- United States

- /

- Healthcare Services

- /

- NYSE:UNH

UnitedHealth (UNH) Margin Growth Challenges Bearish Narratives on Profitability

Reviewed by Simply Wall St

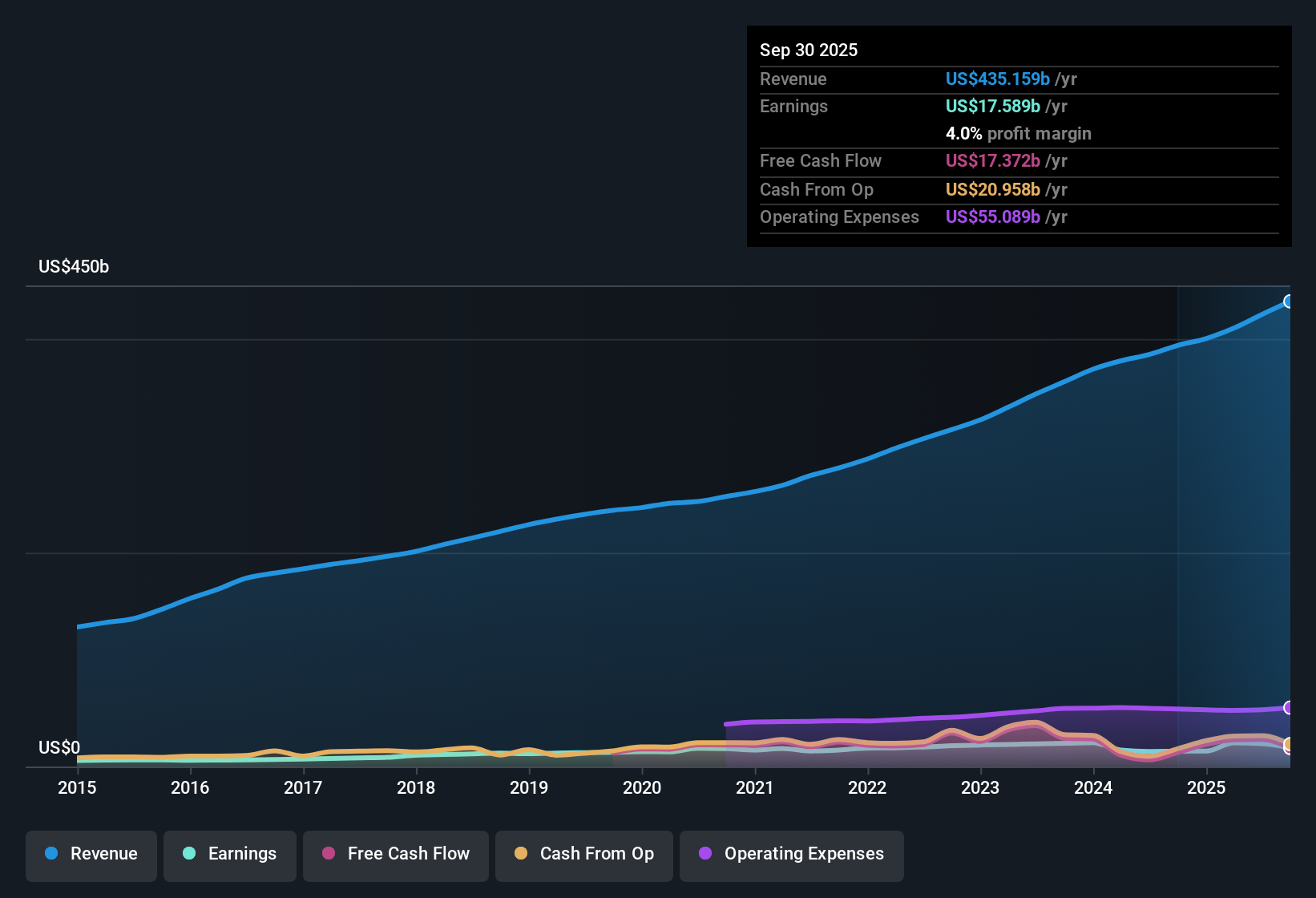

UnitedHealth Group (UNH) posted a 22.9% annual earnings growth, well above its five-year CAGR of 2.6%, and boosted net profit margins to 4% from last year's 3.6%. Looking ahead, the company’s earnings are forecast to rise 8.3% per year and revenue by 4.3% per year, both trailing broader US market growth rates. Investors will note these margin improvements as a bright spot, but will also weigh them against the slightly slower projected future growth.

See our full analysis for UnitedHealth Group.Next, we will see how these earnings results stand up when measured against the market’s main narratives and expectations. Some themes might get confirmation, while others may be challenged by the hard numbers.

See what the community is saying about UnitedHealth Group

DCF Fair Value Nearly 2.5x Higher Than Share Price

- UnitedHealth Group's DCF fair value stands at $853.86, more than twice its current share price of $344.75, suggesting a substantial upside if the fair value estimate is accurate.

- According to the analysts' consensus view, realizing this kind of premium would require strong future execution. Some expect revenues to reach $501.1 billion and for the company to be valued at a PE ratio of 17.0x by 2028. However, projections include shrinking profit margins (from 5.0% to 4.0%) over the next three years.

- Consensus narrative notes that to justify even the official price target of $385.28 (12% above current levels), investors must buy into forecasts of stable profit delivery and margin management even as core healthcare cost pressures rise.

- Analysts remain divided, with the most bullish targeting $626.00 and the most bearish predicting just $198.00, showing real debate over whether UnitedHealth's operations can realize the upside implied by DCF models and sector peers.

- To see how the consensus view squares with the market, check the full narrative for deeper insights. 📊 Read the full UnitedHealth Group Consensus Narrative.

Valuation: Discount to Industry, Premium to Peers

- The company's price-to-earnings (PE) ratio is 17.8x, presenting an apparent discount versus the U.S. healthcare industry average PE of 21.9x, yet a notable premium compared to peers averaging just 10.1x.

- Analysts' consensus narrative emphasizes this "middle ground": UnitedHealth's valuation is attractive for investors comparing industry averages, but not as compelling when stacked directly against closer, perhaps less diversified, competitors.

- Consensus argument highlights that for current value to hold, investors must weigh industry leadership and consistent revenue growth ($501.1 billion projected by 2028) against the risk of paying above peer valuations, especially if profit margins narrow further.

- Analyst expectations for the required future PE ratio (17.0x by 2028) align closely with the present, suggesting little room for multiple expansion unless growth outpaces current forecasts.

Dividend and Profit Growth Drive Strengths, But Financial Position Flagged

- UnitedHealth Group's dividend and track record of steady profit and revenue growth are confirmed in both regulatory filings and consensus estimates, reinforcing its appeal to income-seeking investors.

- Analysts' consensus view weighs these strengths against a single, known risk: the company’s financial position is flagged as not strong, making durable growth more sensitive to external funding pressures or operational hiccups.

- What is surprising is that despite robust dividend history and upside versus DCF fair value, consensus argues the flagged financial positioning could become an Achilles’ heel if sector pressures intensify, threatening the company’s ability to sustain payouts and future growth.

- This underscores why UnitedHealth's ability to navigate Medicare strategy changes and funding cuts is viewed as crucial for defending margin and dividend reliability over time.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for UnitedHealth Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do the figures paint a different picture for you? Craft your personal take and add your narrative in just a matter of minutes. Do it your way

A great starting point for your UnitedHealth Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite UnitedHealth Group's strong profit and dividend history, its flagged financial position could threaten future growth and the reliability of payouts if conditions worsen.

If you’re concerned by these financial risks, use our solid balance sheet and fundamentals stocks screener (1986 results) to find companies with stronger balance sheets and more resilient foundations for growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UNH

UnitedHealth Group

Operates as a health care company in the United States and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives