- United States

- /

- Household Products

- /

- NasdaqGS:CENT

Central Garden & Pet (CENT): Exploring Valuation After Recent Period of Steady Share Price Movements

Reviewed by Simply Wall St

See our latest analysis for Central Garden & Pet.

Central Garden & Pet’s share price has slipped around 15% year-to-date, with a 6% total shareholder return loss over the last year. This reflects mixed momentum and cautious sentiment, even as the underlying business continues to grow. In the short term, recent trading has been steady with a series of modest moves, as investors look for clearer signals on future direction.

If you’re on the lookout for your next opportunity, now is a sensible time to broaden your search and discover fast growing stocks with high insider ownership

With shares trading below analyst price targets and recent earnings growth on the books, could Central Garden & Pet be offering value at today’s levels, or are investors already pricing in all the upside?

Most Popular Narrative: 23% Undervalued

Analyst consensus suggests Central Garden & Pet could be trading well below its fair value estimate, with the last close price notably lower than the narrative target. This creates a major focus on the market factors and business shifts that shape such an upside scenario.

Central is benefiting from continued growth in pet ownership and the willingness of pet owners to purchase premium, wellness-focused, and sustainable products. This is supported by initiatives such as launching natural, eco-friendly brands, including Nylabone's toys made from reclaimed fishing nets and Adams Botanicals plant-based sprays. These efforts are likely to drive sustained top-line growth and strengthen brand loyalty.

Ready to uncover what really powers this high fair value? The secret sauce is a mix of profit expansion and a future multiple that rivals industry leaders. Curious what explosive financial forecasts fuel this price target? Discover the full story and the vital numbers behind the scenes.

Result: Fair Value of $42.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softening demand in pet durables or intensifying supply chain pressures could challenge these upbeat forecasts and limit upside if not quickly addressed.

Find out about the key risks to this Central Garden & Pet narrative.

Another View: Peer Comparisons Add More Context

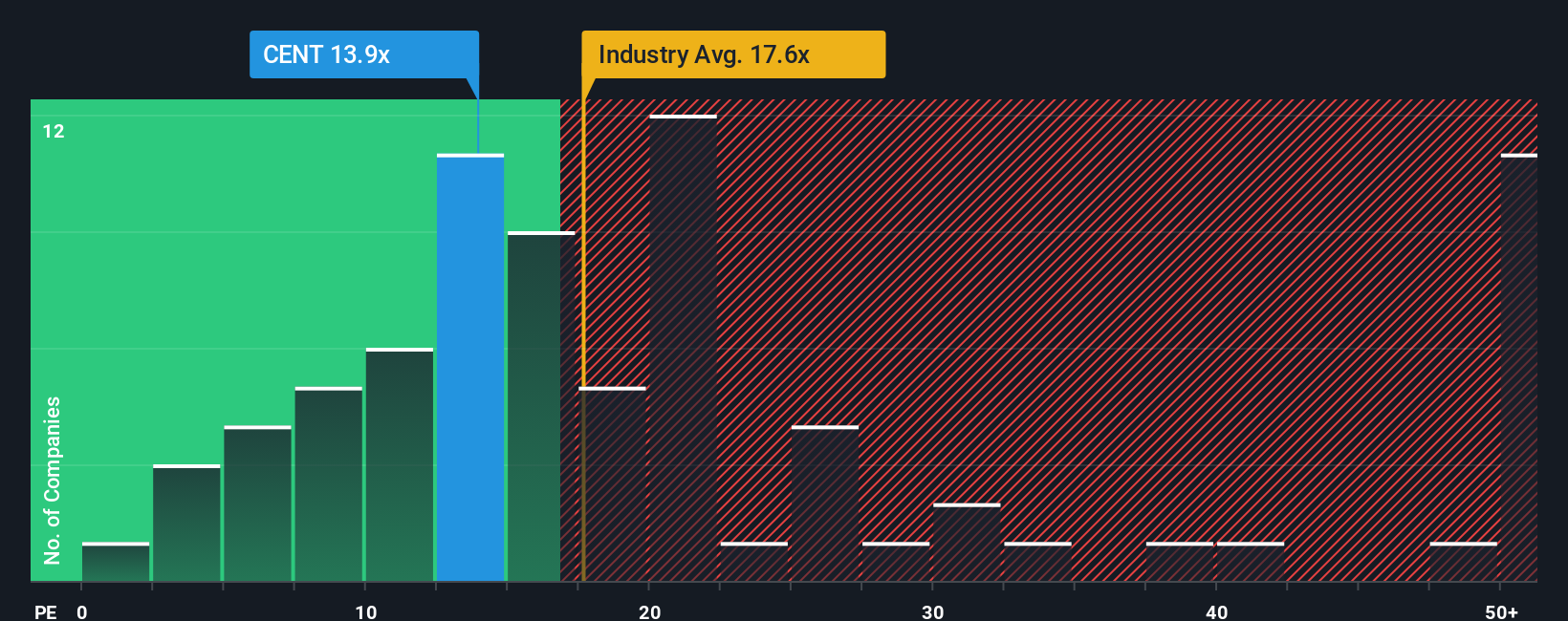

Looking at the company’s valuation from another perspective, Central Garden & Pet trades at a price-to-earnings ratio of 14.7x. That is noticeably cheaper than both the US Household Products industry average of 19.7x and its peer group average of 18.9x. The fair ratio is even higher at 18.3x, suggesting the market could eventually re-rate the stock upward if performance holds.

But does this lower valuation signal an opportunity or indicate that investors are remaining cautious for a reason?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Central Garden & Pet for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Central Garden & Pet Narrative

If you see things differently or would rather dive into the numbers for yourself, it takes just a few minutes to craft your own view with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Central Garden & Pet.

Looking for More Investment Ideas?

There are smart opportunities beyond Central Garden & Pet that you shouldn't overlook. The right stock could be the missing piece for your portfolio. Why wait?

- Tap into the explosive potential of artificial intelligence by checking out these 26 AI penny stocks transforming industries from healthcare to automation.

- Boost your income with steady, high-yield investments found through these 21 dividend stocks with yields > 3% offering attractive returns above 3%.

- Take the lead with trailblazers in blockchain technology and digital currencies by exploring these 81 cryptocurrency and blockchain stocks redefining the boundaries of finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CENT

Central Garden & Pet

Produces and distributes various products for the lawn and garden, and pet supplies markets in the United States.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives