- United States

- /

- Medical Equipment

- /

- NYSEAM:ELMD

How Is Electromed's (NYSEMKT:ELMD) CEO Paid Relative To Peers?

This article will reflect on the compensation paid to Kathleen Skarvan who has served as CEO of Electromed, Inc. (NYSEMKT:ELMD) since 2012. This analysis will also assess whether Electromed pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

Check out our latest analysis for Electromed

Comparing Electromed, Inc.'s CEO Compensation With the industry

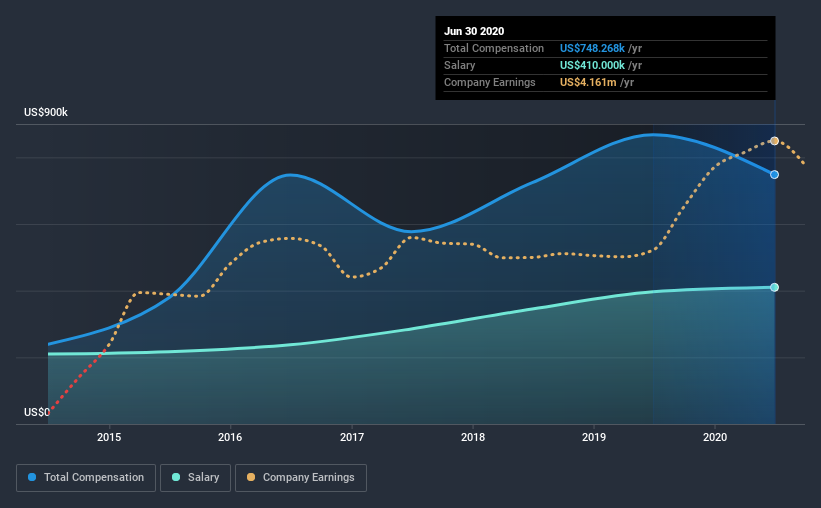

At the time of writing, our data shows that Electromed, Inc. has a market capitalization of US$84m, and reported total annual CEO compensation of US$748k for the year to June 2020. That's a notable decrease of 14% on last year. In particular, the salary of US$410.0k, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar-sized companies in the industry with market capitalizations below US$200m, we found that the median total CEO compensation was US$567k. Hence, we can conclude that Kathleen Skarvan is remunerated higher than the industry median. Furthermore, Kathleen Skarvan directly owns US$1.4m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$410k | US$397k | 55% |

| Other | US$338k | US$471k | 45% |

| Total Compensation | US$748k | US$868k | 100% |

Speaking on an industry level, nearly 22% of total compensation represents salary, while the remainder of 78% is other remuneration. Electromed is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Electromed, Inc.'s Growth

Electromed, Inc. has seen its earnings per share (EPS) increase by 19% a year over the past three years. The trailing twelve months of revenue was pretty much the same as the prior period.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's always a tough situation when revenues are not growing, but ultimately profits are more important. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Electromed, Inc. Been A Good Investment?

We think that the total shareholder return of 67%, over three years, would leave most Electromed, Inc. shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

As we touched on above, Electromed, Inc. is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. However, Electromed has produced strong EPS growth and shareholder returns over the last three years. So, in acknowledgment of the overall excellent performance, we believe CEO compensation is appropriate. The pleasing shareholder returns are the cherry on top. We wouldn't be wrong in saying that shareholders feel that Kathleen's performance creates value for the company.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 3 warning signs for Electromed that investors should think about before committing capital to this stock.

Important note: Electromed is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you decide to trade Electromed, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Electromed might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NYSEAM:ELMD

Electromed

Develops, manufactures, markets, and sells airway clearance therapy and related products that apply high frequency chest wall oscillation (HFCWO) therapy in pulmonary care for patients of various ages in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives