- United States

- /

- Healthcare Services

- /

- NYSE:UNH

Is Dr. Scott Gottlieb’s Board Appointment and Hedge Fund Exit Shaping the Outlook for UnitedHealth (UNH)?

Reviewed by Sasha Jovanovic

- UnitedHealth Group announced that Dr. Scott Gottlieb, former FDA commissioner, joined its Board of Directors as an independent director on November 18, 2025, bringing deep regulatory and healthcare expertise.

- This change in board composition comes at a time of heightened policy uncertainty and regulatory scrutiny, alongside significant shifts in institutional investor positions.

- We'll explore how renewed regulatory scrutiny and a prominent hedge fund's share sale could influence UnitedHealth Group's investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

UnitedHealth Group Investment Narrative Recap

To be a UnitedHealth Group shareholder, you need conviction in the stability and growth potential of the U.S. healthcare sector, especially during periods of substantial regulatory and policy change. The recent board addition of Dr. Scott Gottlieb introduces significant regulatory expertise, but it does not materially change the most pressing near-term catalyst: UnitedHealth's efforts to stabilize Medicare Advantage profitability amid DOJ investigations and shifting government policy. Elevated regulatory scrutiny remains a key risk that could impact net margins and earnings. Among recent company announcements, UnitedHealth Group’s move to raise its 2025 earnings outlook stands out, signaling steady management confidence despite ongoing scrutiny and market uncertainty. This update is directly relevant to investor expectations as the company addresses unanticipated shifts in Medicare membership and policy headwinds. The guidance increase suggests management is aiming to reassure investors even as the sector faces unresolved regulatory and reimbursement challenges. In contrast, investors should be mindful of ongoing Department of Justice inquiries and policy uncertainty that could affect UnitedHealth’s financial performance...

Read the full narrative on UnitedHealth Group (it's free!)

UnitedHealth Group's outlook points to revenues of $501.1 billion and earnings of $20.0 billion by 2028. This scenario assumes annual revenue growth of 5.8% but actually a $1.3 billion decrease in earnings from the current $21.3 billion.

Uncover how UnitedHealth Group's forecasts yield a $386.72 fair value, a 17% upside to its current price.

Exploring Other Perspectives

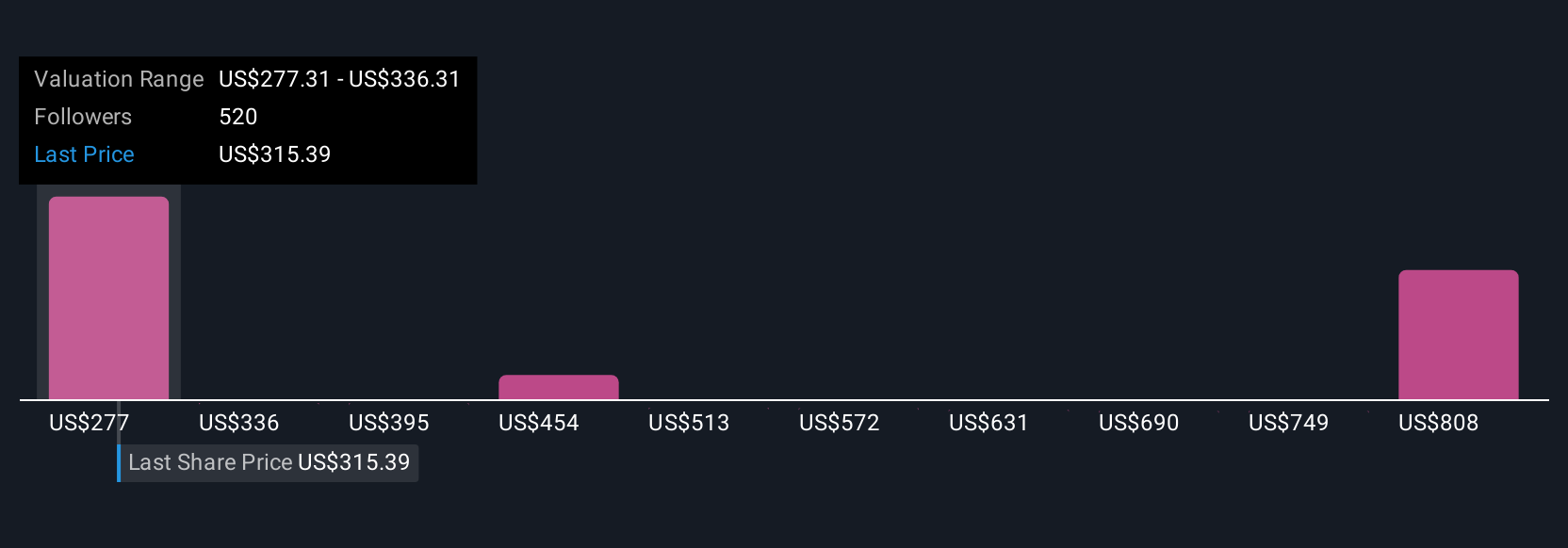

Eighty-three members of the Simply Wall St Community provided fair value estimates for UnitedHealth Group, from US$300 to US$847, showcasing a wide spread of independent outlooks. While this range reflects sharply contrasting opinions, you should also consider how ongoing government scrutiny could alter both near-term profits and the company’s longer-term trajectory.

Explore 83 other fair value estimates on UnitedHealth Group - why the stock might be worth over 2x more than the current price!

Build Your Own UnitedHealth Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UnitedHealth Group research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free UnitedHealth Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UnitedHealth Group's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UNH

UnitedHealth Group

Operates as a health care company in the United States and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026