- United States

- /

- Personal Products

- /

- OTCPK:CYAN

Here's Why Cyanotech (NASDAQ:CYAN) Can Manage Its Debt Responsibly

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Cyanotech Corporation (NASDAQ:CYAN) does carry debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Cyanotech

What Is Cyanotech's Net Debt?

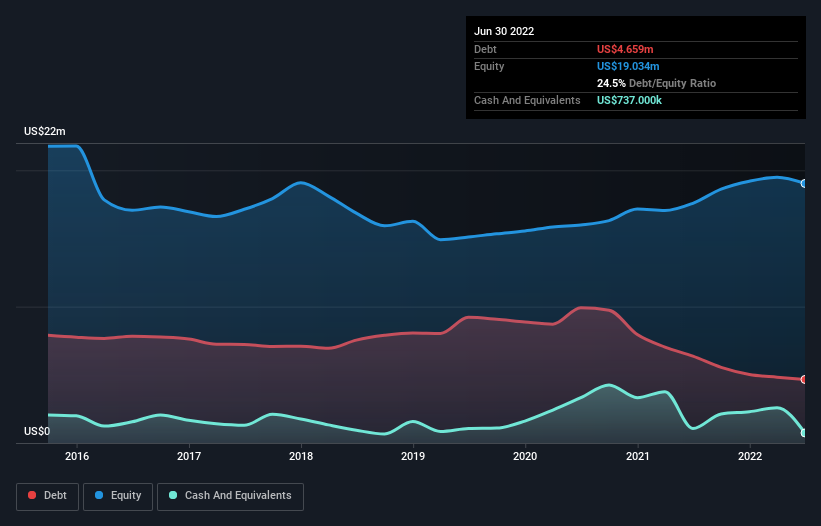

As you can see below, Cyanotech had US$4.66m of debt at June 2022, down from US$6.37m a year prior. On the flip side, it has US$737.0k in cash leading to net debt of about US$3.92m.

How Healthy Is Cyanotech's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Cyanotech had liabilities of US$4.07m due within 12 months and liabilities of US$7.61m due beyond that. On the other hand, it had cash of US$737.0k and US$3.20m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$7.74m.

While this might seem like a lot, it is not so bad since Cyanotech has a market capitalization of US$16.7m, and so it could probably strengthen its balance sheet by raising capital if it needed to. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Looking at its net debt to EBITDA of 1.2 and interest cover of 4.5 times, it seems to us that Cyanotech is probably using debt in a pretty reasonable way. But the interest payments are certainly sufficient to have us thinking about how affordable its debt is. It is well worth noting that Cyanotech's EBIT shot up like bamboo after rain, gaining 46% in the last twelve months. That'll make it easier to manage its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Cyanotech's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the most recent three years, Cyanotech recorded free cash flow worth 69% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Our View

Happily, Cyanotech's impressive EBIT growth rate implies it has the upper hand on its debt. But truth be told we feel its interest cover does undermine this impression a bit. When we consider the range of factors above, it looks like Cyanotech is pretty sensible with its use of debt. That means they are taking on a bit more risk, in the hope of boosting shareholder returns. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 1 warning sign for Cyanotech that you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OTCPK:CYAN

Cyanotech

An agricultural company, engages in the production and sale of natural ingredients and dietary supplement products from microalgae for health and wellness markets.

Slight risk and slightly overvalued.

Market Insights

Community Narratives