- United States

- /

- Medical Equipment

- /

- NYSEAM:STXS

Investors Who Bought Stereotaxis (NYSEMKT:STXS) Shares Five Years Ago Are Now Up 597%

For many, the main point of investing in the stock market is to achieve spectacular returns. And highest quality companies can see their share prices grow by huge amounts. Just think about the savvy investors who held Stereotaxis, Inc. (NYSEMKT:STXS) shares for the last five years, while they gained 597%. If that doesn't get you thinking about long term investing, we don't know what will. It's also good to see the share price up 67% over the last quarter.

Anyone who held for that rewarding ride would probably be keen to talk about it.

See our latest analysis for Stereotaxis

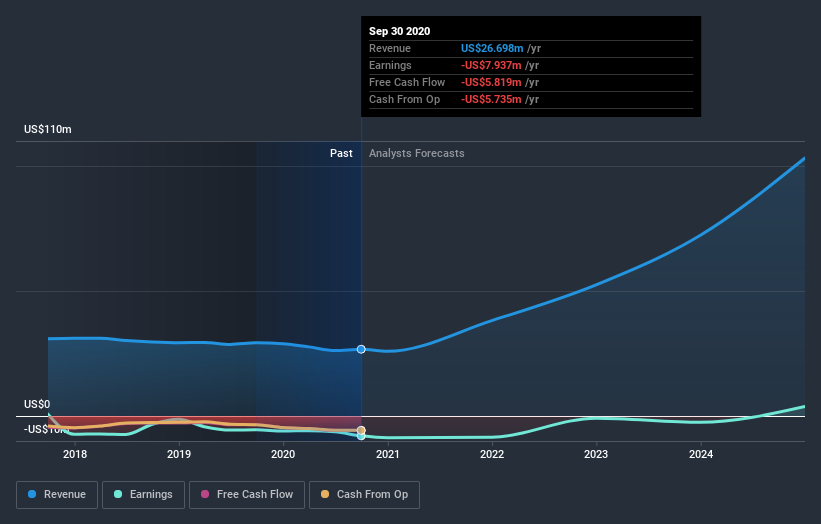

Because Stereotaxis made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last half decade Stereotaxis' revenue has actually been trending down at about 6.6% per year. So it's pretty surprising to see that the share price is up 47% per year. Obviously, whatever the market is excited about, it's not a track record of revenue growth. At the risk of upsetting holders, this does suggest that hope for a better future is playing a significant role in the share price action.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free report showing analyst forecasts should help you form a view on Stereotaxis

A Different Perspective

Stereotaxis shareholders gained a total return of 2.5% during the year. But that was short of the market average. If we look back over five years, the returns are even better, coming in at 47% per year for five years. Maybe the share price is just taking a breather while the business executes on its growth strategy. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Stereotaxis is showing 3 warning signs in our investment analysis , you should know about...

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you’re looking to trade Stereotaxis, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSEAM:STXS

Stereotaxis

Designs, manufactures, and markets robotic systems, instruments, and information systems for the interventional laboratory in the United States and internationally.

Adequate balance sheet low.