- United States

- /

- Healthtech

- /

- NYSE:VEEV

Veeva Systems (VEEV): Assessing Valuation After a 20% Share Price Slide Despite Ongoing Growth

Reviewed by Simply Wall St

Veeva Systems (VEEV) has been sliding over the past month, with the stock down about 20% even as the underlying business keeps growing. That disconnect is what makes the setup interesting now.

See our latest analysis for Veeva Systems.

Over the past few months that 30 day share price return of minus 20.11 percent has dragged sentiment lower, even though the year to date share price return remains positive and the three year total shareholder return of 35.62 percent still points to a solid underlying story.

If Veeva’s move has you rethinking where you want exposure in healthcare tech, it could be worth scouting other specialised names using healthcare stocks.

With the shares now trading well below analyst targets despite double digit revenue and profit growth, the key question is whether Veeva is temporarily mispriced or if the market is correctly discounting all that future upside.

Most Popular Narrative: 30.1% Undervalued

With Veeva Systems last closing at $218.10 against a narrative fair value near $312, the story hinges on whether future execution closes that gap.

The resolution of the long standing dispute with IQVIA removes critical data interoperability barriers, enabling Veeva to fully integrate industry leading datasets into its Commercial Cloud. This may expand its addressable market, improve product adoption across multiple commercial applications, and support faster top line revenue growth over the next several years. Veeva's progress embedding advanced AI agents directly within its Vault platform across both R&D and Commercial suites may strengthen its role as a workflow and automation partner amid the rising complexity of personalized medicine, genomics, and data driven trials. This in turn could support higher pricing power, platform stickiness, and net margin expansion in the medium to the long term.

Curious how steady double digit growth, rising margins, and a rich future earnings multiple can still point to upside from here? The full narrative unpacks the math behind that fair value, including the long term profit engine that underpins it.

Result: Fair Value of $312.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained software multiple compression or slower than expected AI and CRM adoption among cautious pharma customers could quickly narrow that apparent valuation gap.

Find out about the key risks to this Veeva Systems narrative.

Another Angle on Valuation

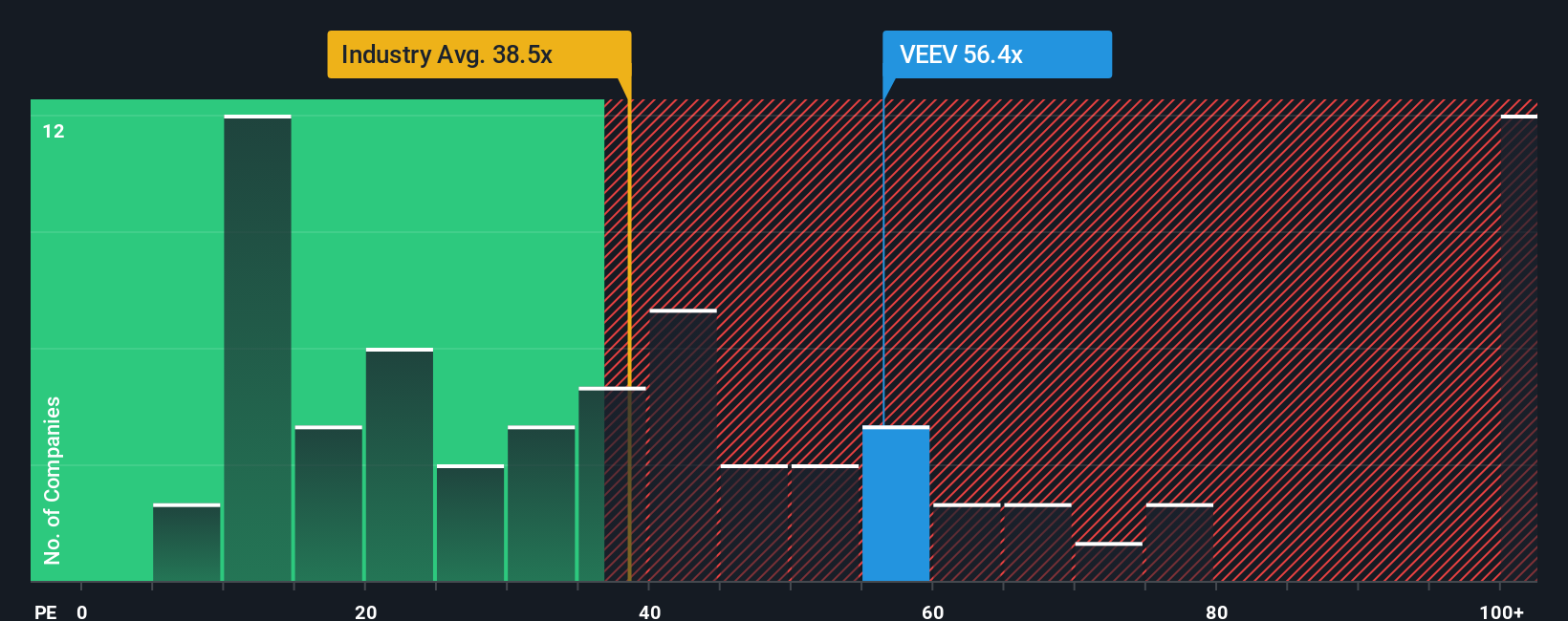

On earnings, Veeva looks less forgiving. The stock trades around 41.7 times earnings versus a 31.9 times industry average and a 31.8 times fair ratio our model suggests markets could drift toward, which would leave less upside and more de rating risk if sentiment stays cautious.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Veeva Systems Narrative

If the implied story here does not quite match your own view or research approach, you can quickly craft a personalised take in minutes, Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Veeva Systems.

Ready for more actionable stock ideas?

Before you move on, explore focused screeners on Simply Wall St so you are not leaving potential opportunities unseen.

- Target long-term wealth building with reliable income by reviewing these 13 dividend stocks with yields > 3% that combine solid yields with quality fundamentals and balanced payout profiles.

- Position yourself early in transformative innovation by scanning these 28 quantum computing stocks focused on developments in computing power, advanced materials, and breakthrough research.

- Seek potential mispriced opportunities by filtering for these 918 undervalued stocks based on cash flows where strong cash flows and resilient balance sheets may not yet be fully reflected in the share price.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VEEV

Veeva Systems

Provides cloud-based software for the life sciences industry in North America, Europe, the Asia Pacific, the Middle East, Africa, and Latin America.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion