- United States

- /

- Personal Products

- /

- NasdaqGS:IPAR

Does Interparfums’ Global Expansion Signal a Bargain After Its 30% Share Price Drop in 2025?

Reviewed by Bailey Pemberton

- Wondering if Interparfums is a bargain or overpriced right now? You are not alone, especially with so much buzz around its valuation lately.

- While the stock has declined by 8.8% over the past week and is down 30.5% year-to-date, it is still up an impressive 114.3% over five years. This keeps investors guessing about its future direction.

- Recent headlines have highlighted Interparfums' expansion in global markets and high-profile licensing agreements. These developments have fueled both optimism and speculation among investors, bringing fresh attention to the company's long-term growth story and affecting its share price.

- The company currently boasts a 6 out of 6 valuation score, signaling that it appears undervalued by every check in our model. Let's review what that actually means for investors and explore a few traditional valuation approaches before considering a different perspective on Interparfums' value at the end.

Find out why Interparfums's -24.3% return over the last year is lagging behind its peers.

Approach 1: Interparfums Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the value of a company by projecting its future cash flows and discounting them back to today's dollars. This approach helps investors understand what a business is truly worth based on its ability to generate cash over time.

For Interparfums, the current Free Cash Flow stands at $155.18 million. Analysts expect Free Cash Flow to grow through 2026, with projections reaching $228.92 million. This is an estimated annual growth rate of around 47.5%. Looking further ahead, Simply Wall St extrapolations estimate Free Cash Flow could rise to about $730.84 million by 2035. However, these longer-term figures are less certain, as typical analyst estimates only cover five years.

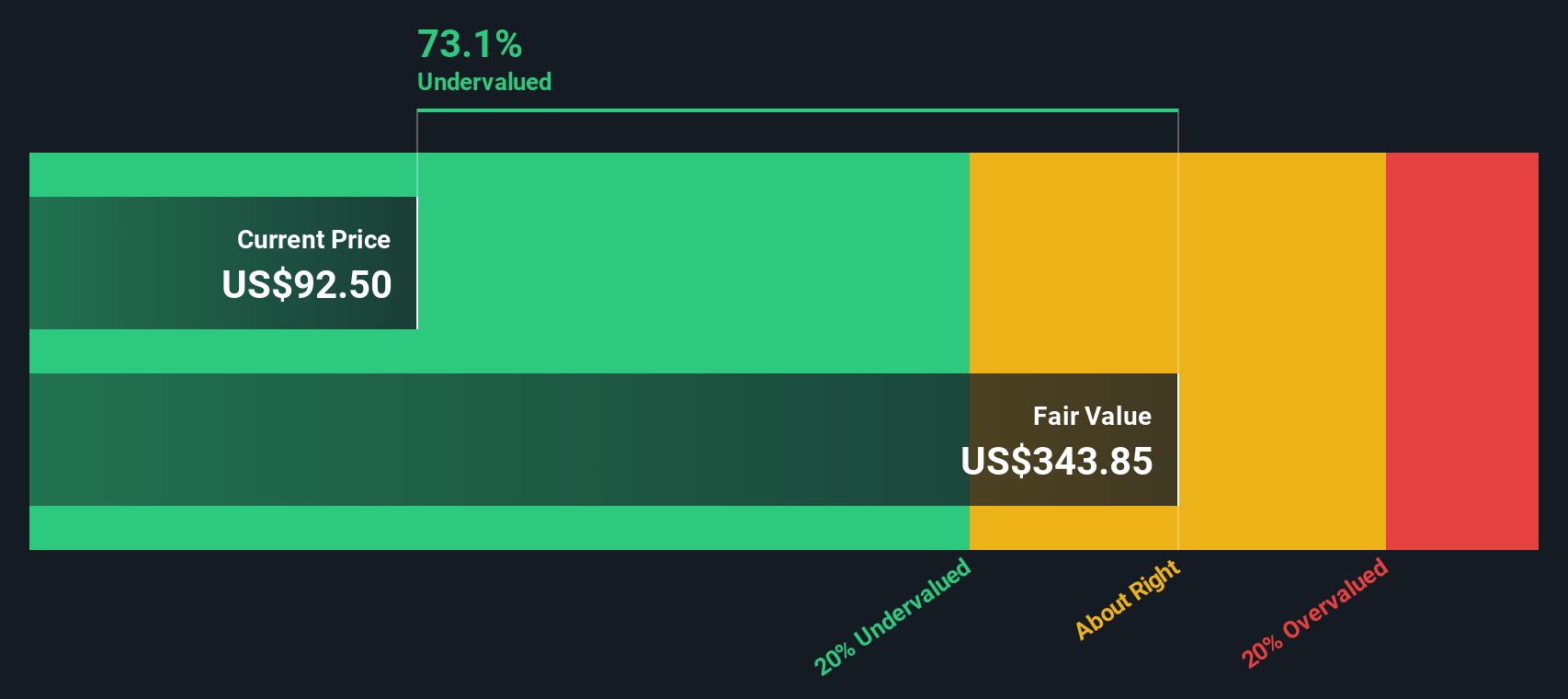

After discounting these projected cash flows back to the present, the estimated intrinsic value comes out to $340.24 per share. When compared to today's share price, this suggests Interparfums is trading at a 73.7% discount. This implies that the current market is significantly undervaluing the business based on its future cash-generating potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Interparfums is undervalued by 73.7%. Track this in your watchlist or portfolio, or discover 848 more undervalued stocks based on cash flows.

Approach 2: Interparfums Price vs Earnings

The price-to-earnings (PE) ratio is a widely used metric for valuing established and profitable companies like Interparfums because it directly links the company’s market value to its actual earnings. It provides investors with a straightforward snapshot of how much they are paying per dollar of income, making it easier to compare across companies that are generating profits.

What constitutes a “normal” or “fair” PE ratio can vary greatly depending on a company’s growth outlook and perceived risk. Fast-growing companies typically command higher PE ratios than mature or slower-growing businesses because investors expect more robust earnings in the future. Additionally, factors such as stability, industry trends, and market sentiment affect what investors consider a reasonable multiple.

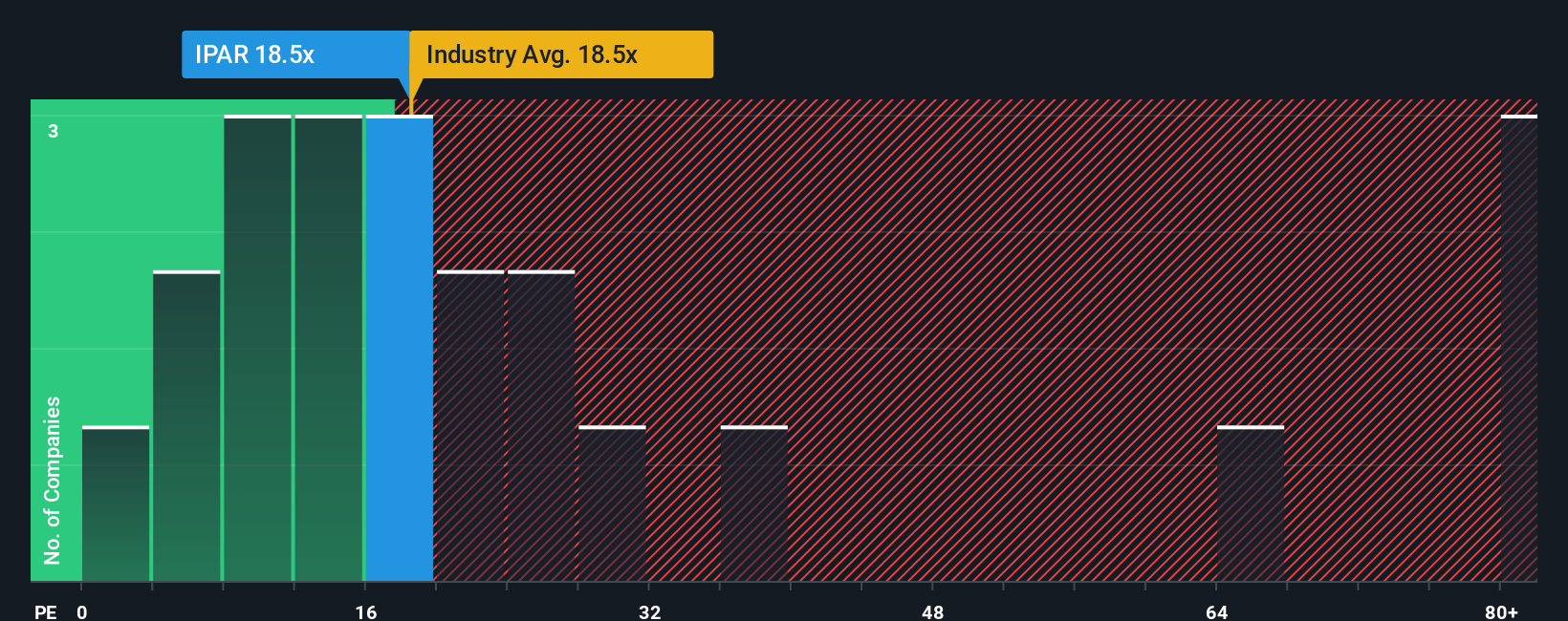

Currently, Interparfums trades at a PE ratio of 17.8x. This is lower than the broader Personal Products industry average of 22.0x and its peer average of 32.0x, suggesting that on a surface-level comparison, it appears undervalued. However, relying solely on industry averages or peer comparisons may not capture the full picture, as each company has unique growth prospects, risk factors, and operational strengths.

To address this, Simply Wall St calculates a proprietary “Fair Ratio” that incorporates not only industry and market cap but also company-specific elements such as earnings growth expectations, profit margins, and business risks. For Interparfums, this Fair Ratio stands at 18.7x. Because this is nearly identical to the current PE ratio, it suggests that the market is pricing the stock about right relative to its fundamentals and outlook.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Interparfums Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives, a simple, powerful approach that allows you to give your own story behind the numbers, connecting your perspective on a company’s future to its financial forecast and resulting fair value.

A Narrative is more than just data; it is your investment thesis captured in a single place, where you lay out the reasons you believe Interparfums will succeed or face challenges, and link them directly to estimates for future revenue, earnings, and margins.

This ties the company’s story, for example its expansion into digital channels or dependence on licensing, to concrete forecasts and an up-to-date fair value. This makes your investment decisions more meaningful and easier to understand.

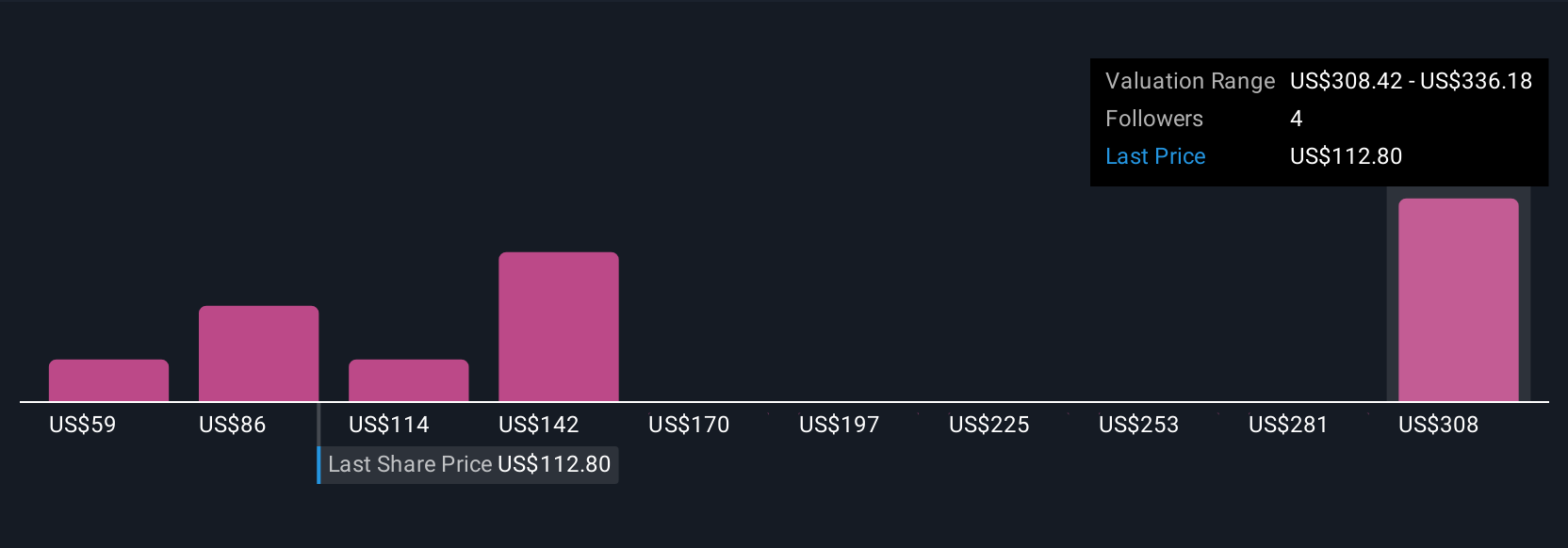

Narratives are available to everyone on Simply Wall St’s Community page, allowing millions of investors to create, update, and share their outlook, and to compare fair value to the current share price so you can decide exactly when to buy or sell.

Because Narratives dynamically update as news or earnings emerge, your fair value always reflects the latest facts, helping you stay ahead of the market.

For example, some Interparfums investors focus on the company’s strong global brand portfolio and forecast fair values as high as $163 per share, while others highlight risks from shifting consumer preferences and assign values closer to $115. This shows how different perspectives lead to different estimates and smarter decisions for your portfolio.

Do you think there's more to the story for Interparfums? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IPAR

Interparfums

Manufactures, markets, and distributes a range of fragrances and fragrance related products in the United States and internationally.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives