- United States

- /

- Healthtech

- /

- NYSE:VEEV

Assessing Veeva Systems (VEEV): Is Growth Already Priced In or Is the Stock Still Undervalued?

Reviewed by Simply Wall St

Veeva Systems (VEEV) has been gaining some attention lately following a steady climb in recent weeks. The cloud software provider for the life sciences industry is up roughly 8% over the past 3 months, leaving investors weighing what could come next for the stock.

See our latest analysis for Veeva Systems.

Momentum continues to build for Veeva Systems, with a 41% year-to-date share price return and a 27% total shareholder return over the past year. The latest moves suggest investors are growing more optimistic about the company’s growth potential as confidence in its cloud-based solutions remains strong.

If Veeva’s gains have you interested in what’s next for the healthcare sector, take this opportunity to discover other standouts with our See the full list for free.

With growth continuing and shares near recent highs, investors are left wondering whether Veeva Systems is still undervalued given its performance, or if the market has already taken all of its future growth potential into account.

Most Popular Narrative: 7.4% Undervalued

With analysts’ consensus fair value at $320.62, Veeva Systems’ last close at $296.96 suggests the stock still trades below what the narrative considers justified. This gap is fueling strong debate over what’s behind the premium outlook. Here is the key driver from the most-watched narrative.

The resolution of the long-standing dispute with IQVIA removes critical data interoperability barriers, enabling Veeva to fully integrate industry-leading datasets into its Commercial Cloud. This should materially expand its addressable market, improve product adoption across multiple commercial applications, and accelerate top-line revenue growth over the next several years.

Curious about the bold assumptions propping up this bullish fair value? This narrative points to a major shift in growth, profitability, and financial trajectory, but its most eye-catching forecast remains hidden beneath the surface. Which future metric are analysts betting on to justify the upside? Unlock the specifics in the full story.

Result: Fair Value of $320.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as slower-than-expected customer adoption or intensifying competition could quickly challenge the upbeat outlook and shift sentiment around Veeva’s prospects.

Find out about the key risks to this Veeva Systems narrative.

Another View: Looking Through the Earnings Lens

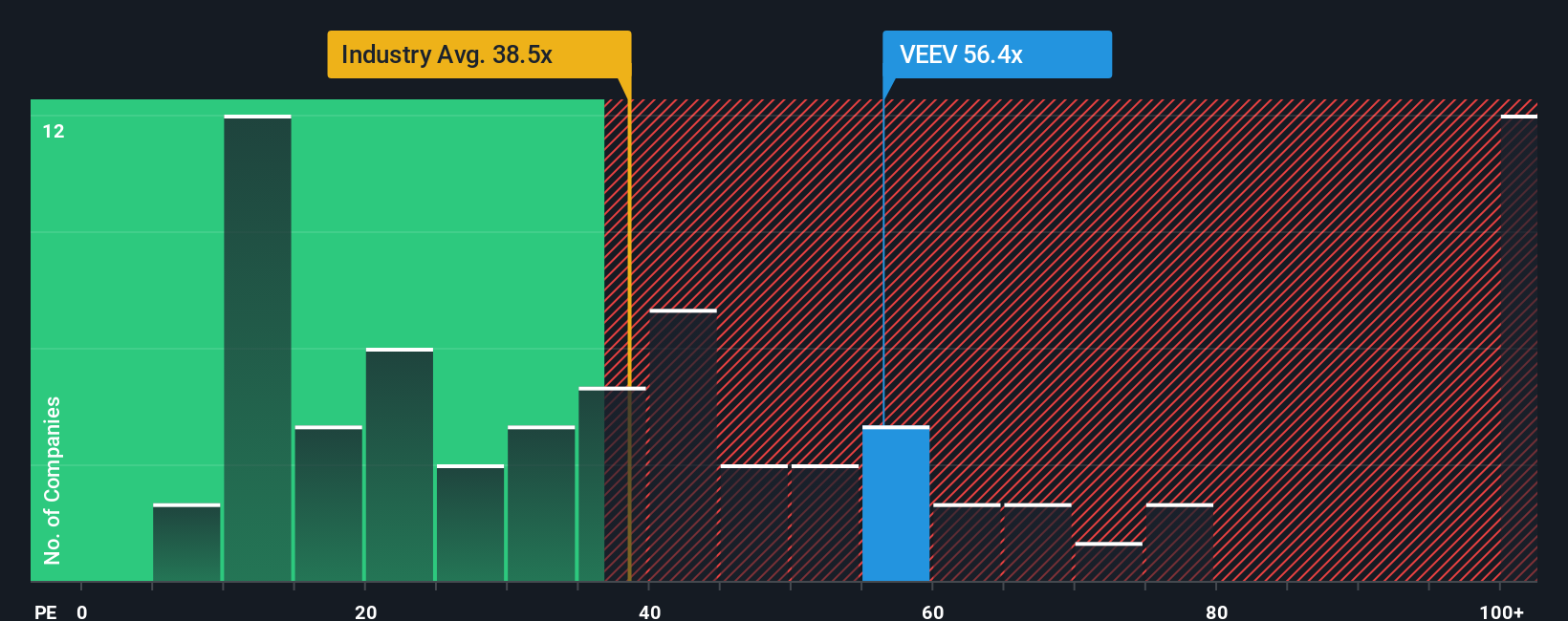

While analyst targets suggest Veeva Systems is undervalued, earnings ratios present a mixed picture. The company’s price-to-earnings ratio of 60.1 times is close to industry peers, but much higher than its fair ratio of 33.9 times. Does this indicate a valuation risk that investors should monitor carefully?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Veeva Systems Narrative

If you'd rather form your own conclusions or dig deeper into the data, you can create a personalized narrative for Veeva Systems in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Veeva Systems.

Looking for More Investment Ideas?

Great opportunities go beyond just one stock. Supercharge your portfolio by targeting trends and hidden gems that others overlook. Now is the time to seize your advantage.

- Capture explosive upside with these 25 AI penny stocks that are shaping the future of artificial intelligence and redefining what is possible in tomorrow’s markets.

- Grow your income potential by tapping into these 14 dividend stocks with yields > 3% offering yields above 3 percent, delivering steady returns even when markets get choppy.

- Position yourself early in high-growth sectors by backing these 27 quantum computing stocks tackling breakthroughs in quantum computing and next-generation technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VEEV

Veeva Systems

Provides cloud-based software for the life sciences industry in North America, Europe, the Asia Pacific, the Middle East, Africa, and Latin America.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives