- United States

- /

- Healthcare Services

- /

- NYSE:UNH

UnitedHealth Group (UNH) Valuation in Focus as Investors Watch Cost Pressures and Regulatory Shifts

Reviewed by Simply Wall St

UnitedHealth Group (UNH) is in focus this week after a series of cost pressures, regulatory setbacks, and its move to exit certain Medicare Advantage plans. With quarterly results approaching, investors are looking for signs of stabilization.

See our latest analysis for UnitedHealth Group.

Shares of UnitedHealth Group have struggled to recover from steep losses earlier this year, with a year-to-date share price decline of 28.15% and a 12-month total shareholder return of -34.4%. Momentum has improved in the near term, as the stock rebounded nearly 29% over the last 90 days. However, the recovery remains in context with ongoing cost concerns, regulatory headwinds, and recent leadership changes. While short-term price action hints at potential stabilization, investors remain cautious about the company's longer-term growth profile.

If you are keeping an eye on healthcare giants like UnitedHealth, now is a great time to discover other leaders in the sector with See the full list for free.

Given the recent sell-off, ongoing challenges, and signs of operational progress, investors are left to consider whether UnitedHealth Group is trading at a bargain or if the market has already accounted for future risks and growth potential.

Most Popular Narrative: Fairly Valued

UnitedHealth Group's fair value calculation from the most widely followed narrative stands just a fraction above today's share price. This setup creates a compelling valuation debate as analyst confidence improves and quarterly results approach.

Improved regulatory clarity and robust free cash flow position the company to invest in growth and pursue additional strategic opportunities, including mergers and acquisitions.

Ready to uncover what’s fueling this fresh wave of optimism? There is an unexpected earnings blueprint and a bold profit path behind this valuation. Dive in and decode which financial levers make analysts believe UnitedHealth’s story is not over yet.

Result: Fair Value of $360.84 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, investors should note that unexpected care cost spikes or ongoing regulatory uncertainty could quickly undermine confidence in UnitedHealth’s recovery story.

Find out about the key risks to this UnitedHealth Group narrative.

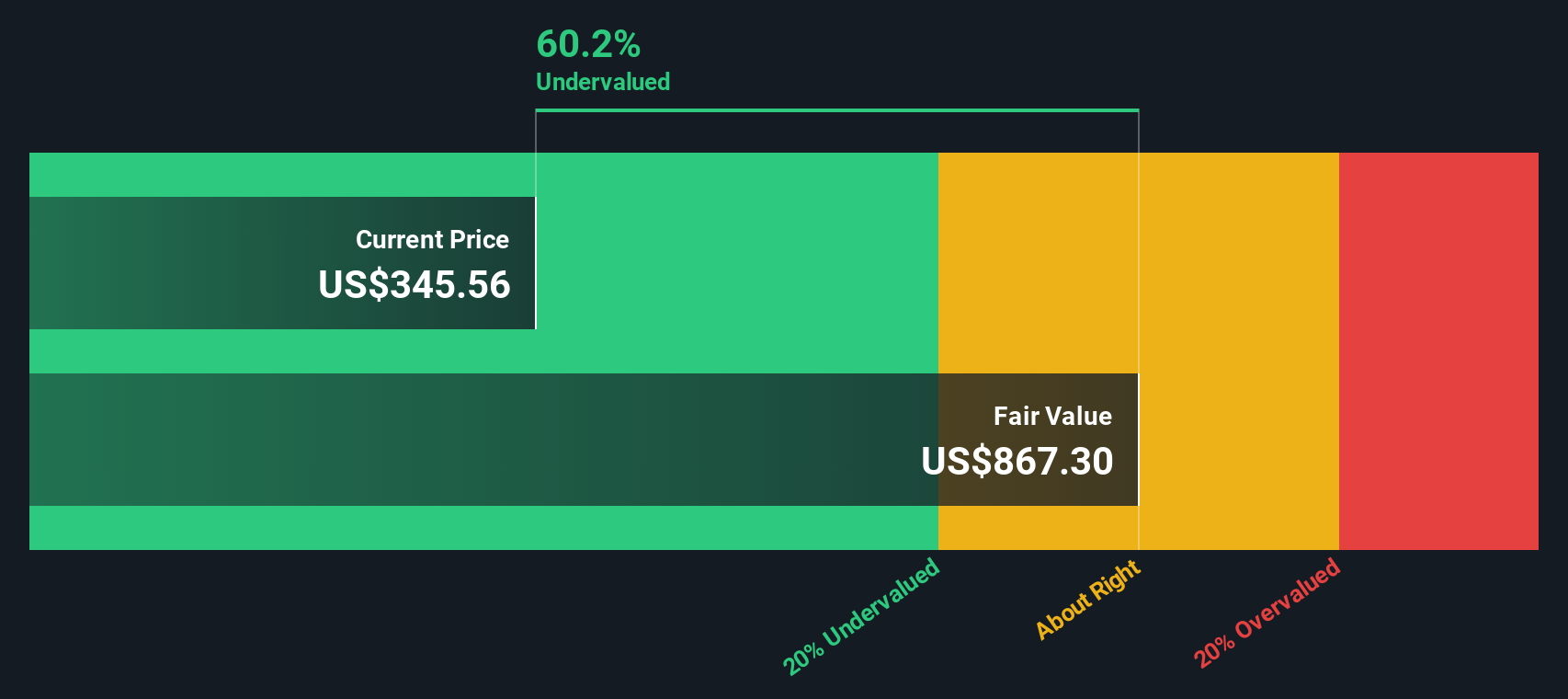

Another View: Discounted Cash Flow Paints a Different Picture

While a multiples-based valuation suggests UnitedHealth Group is fairly valued or even slightly expensive, our SWS DCF model arrives at a far different conclusion. According to this approach, the stock is trading at a 57.5% discount to its estimated fair value. This sharp divergence raises a big question: which set of assumptions will prove right as the market evolves?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own UnitedHealth Group Narrative

If the current story does not quite fit your perspective or you like to dive into the numbers yourself, you can create your own narrative and insights in just a few minutes, all with Do it your way.

A great starting point for your UnitedHealth Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Do not miss out on the market’s next wave of opportunities. Simply Wall Street’s powerful Screener helps you target companies with exceptional potential every day.

- Catch tomorrow’s trends early as you browse these 27 AI penny stocks reshaping industries with advanced automation and intelligent business models.

- Zero in on hidden value by targeting these 875 undervalued stocks based on cash flows identified by strong fundamentals and attractive price points others might overlook.

- Boost your passive income strategy by finding these 17 dividend stocks with yields > 3% that consistently offer healthy yields over 3% and reward shareholders year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UNH

UnitedHealth Group

Operates as a health care company in the United States and internationally.

Outstanding track record established dividend payer.

Similar Companies

Market Insights

Community Narratives