- United States

- /

- Personal Products

- /

- NasdaqGS:HNST

Assessing Honest Company (HNST) Valuation After Recent Modest Share Price Movement

Reviewed by Simply Wall St

See our latest analysis for Honest Company.

Even with recent volatility, Honest Company's 1-year total shareholder return of -9.3% fares better than its steep 49.8% year-to-date share price decline. This suggests long-term holders have experienced less pain compared to short-term traders. Recent weakness might signal shifting sentiment or questions around future growth.

If Honest's recent moves have you rethinking your watchlist, consider broadening your search and discover fast growing stocks with high insider ownership.

With Honest Company shares trading far below recent highs and showing some positive financial metrics, investors must ask whether there is overlooked value here or if the market is fully pricing in the company's growth prospects.

Most Popular Narrative: 49.8% Undervalued

Honest Company's widely followed narrative sets its fair value far above the current share price, signaling a potential gap between market sentiment and growth forecasts.

The company is capitalizing on the accelerating shift towards natural and clean-label products, evident from strong growth in sensitive skin, fragrance-free, and natural baby personal care items. This positions Honest to benefit from increasing consumer demand and supports future revenue expansion.

Want to know how bold projections for future profits and margins justify this aggressive upside? The narrative's pricing relies on crucial growth assumptions and a premium multiple. Which single metric lifts the valuation toward this high target? Click to see the full financial playbook behind the numbers that fuel market optimism.

Result: Fair Value of $6.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing growth in core categories and continued exposure to tariff risks could challenge Honest Company's ability to sustain long-term revenue and margin expansion.

Find out about the key risks to this Honest Company narrative.

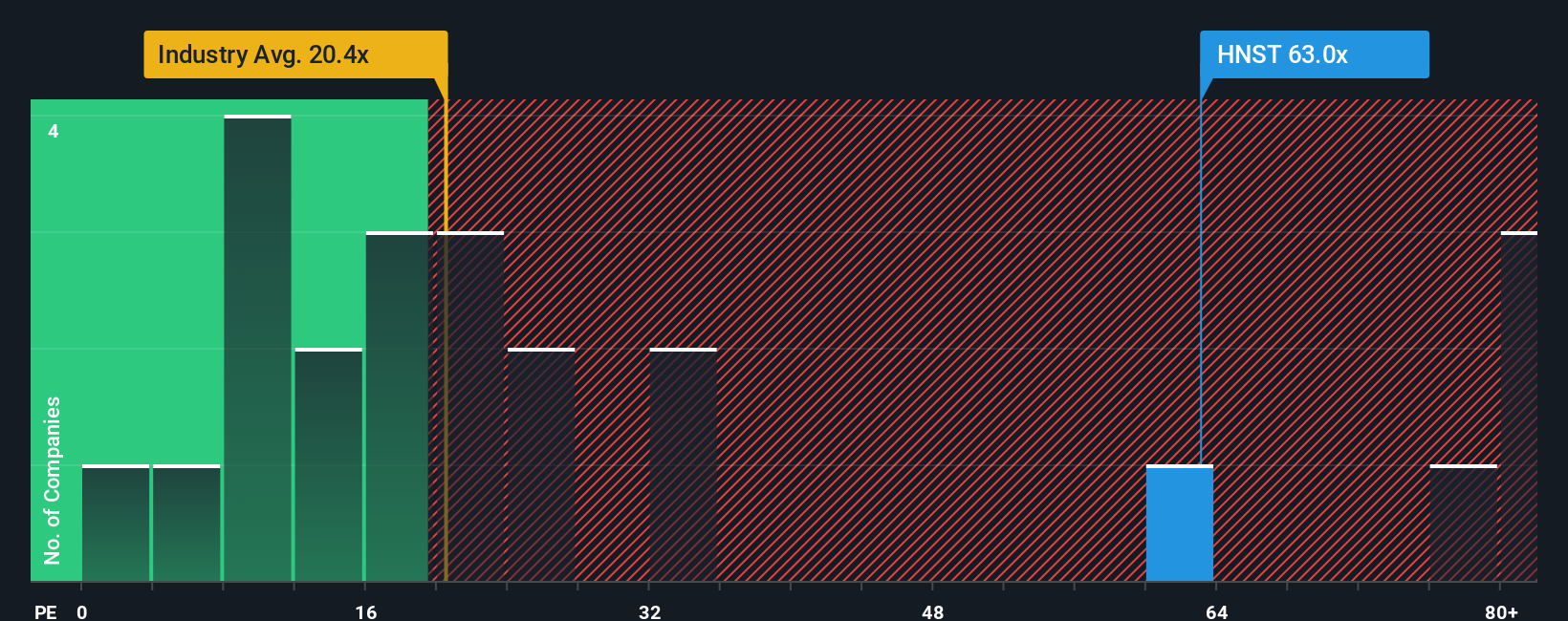

Another View: Assessing Value by Industry Ratios

While analysts see Honest Company as potentially 49.8% undervalued, industry ratios suggest a different story. Shares trade at a price-to-earnings ratio of 58.6x, which is much higher than the Personal Products industry average of 19.4x, the peer average of 14x, and the fair ratio of 19.7x. This large gap could mean a greater risk of a market re-rating or a missed value opportunity, depending on whether those high multiples are justified. How should investors interpret this disconnect?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Honest Company Narrative

If you think the story looks different based on your research or want to run the numbers your own way, you can easily craft a narrative yourself in just a few minutes. Do it your way

A great starting point for your Honest Company research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more smart investment ideas?

You’re only seeing part of the opportunity. Widen your scope with carefully selected stocks that can boost your results well beyond Honest Company’s story.

- Target long-term gains by tapping into steady income streams via these 22 dividend stocks with yields > 3% with attractive yields above 3%.

- Capture tomorrow’s tech trends and secure your place at the forefront with these 27 AI penny stocks already making waves in artificial intelligence.

- Catch high potential at bargain prices fast by screening these 840 undervalued stocks based on cash flows based on real cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Honest Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HNST

Honest Company

Manufactures and sells diapers and wipes, skin and personal care, and household and wellness products.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives