- United States

- /

- Healthcare Services

- /

- NYSEAM:AMS

Need To Know: American Shared Hospital Services (NYSEMKT:AMS) Insiders Have Been Selling Shares

We often see insiders buying up shares in companies that perform well over the long term. Unfortunately, there are also plenty of examples of share prices declining precipitously after insiders have sold shares. So shareholders might well want to know whether insiders have been buying or selling shares in American Shared Hospital Services (NYSEMKT:AMS).

Do Insider Transactions Matter?

It's quite normal to see company insiders, such as board members, trading in company stock, from time to time. However, rules govern insider transactions, and certain disclosures are required.

Insider transactions are not the most important thing when it comes to long-term investing. But logic dictates you should pay some attention to whether insiders are buying or selling shares. As Peter Lynch said, 'insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise.'

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

View our latest analysis for American Shared Hospital Services

The Last 12 Months Of Insider Transactions At American Shared Hospital Services

In the last twelve months, the biggest single purchase by an insider was when Independent Director Raymond Stachowiak bought US$438k worth of shares at a price of US$2.73 per share. That means that an insider was happy to buy shares at around the current price of US$2.98. Of course they may have changed their mind. But this suggests they are optimistic. While we always like to see insider buying, it's less meaningful if the purchases were made at much lower prices, as the opportunity they saw may have passed. In this case we're pleased to report that the insider bought shares at close to current prices. Raymond Stachowiak was the only individual insider to buy shares in the last twelve months.

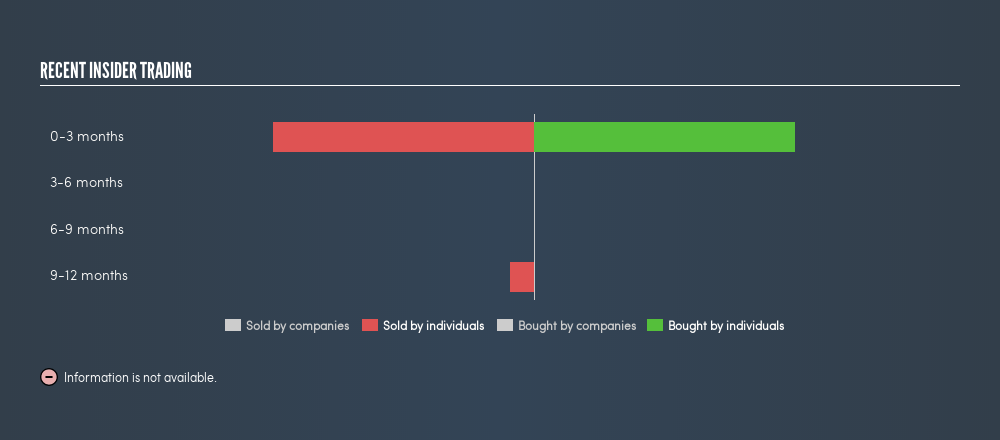

All up, insiders sold more shares in American Shared Hospital Services than they bought, over the last year. You can see a visual depiction of insider transactions (by individuals) over the last 12 months, below. By clicking on the graph below, you can see the precise details of each insider transaction!

I will like American Shared Hospital Services better if I see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Insider Ownership

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. American Shared Hospital Services insiders own about US$6.1m worth of shares. That equates to 36% of the company. While this is a strong but not outstanding level of insider ownership, it's enough to indicate some alignment between management and smaller shareholders.

So What Do The American Shared Hospital Services Insider Transactions Indicate?

Insider sales and purchases have netted out over the last three months, so it's hard to draw any conclusion from recent trading. Recent sales exacerbate our caution arising from analysis of American Shared Hospital Services insider transactions. The modest level of insider ownership is, at least, some comfort. I like to dive deeper into how a company has performed in the past. You can find historic revenue and earnings in this detailed graph.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSEAM:AMS

American Shared Hospital Services

Provides technology solutions for stereotactic radiosurgery and advanced radiation therapy equipment and services.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives