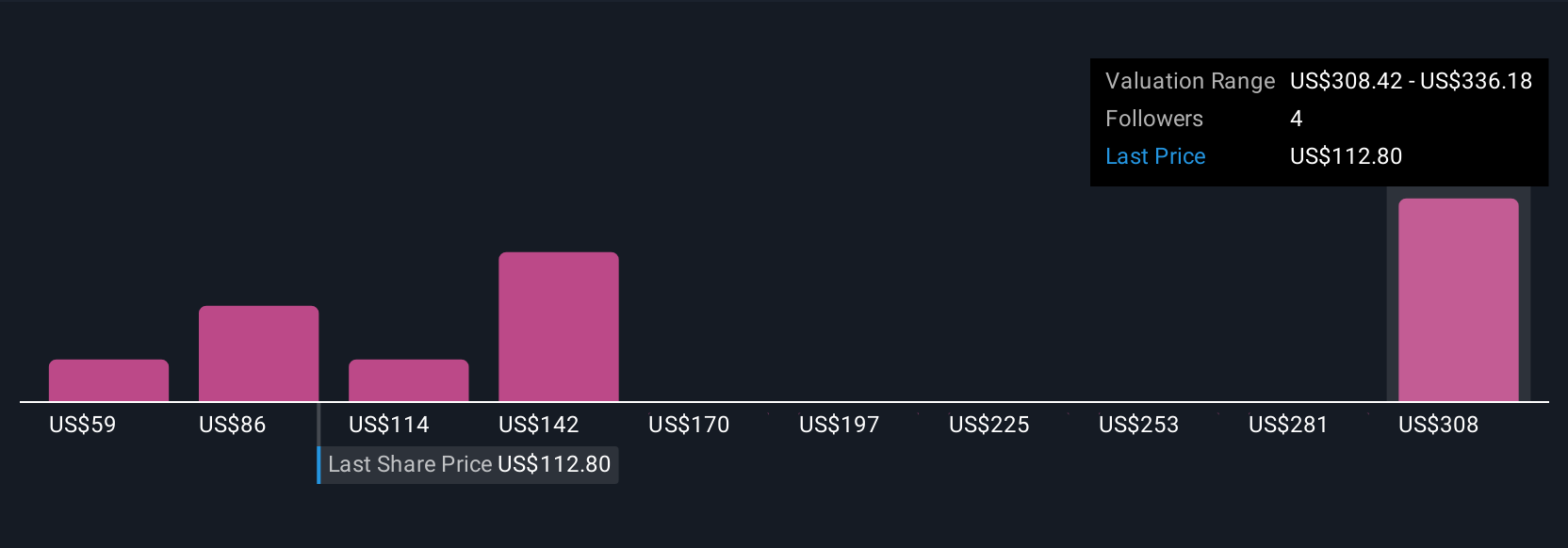

Simply Wall St Community members offered nine unique fair value estimates for Interparfums shares, with targets ranging from US$52.71 to US$14,448. Currency swings and brand concentration remain front of mind, raising questions about future results as opinions on valuation differ so widely.

Explore 9 other fair value estimates on Interparfums - why the stock might be worth 34% less than the current price!

Build Your Own Interparfums Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Interparfums research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Interparfums research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Interparfums' overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IPAR

Interparfums

Manufactures, markets, and distributes a range of fragrances and fragrance related products in the United States and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives