- United States

- /

- Healthcare Services

- /

- NYSE:USPH

Could USPH's Latest Dividend and Acquisition Push Signal a Shift in Its Growth Strategy?

Reviewed by Sasha Jovanovic

- U.S. Physical Therapy, Inc. reported third quarter 2025 revenue of US$197.13 million and net income of US$13.14 million, while its board also declared a US$0.45 per share quarterly dividend and confirmed active pursuit of acquisitions in the industrial injury prevention segment.

- This combination of strong earnings growth and a clear capital allocation shift toward expanding faster-growing, higher-return business lines highlights management’s intent to accelerate future profitability.

- We’ll examine how management’s acquisition focus in industrial injury prevention could reshape U.S. Physical Therapy’s investment narrative moving forward.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

U.S. Physical Therapy Investment Narrative Recap

To be a shareholder in U.S. Physical Therapy today, you have to believe management can leverage rising demand for physical therapy and the higher-return industrial injury prevention segment to offset persistent industry headwinds. The company’s recent announcement of accelerated IIP-focused acquisitions has not materially changed the biggest short-term risk: ongoing pressure from reimbursement cuts. The main near-term catalyst remains successful execution of these acquisitions to drive diversified earnings growth, without compromising operational quality or balance sheet strength.

Against this backdrop, the latest quarterly dividend declaration of US$0.45 per share reinforces management’s commitment to delivering shareholder value. This payout further supports the investment narrative by offering tangible returns, even as the company pursues faster-growing segments in a competitive market. However, investors should also weigh the recent drop in free cash flow margins and ongoing reimbursement challenges as core risks.

Conversely, it’s equally important for investors to keep in mind the risk posed by sustained downward pressure on Medicare and commercial reimbursement rates, which…

Read the full narrative on U.S. Physical Therapy (it's free!)

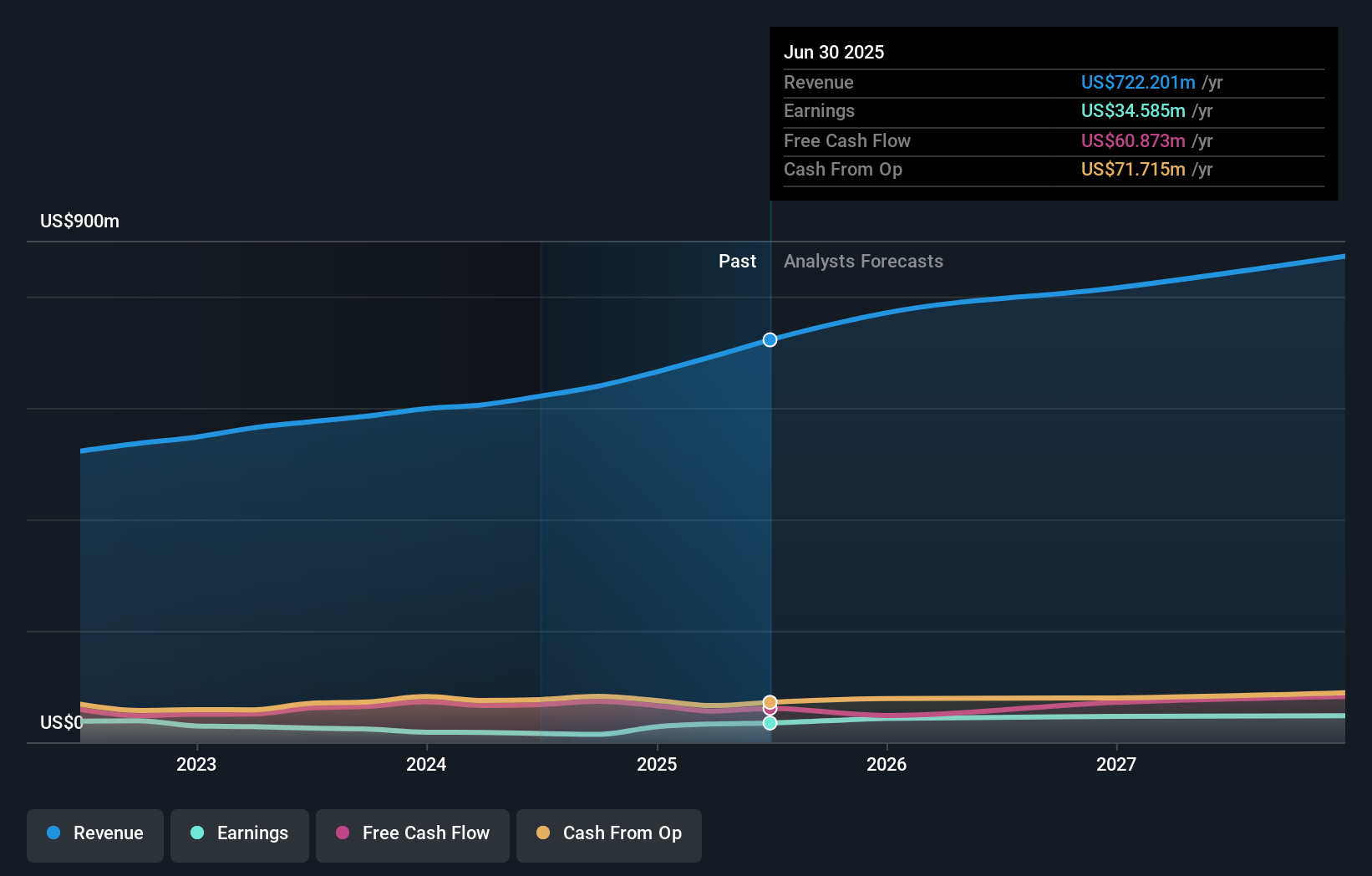

U.S. Physical Therapy's outlook envisions $918.4 million in revenue and $52.5 million in earnings by 2028. This scenario requires 8.3% annual revenue growth and a $17.9 million increase in earnings from the current $34.6 million.

Uncover how U.S. Physical Therapy's forecasts yield a $106.83 fair value, a 47% upside to its current price.

Exploring Other Perspectives

According to the Simply Wall St Community, a single fair value estimate at US$106.83 highlights limited consensus but a substantial gap to current prices. While some see growth potential tied to industrial injury prevention, persistent reimbursement risks may cause wide differences in outlook; compare several viewpoints before forming your own.

Explore another fair value estimate on U.S. Physical Therapy - why the stock might be worth just $106.83!

Build Your Own U.S. Physical Therapy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your U.S. Physical Therapy research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free U.S. Physical Therapy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate U.S. Physical Therapy's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:USPH

U.S. Physical Therapy

Operates and manages outpatient physical therapy clinics.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives