- United States

- /

- Healthtech

- /

- NYSE:VEEV

Does Veeva Systems’ Product Expansion Signal a Good Entry Point After 38% YTD Surge?

Reviewed by Bailey Pemberton

If you're eyeing Veeva Systems and wondering whether now is the right moment to buy, hold, or cash out, you’re not alone. The stock market is filled with investors trying to make sense of where healthcare tech companies like Veeva fit in amid an ever-shifting landscape. Over the past year, Veeva’s shares have delivered a robust 37.1% return, with year-to-date performance even higher at 38.4%. That kind of upward momentum always gets attention; although monthly fluctuations, such as a mild 0.4% dip in the past week and a 4.5% rise over the last month, remind us that growth rarely travels in a straight line.

What’s behind these moves? Recently, Veeva attracted headlines after further expanding its product line for the life sciences industry, an announcement that reinforced its reputation for innovation without causing any major swings in sentiment. The stock’s long-term performance tells a nuanced story: over the past three years, shares are up an impressive 71.0%, but the five-year gain stands at just 2.4%, underscoring periods of both explosive growth and consolidation.

Of course, all these price changes leave one key question: is Veeva’s current valuation justified? Right now, its valuation score sits at just 1 out of 6, indicating that by most traditional measures, the stock is not broadly undervalued. Before you make a decision, let’s break down the usual yardsticks used to value a business like Veeva Systems. Stay with me, because I have an even smarter way to approach valuation coming up at the end of this article.

Veeva Systems scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Veeva Systems Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's true value by projecting its future cash flows and discounting them back to today. This approach gives investors a clearer picture of what the business may be worth at present. For Veeva Systems, the analysis starts with current Free Cash Flow of $1.32 billion and then considers how much that could grow in the coming years.

Analysts expect Veeva’s cash flows to rise steadily, projecting approximately $1.47 billion in 2027 and $2.37 billion by 2030. While projections beyond five years rely more on extrapolation, these figures suggest a company that continues to generate more cash as its products gain traction in the life sciences space.

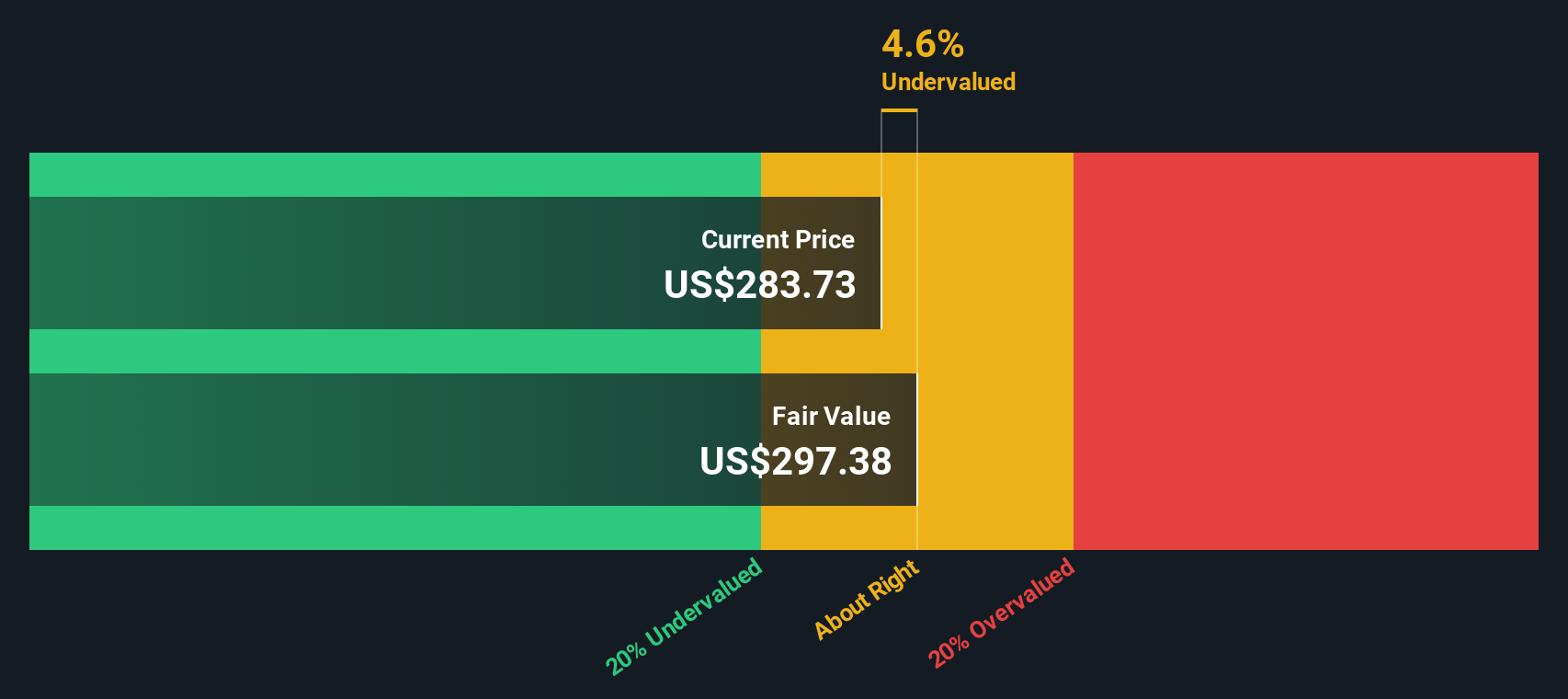

When these future cash flows are calculated in the DCF model, the intrinsic value for Veeva Systems is estimated to be around $297.67 per share. This is just 2.1% higher than today’s price, indicating the shares are trading very close to what analysts believe is their objective worth.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Veeva Systems's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Veeva Systems Price vs Earnings

For companies like Veeva Systems that are solidly profitable, the Price-to-Earnings (PE) ratio is one of the most reliable tools investors use to assess value. The PE ratio tells us how much the market is willing to pay for each dollar of earnings, and it generally reflects expectations for growth, profitability, and the risks facing a business. Higher growth and lower risk typically justify a loftier PE, while slower-growing or riskier firms should command a lower multiple.

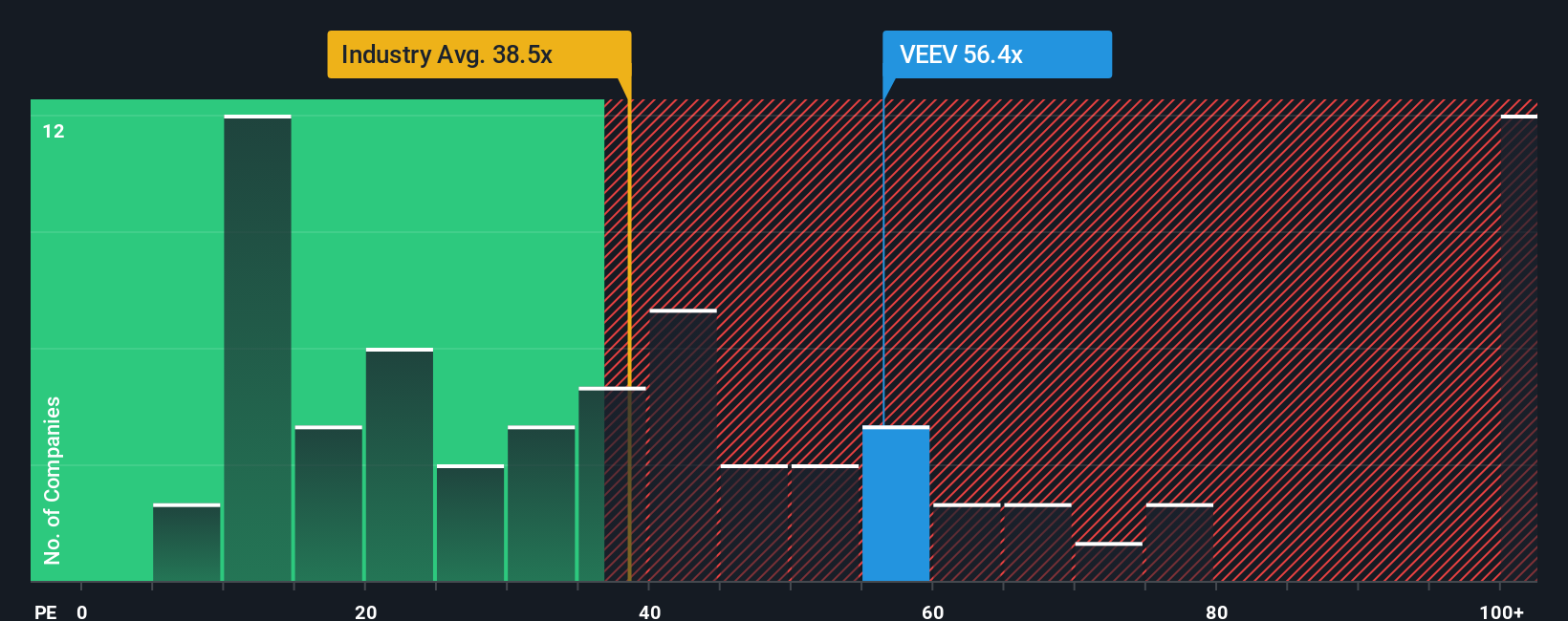

Currently, Veeva trades at a PE ratio of 59x. For context, the average PE for its Healthcare Services industry peers is 39x, and the typical peer in its immediate group sits at 54x. At first glance, this suggests Veeva shares are priced at a premium, possibly due to its history of consistent growth and strong earnings.

But rather than just comparing to broad sector or peer averages, we can look at Simply Wall St’s “Fair Ratio.” This proprietary metric calculates what would be a reasonable PE for Veeva specifically, based on its growth, risk, industry dynamics, margins, and market cap. For Veeva, the Fair Ratio stands at 33x. This approach is more nuanced because it tailors expectations to Veeva’s reality rather than grouping it with less relevant peers.

With the current PE at 59x and the Fair Ratio at 33x, Veeva appears to be significantly overvalued on this measure.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Veeva Systems Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your own story about a company, weaving together the reasons behind your assumptions about its fair value, future revenue, earnings, and margins. This approach goes beyond the numbers and helps you connect what you believe about Veeva’s business, such as its expanding product line or risks from competition, to a set of future financial outcomes.

On Simply Wall St’s Community page, investors can easily build and share their Narratives, linking Veeva’s business outlook to a forecast and an objective Fair Value. You can then compare that Fair Value with today’s share price to support your decision-making process. Narratives are updated automatically whenever fresh news or earnings are released, helping ensure your analysis remains relevant.

For example, on Veeva Systems, some investors are optimistic, setting a Fair Value as high as $362 per share based on expectations of AI-enabled growth and major pharmaceutical partnerships. Others see more risks and estimate a lower Fair Value around $222 due to industry competition and customer concentration.

No matter your perspective, Narratives provide a powerful and accessible way to transform your insights about Veeva into clear, actionable decisions.

Do you think there's more to the story for Veeva Systems? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VEEV

Veeva Systems

Provides cloud-based software for the life sciences industry in North America, Europe, the Asia Pacific, the Middle East, Africa, and Latin America.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives