- United States

- /

- Medical Equipment

- /

- NYSEAM:RVP

How Should Investors React To Retractable Technologies' (NYSEMKT:RVP) CEO Pay?

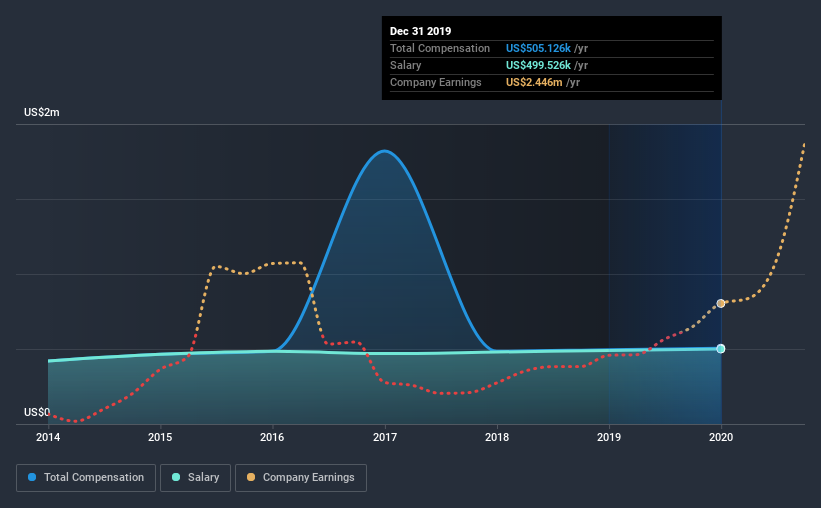

Thomas Shaw has been the CEO of Retractable Technologies, Inc. (NYSEMKT:RVP) since 1994, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Retractable Technologies.

View our latest analysis for Retractable Technologies

Comparing Retractable Technologies, Inc.'s CEO Compensation With the industry

Our data indicates that Retractable Technologies, Inc. has a market capitalization of US$392m, and total annual CEO compensation was reported as US$505k for the year to December 2019. That's mostly flat as compared to the prior year's compensation. In particular, the salary of US$499.5k, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar companies from the same industry with market caps ranging from US$200m to US$800m, we found that the median CEO total compensation was US$2.1m. In other words, Retractable Technologies pays its CEO lower than the industry median. What's more, Thomas Shaw holds US$186m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | US$500k | US$490k | 99% |

| Other | US$5.6k | US$5.5k | 1% |

| Total Compensation | US$505k | US$496k | 100% |

On an industry level, roughly 21% of total compensation represents salary and 79% is other remuneration. Retractable Technologies pays a high salary, concentrating more on this aspect of compensation in comparison to non-salary pay. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Retractable Technologies, Inc.'s Growth Numbers

Over the past three years, Retractable Technologies, Inc. has seen its earnings per share (EPS) grow by 128% per year. It achieved revenue growth of 67% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's great to see that revenue growth is strong, too. These metrics suggest the business is growing strongly. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Retractable Technologies, Inc. Been A Good Investment?

Boasting a total shareholder return of 1,709% over three years, Retractable Technologies, Inc. has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Thomas receives almost all of their compensation through a salary. As previously discussed, Thomas is compensated less than what is normal for CEOs of companies of similar size, and which belong to the same industry. Considering robust EPS growth, we believe Thomas to be modestly paid. And given most shareholders are probably very happy with recent shareholder returns, they might even think Thomas deserves a raise!

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We did our research and identified 3 warning signs (and 1 which is concerning) in Retractable Technologies we think you should know about.

Switching gears from Retractable Technologies, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you decide to trade Retractable Technologies, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NYSEAM:RVP

Retractable Technologies

Designs, develops, manufactures, and markets safety syringes and other safety medical products for the healthcare profession in the United States, rest of North and South America, and internationally.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion