- United States

- /

- Healthcare Services

- /

- NYSE:USPH

U.S. Physical Therapy (USPH): Evaluating Valuation After Recent Share Price Gains and Sector Momentum

Reviewed by Kshitija Bhandaru

U.S. Physical Therapy (USPH) shares have seen some ups and downs recently, sparking investor interest after mixed performance over the past month. The stock's movement invites a closer look at what might be driving changes in its valuation.

See our latest analysis for U.S. Physical Therapy.

After a strong run in recent months, U.S. Physical Therapy’s 1-month share price return of 8% and 90-day gain of nearly 18% stand out. Its 1-year total shareholder return of almost 12% reflects steady long-term progress. Momentum appears to be building, supported by solid operational performance and improved sentiment around the sector.

If you’re looking to discover more innovative healthcare names showing positive movement, check out the full roster in our See the full list for free..

But with shares trading well below analyst price targets and an encouraging run in key metrics, the question remains: is U.S. Physical Therapy undervalued at today’s level, or is the market already factoring in its growth prospects?

Most Popular Narrative: 17.9% Undervalued

According to the most widely followed narrative, U.S. Physical Therapy’s fair value sits well above its last close of $87.72, positioning the company at an attractive discount compared to its projected fundamentals. This setup draws attention to several key growth strategies the business is rolling out, all of which support the narrative’s bullish stance.

Expansion into employer health services and potential regulatory benefits support diversified income streams and further improve future profitability.

Curious about the bold financial assumptions powering this narrative? There is a striking outlook on margin expansion and multi-pronged revenue growth that pushes the value well beyond today’s price. See which future targets and valuation calls fuel this bullish case. The details may surprise you.

Result: Fair Value of $106.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reimbursement pressures and rising labor costs could present significant challenges to U.S. Physical Therapy’s future earnings and profit margins.

Find out about the key risks to this U.S. Physical Therapy narrative.

Another View: What Do the Market Ratios Say?

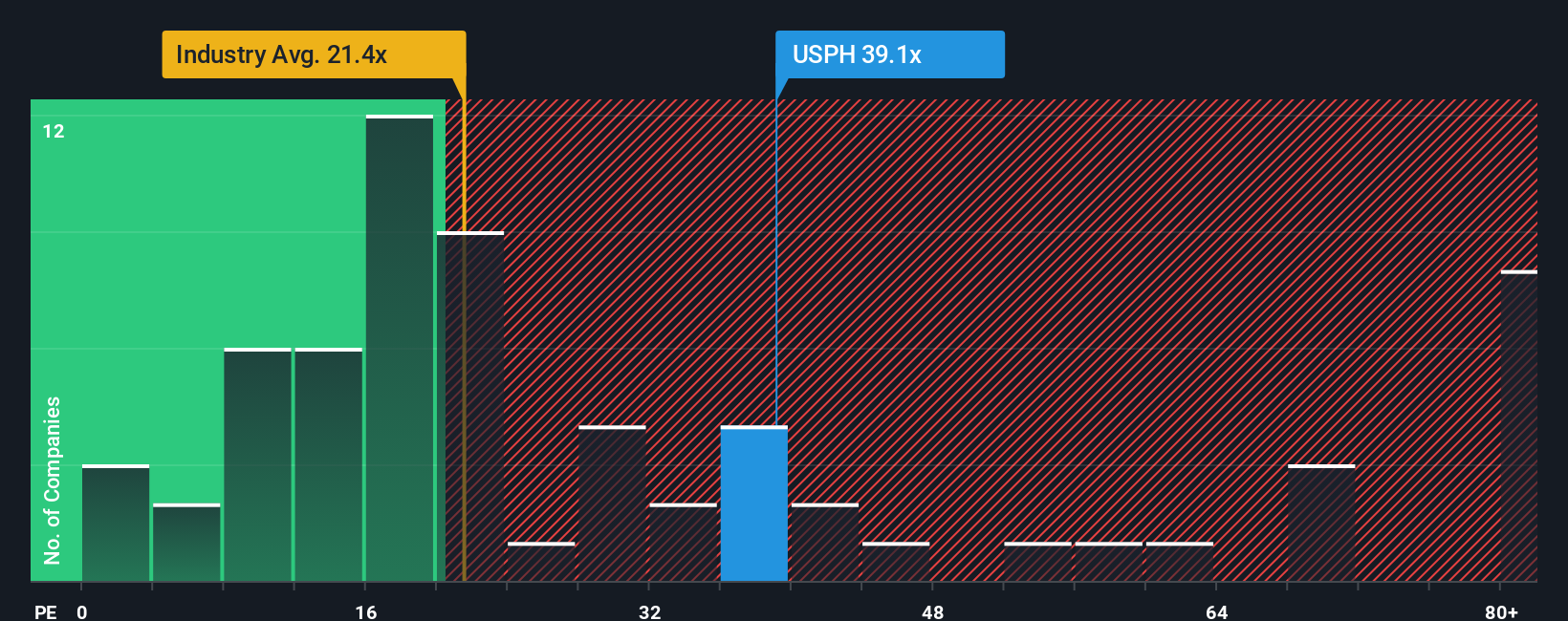

While the analyst valuation points to U.S. Physical Therapy as undervalued, a look at its price-to-earnings ratio paints a cautionary picture. The company trades at 38.6x earnings, well above both the industry average of 21.5x and its peer group at 15.4x. Its fair ratio is estimated at 18.2x, which suggests investors are paying a significant premium compared to where the market could trend over time. Does this premium reflect future growth, or should investors be wary of paying too much for the stock?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own U.S. Physical Therapy Narrative

Keep in mind, if you see the numbers differently or want to dig into your own research, it only takes a few minutes to craft your personal perspective. Do it your way.

A great starting point for your U.S. Physical Therapy research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Now is the perfect time to uncover unique opportunities and stay ahead of the market. Discover tomorrow’s winners before the crowd catches on, and consider options beyond the obvious when smarter choices await your attention.

- Capitalize on the potential of emerging companies by focusing on these 3582 penny stocks with strong financials that have robust financials and real growth stories.

- Enhance your passive income strategy by tapping into these 19 dividend stocks with yields > 3% with yields higher than most savings accounts right now.

- Explore the future with these 24 AI penny stocks at the forefront of artificial intelligence breakthroughs and innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:USPH

U.S. Physical Therapy

Operates and manages outpatient physical therapy clinics.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives