- United States

- /

- Healthcare Services

- /

- NYSE:USPH

Share Buyback and Insider Activity Could Be a Game Changer for U.S. Physical Therapy (USPH)

Reviewed by Sasha Jovanovic

- U.S. Physical Therapy, Inc. recently announced a share repurchase program, with up to US$25 million in shares authorized for buyback by its Board of Directors.

- Alongside the buyback, recent insider buying from a board member highlights management’s positive outlook, contrasting with some insider selling over the past year.

- We’ll explore how the newly announced buyback could shape U.S. Physical Therapy’s investment narrative and outlook for shareholders.

Find companies with promising cash flow potential yet trading below their fair value.

U.S. Physical Therapy Investment Narrative Recap

To be a shareholder in U.S. Physical Therapy, one generally needs to believe in the company's ability to capitalize on rising healthcare demand and sustain clinic growth despite reimbursement and labor headwinds. The recently announced US$25 million share repurchase program is unlikely to materially impact the most pressing near-term catalyst, which remains patient volume trends, nor does it offset the persistent risk of potential Medicare reimbursement cuts affecting profitability.

Of the recent developments, the appointment of Michael G. Mayrsohn as a director stands out for its timing alongside the buyback news. Leadership composition can be significant as the company faces industry-specific challenges and opportunities, with board experience often critical to executing cost efficiency initiatives, one of the catalysts underlying current investor interest.

In contrast, investors should be aware that ongoing healthcare reimbursement pressures, including cumulative Medicare rate changes, could...

Read the full narrative on U.S. Physical Therapy (it's free!)

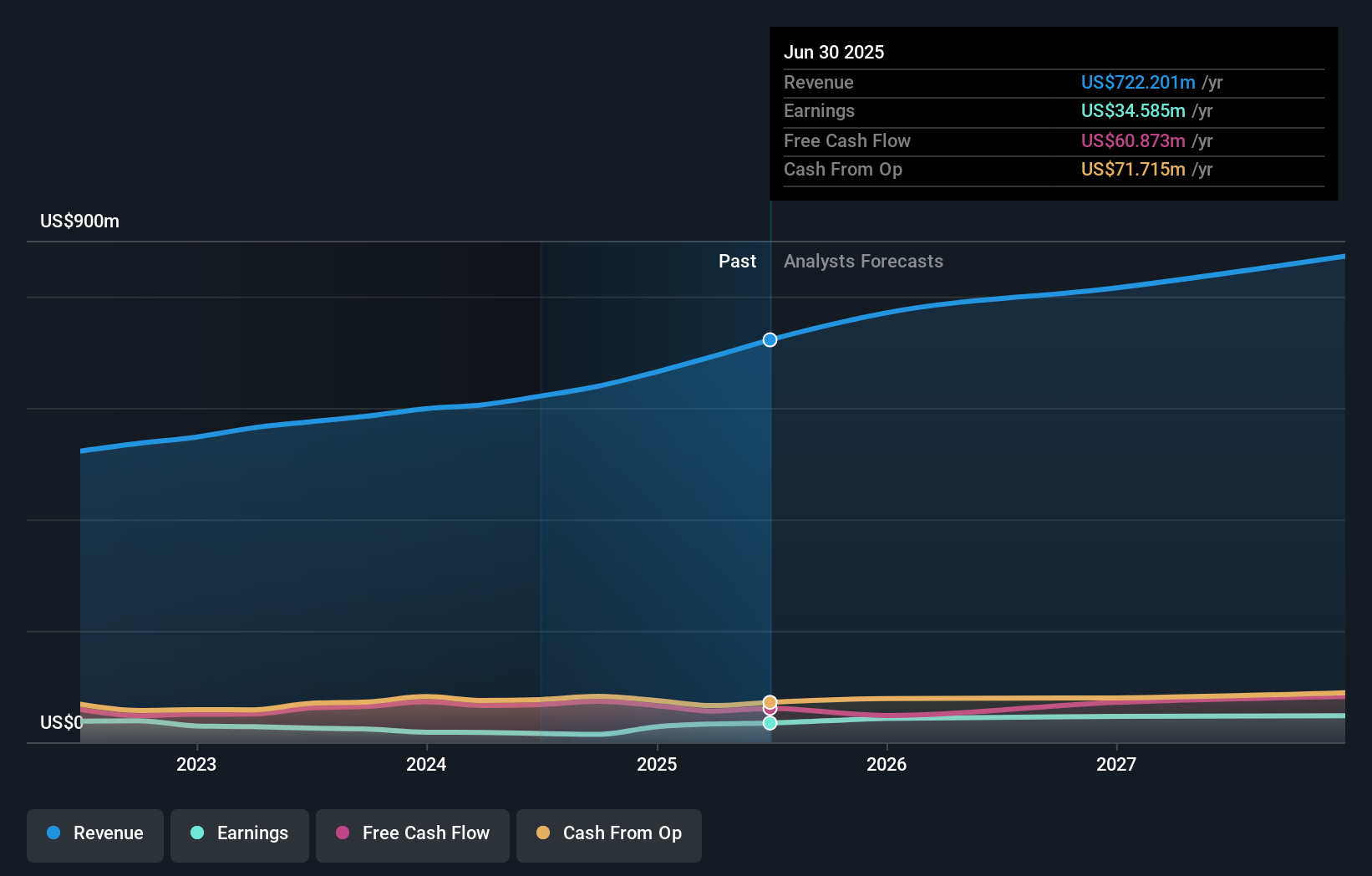

U.S. Physical Therapy's outlook projects $918.4 million in revenue and $52.5 million in earnings by 2028. This is based on an expected annual revenue growth rate of 8.3% and a $17.9 million increase in earnings from the current $34.6 million.

Uncover how U.S. Physical Therapy's forecasts yield a $106.83 fair value, a 45% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community features a single fair value estimate for US Physical Therapy at US$106.83 per share, preceding the buyback news. While consensus exists here, keep in mind that persistent Medicare and payer policy changes may influence future outcomes. Explore a variety of community viewpoints before making any decisions.

Explore another fair value estimate on U.S. Physical Therapy - why the stock might be worth as much as 45% more than the current price!

Build Your Own U.S. Physical Therapy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your U.S. Physical Therapy research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free U.S. Physical Therapy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate U.S. Physical Therapy's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:USPH

U.S. Physical Therapy

Operates and manages outpatient physical therapy clinics.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026