- United States

- /

- Personal Products

- /

- NasdaqGS:HNST

Honest Company Stock Sinks 51% as New Product Launches Spark Valuation Debate

Reviewed by Bailey Pemberton

- Wondering if Honest Company stock is a smart buy at this price? Let’s dive into what recent numbers and real trends are telling us about its true value.

- The stock has seen a notable drop lately, falling 16.9% over the past month and 51.4% year-to-date. This has sparked new questions about its growth outlook and the risks investors may be seeing.

- Recent headlines suggest Honest Company is exploring new product launches and expanding its retail partnerships. These moves could reshape its market position. These developments are drawing the attention of analysts and investors alike, who are hoping they will pave the way to a turnaround after recent share price declines.

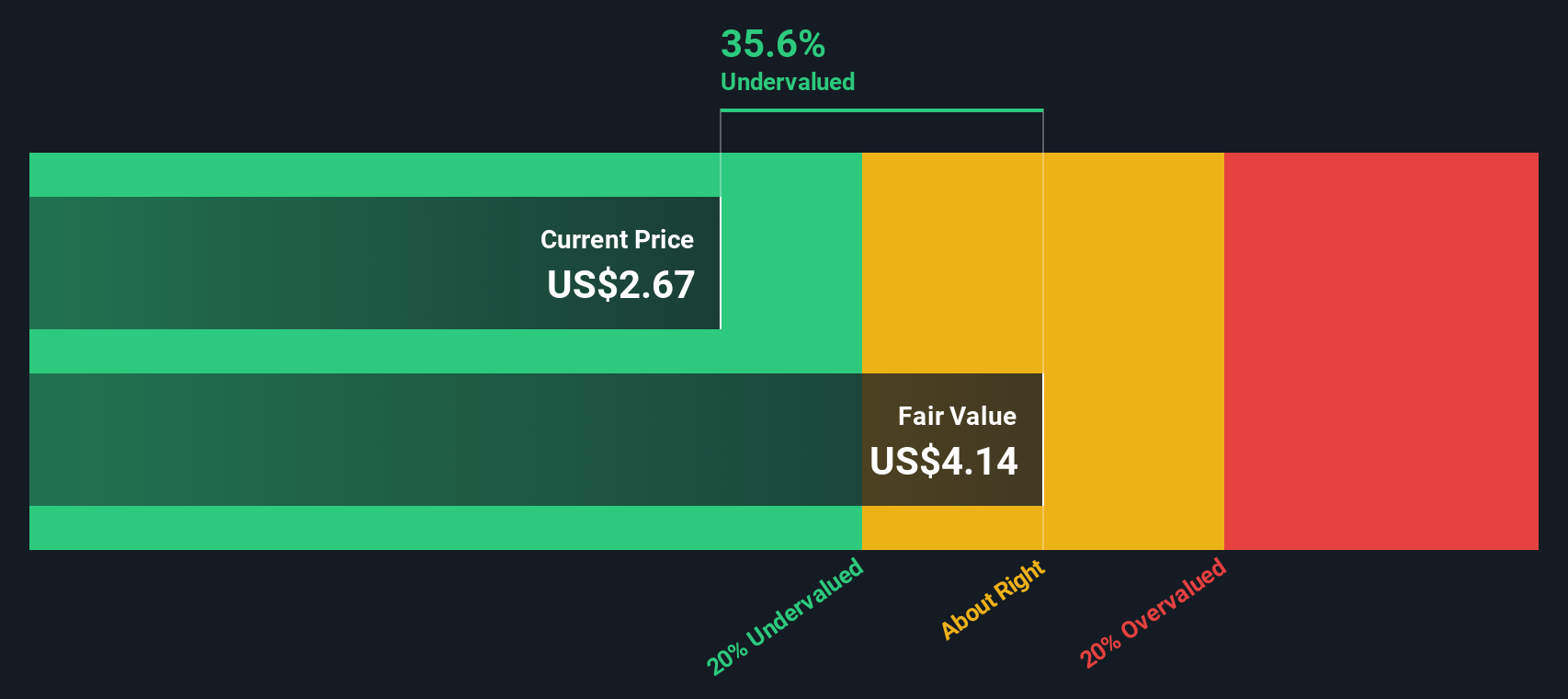

- Currently, the company scores 2 out of 6 on our valuation checks. This means it is only considered undervalued on a couple of key factors. There are several ways to look at what the business is worth, and later on we will explore which approaches bring us closest to the real answer.

Honest Company scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Honest Company Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today's value. This method aims to capture the real worth of a business based on what it is expected to earn over time. It is a widely used tool for valuing stocks beyond market hype or short-term swings.

For Honest Company, the latest reported Free Cash Flow (FCF) is -$6.64 million, meaning the business is currently spending more than it earns on a cash flow basis. However, analysts expect this picture to improve dramatically. They forecast FCF to jump to $22.1 million by the end of 2026, with further gains projected for years after. Simply Wall St extrapolates FCF to reach around $41.5 million by 2035, reflecting consistent annual growth as the business scales operations and launches new products.

Calculating all these projected cash flows, the DCF model estimates Honest Company's fair value at $6.19 per share. That is about 46.7% above the current share price, indicating the stock could be significantly undervalued at these levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Honest Company is undervalued by 46.7%. Track this in your watchlist or portfolio, or discover 848 more undervalued stocks based on cash flows.

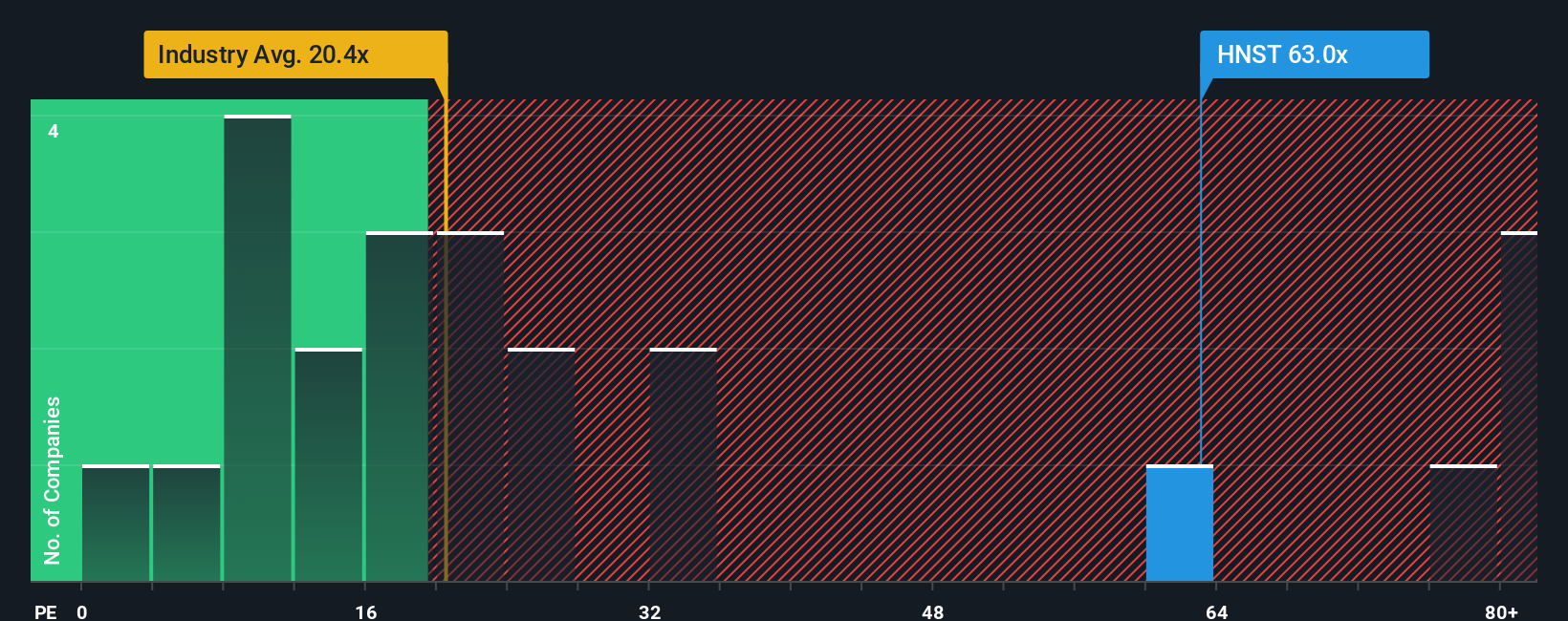

Approach 2: Honest Company Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is frequently used to value profitable companies like Honest Company because it measures how much investors are willing to pay for each dollar of current earnings. This makes it especially relevant for businesses that have moved beyond startup losses and begun generating consistent profits, as it offers a clear yardstick for comparing value across different companies and industries.

What counts as a “fair” PE ratio can shift dramatically depending on earnings growth prospects and risk. Generally, companies expected to grow faster or with lower perceived risk command higher PE ratios. Those facing headwinds or inconsistent profits tend to trade at a lower multiple.

Honest Company currently trades at a PE ratio of 56.7x. For context, the Personal Products industry average sits at 21.8x, and its direct peers average around 13.9x. Clearly, the market is placing a premium on Honest Company relative to these groups. However, Simply Wall St’s proprietary “Fair Ratio” for Honest Company is 19.6x, which is calculated by weighing in factors like expected earnings growth, profit margins, risk profile, industry dynamics, and overall market capitalization. This Fair Ratio offers a more nuanced view than just comparing to peers or industry averages alone.

Comparing Honest Company’s actual PE of 56.7x to its Fair Ratio of 19.6x suggests the stock is significantly overvalued on this measure, as the market is pricing in much faster growth or less risk than what is currently projected.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1407 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Honest Company Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives, a tool that helps you link a company’s story with its financial forecast and, ultimately, its fair value.

A Narrative is a simple, user-driven scenario that allows you to state your assumptions about a company’s future, such as revenue growth, profit margins, and risks, and describe the story behind those numbers. It bridges numbers and real-world business changes, turning complex valuation models into an approachable, intuitive summary. Narratives are freely available within the Community page on Simply Wall St, where millions of investors share and compare their perspectives.

With Narratives, you can instantly see how your outlook stacks up versus others, easily see if you feel the fair value is higher or lower than the current price, and get support for decisions about buying, holding, or selling. Narratives are also dynamic because the fair value is updated any time new information, such as earnings releases or major news, is added. This makes it easy to keep your investment thesis current and relevant.

For example, one investor might believe Honest Company deserves a fair value as high as $8.00 if clean-label trends accelerate. Another, more cautious investor might see $4.25 as fair given slower growth or risks. This demonstrates how Narratives let you make the numbers fit your own story and expectations.

Do you think there's more to the story for Honest Company? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Honest Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HNST

Honest Company

Manufactures and sells diapers and wipes, skin and personal care, and household and wellness products.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives