- United States

- /

- Healthcare Services

- /

- NYSE:UNH

UnitedHealth Group (UNH) Reports Decrease In Q2 Net Income To US$3,406 Million

Reviewed by Simply Wall St

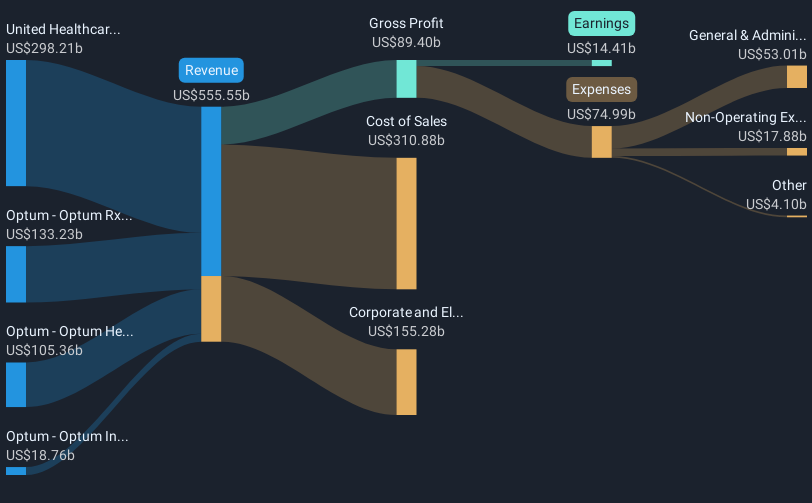

UnitedHealth Group (UNH) reported a decrease in second-quarter net income and diluted earnings per share year-over-year, despite strong results for the first half of the year. Meanwhile, the company's stock price remained flat over the past week. This performance transpired amid a broader market environment where the S&P 500 and Nasdaq faced slight declines following a recent high streak, attributed to immediate investor reactions to numerous earnings reports and anticipated Federal Reserve decisions on interest rates. UnitedHealth's mixed earnings results would have added weight to these broader market patterns.

We've identified 1 warning sign for UnitedHealth Group that you should be aware of.

The mixed earnings report and flat share price movement of UnitedHealth Group (UNH) could potentially impact its narrative, focusing on technology and value-based program investments. The company's strategic efforts to improve Medicare strategy and digital tools aim for future operational efficiency. However, with the current revenue of US$410.06 billion and earnings at US$22.11 billion, changes in Medicare membership and CMS risk model issues might pressure future revenue and earnings forecasts.

Over the past five years, UnitedHealth Group's total shareholder return was a modest 0.28%, as compared to the one-year underperformance against the US market, which returned 17.7%. Despite the fair expectations from strategic shifts, the broader market dynamics have resulted in less favorable outcomes for investors over this longer-term period. The company's stock performance relative to the healthcare industry, which saw a 32.6% decline over a year, paints a challenging picture.

The current share price of US$282.12 falls significantly short of the analyst consensus price target of US$379.34. This gap highlights potential investor hesitance or market uncertainty about projected earnings growth or revenue stabilization efforts. Analysts anticipate earnings of US$25.4 billion by 2028, with a PE ratio of 15.5x, which suggests room for optimism if the company navigates its expected challenges effectively. Still, the reaction to the current report may influence these future trajectories.

Gain insights into UnitedHealth Group's future direction by reviewing our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UNH

UnitedHealth Group

Operates as a health care company in the United States and internationally.

Outstanding track record established dividend payer.

Similar Companies

Market Insights

Community Narratives