- United States

- /

- Healthcare Services

- /

- NYSE:UNH

Does the Recent 33% Dip in UnitedHealth Group Shares Signal an Opportunity for 2025?

Reviewed by Bailey Pemberton

If you’ve ever found yourself weighing whether now is the right moment to jump into UnitedHealth Group stock, you’re not alone. The recent movements in the share price have given both seasoned investors and first-timers plenty to talk about. Over the last month, UnitedHealth Group’s shares have climbed 6.9%, and the past week alone saw a modest 0.7% uptick. However, those numbers tell only part of the story. If you expand your view to the past year, you’ll notice the stock is still down by 33.1%. That is a noticeable dip, reflecting not just market turbulence but also shifting expectations about growth and risk across the healthcare sector.

Much of this swing in sentiment can be traced back to sector-wide headlines about changing reimbursement rates and ongoing regulatory discussions that affect insurance providers. These factors have contributed to investor uncertainty, which can push valuations lower even if the business fundamentals remain largely intact. UnitedHealth Group’s five-year return, though, still sits in positive territory at 23.8%, suggesting there may be long-term potential when the mood shifts back in the company’s favor.

So, what does this mean for the stock’s valuation? By our scorecard, UnitedHealth Group lands a valuation score of 4 out of 6. This is not a perfect score, but it is an indication the company could be undervalued by several key metrics. Next, we’ll break down how those valuation approaches stack up and hint at a smarter way to put all this information together for a clearer investment decision.

Why UnitedHealth Group is lagging behind its peers

Approach 1: UnitedHealth Group Discounted Cash Flow (DCF) Analysis

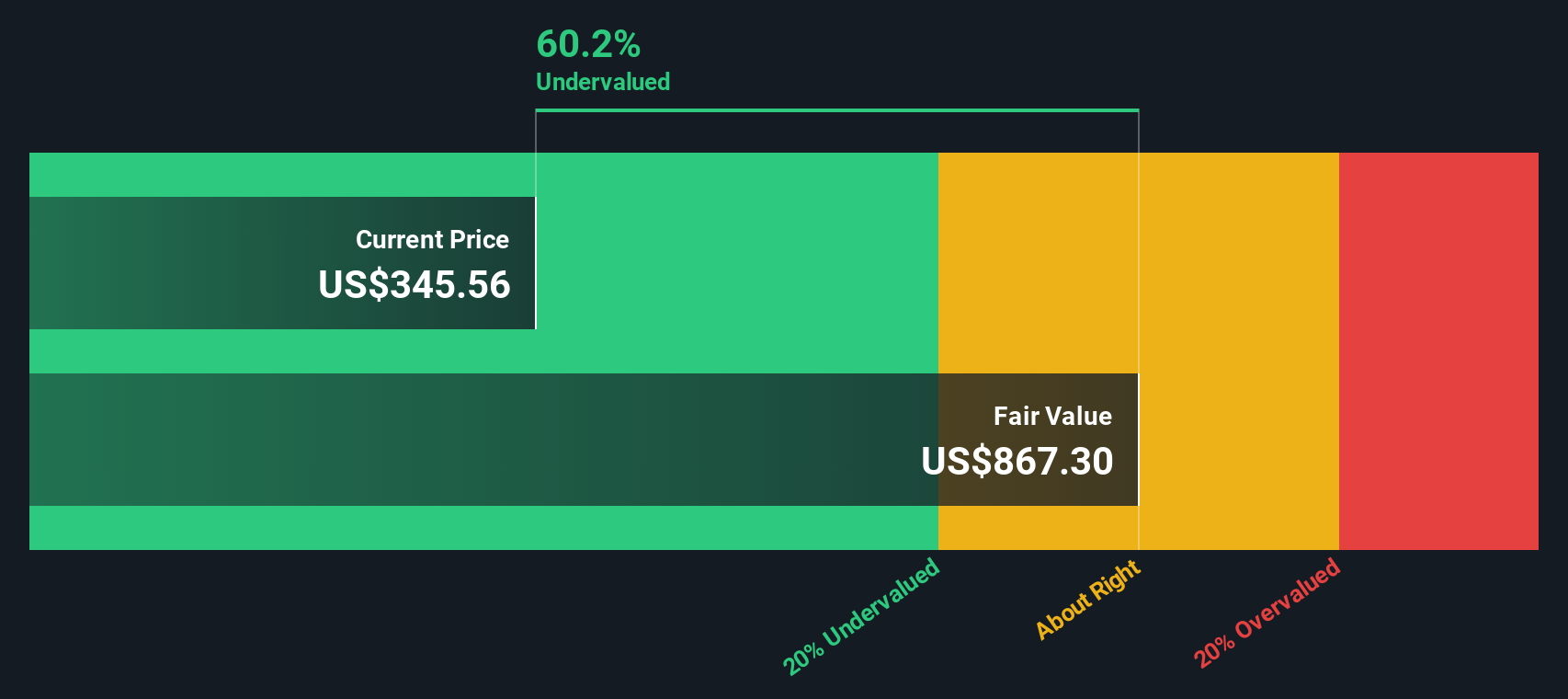

The Discounted Cash Flow (DCF) valuation approach estimates the intrinsic value of UnitedHealth Group by projecting its future cash flows and discounting them back to today's dollars. This model helps investors evaluate what the business is truly worth based on expected cash flows the company can generate over time.

Currently, UnitedHealth Group is generating Free Cash Flow (FCF) of $25.21 billion. Over the next five years, analysts estimate that FCF will steadily increase, reaching $27.09 billion by the end of 2029. Beyond these initial projections, further growth assumptions are extrapolated, reflecting moderate increases in cash generation through 2035. All figures are in US dollars, and estimates beyond 2029 are provided by Simply Wall St based on prior growth rates and sector expectations.

Based on these projected cash flows and the DCF model, the estimated fair value per share for UnitedHealth Group is $853.86. At current market levels, this suggests UnitedHealth Group is trading at a 56.9% discount to its calculated intrinsic value, indicating that the stock may be deeply undervalued according to this method.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests UnitedHealth Group is undervalued by 56.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

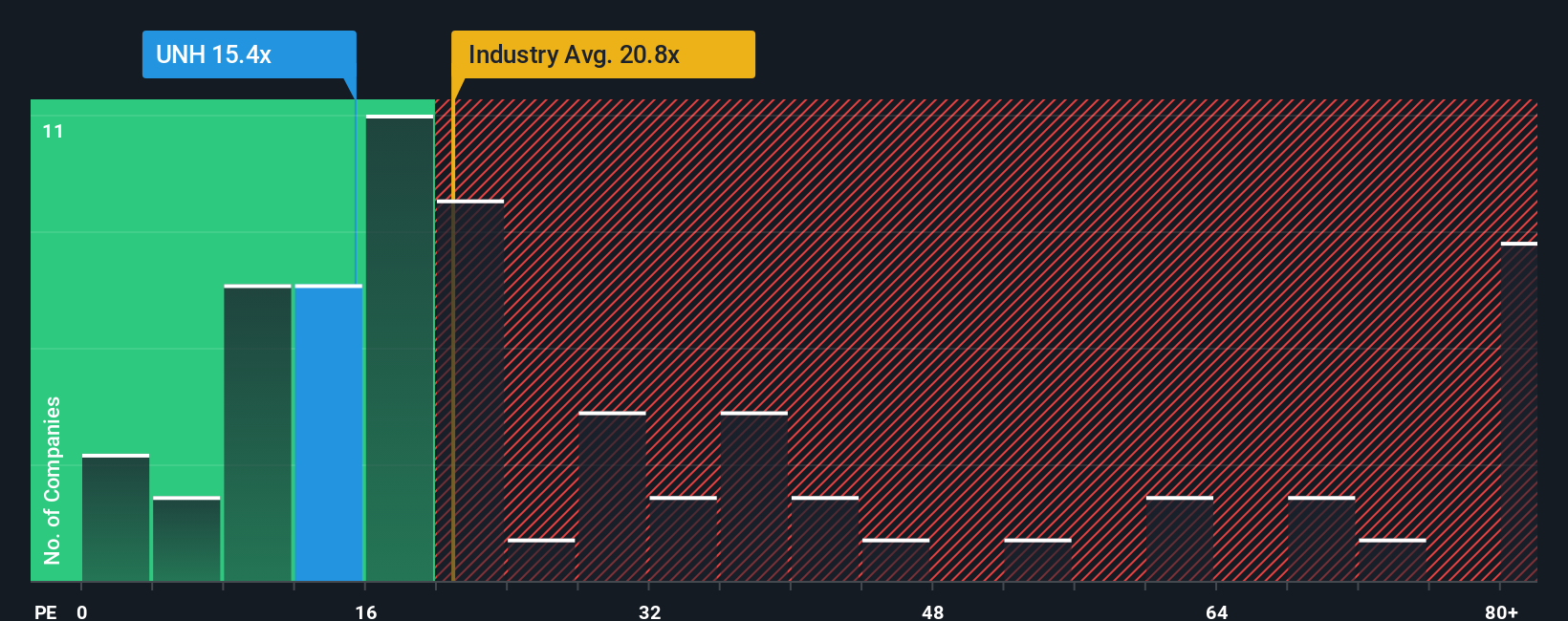

Approach 2: UnitedHealth Group Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a popular valuation metric for established, profitable companies like UnitedHealth Group because it directly relates the share price to the company’s earnings power. For businesses with solid profits year after year, the PE ratio gives investors a quick way to gauge how much they’re paying for each dollar of earnings.

It’s important to recognize that what counts as a “normal” PE ratio can vary. Higher expected growth or lower risk supports a higher PE, while slower growth or higher risk tends to pull it down. UnitedHealth Group currently trades at a PE ratio of 15.6x. In comparison, the industry average in healthcare sits at 21.7x and the average among its peers is 13.4x. This means UnitedHealth Group’s shares are priced below the broader industry but a little above its peers.

Beyond simple comparisons, Simply Wall St’s “Fair Ratio” provides an advanced benchmark. This measure reflects not only peer and industry figures but also adjusts for UnitedHealth Group’s earnings growth, risk profile, profit margins, and size. The Fair Ratio for UnitedHealth Group is 36.9x, suggesting a far higher valuation could be justified by the company’s underlying characteristics. Because the Fair Ratio takes these unique company factors into account, it offers a more complete picture than traditional benchmarks.

With the current PE of 15.6x well below the Fair Ratio of 36.9x, UnitedHealth Group appears undervalued by this measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your UnitedHealth Group Narrative

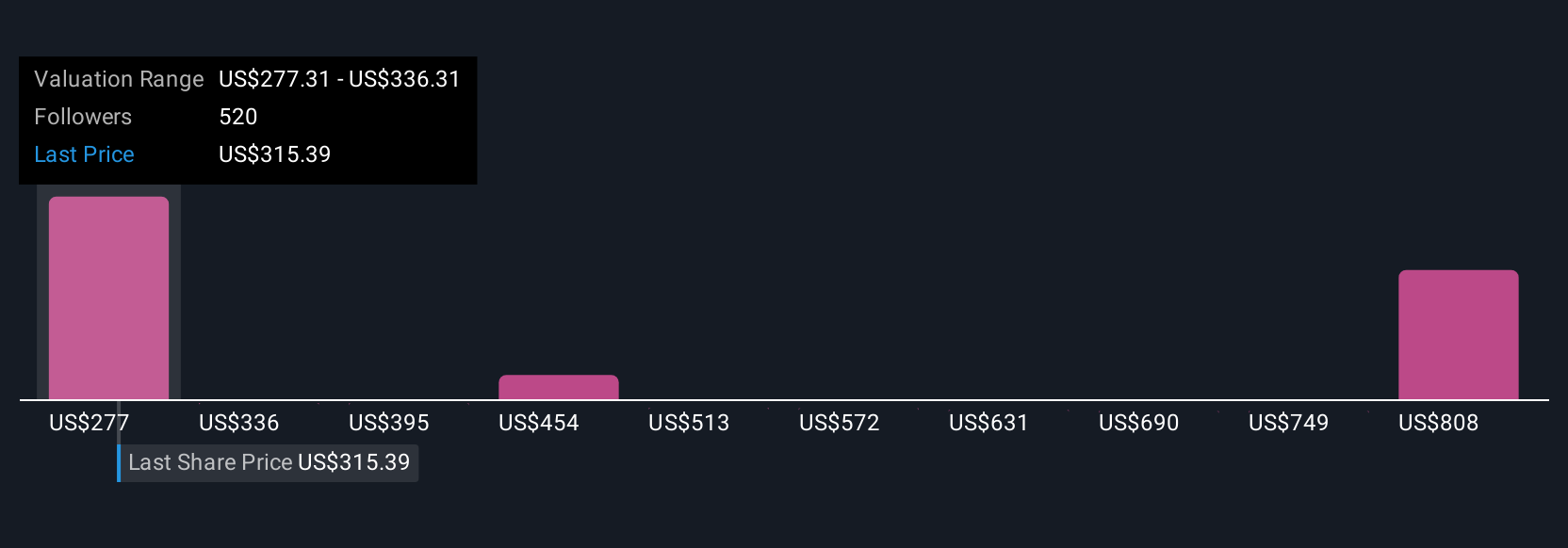

Earlier we mentioned there is an even smarter way to understand valuation, so let’s introduce you to Narratives. A Narrative connects the company’s story, your view of its performance, risks, and future, with a specific financial forecast and an estimated fair value.

Instead of relying solely on numbers like PE ratios, with Narratives you craft or select a scenario. For example, are you expecting UnitedHealth Group’s investments in value-based care and technology to boost margins, or are you more cautious due to Medicare strategy challenges and regulatory headwinds?

This makes investing more dynamic and approachable; millions of investors on Simply Wall St’s Community page use Narratives to easily track how their perspectives, and the company’s evolving news or results, shape the fair value and whether the stock is trading below or above it.

If analysts expect UnitedHealth’s fair value to range from $198 up to $626 per share, a conservative investor might focus on the lower value due to potential Medicare risks, while an optimistic one could expect margin recovery and aim for the higher target. Narratives let you invest in a way that fits your own view and adapt quickly as real-world information changes.

Do you think there's more to the story for UnitedHealth Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UNH

UnitedHealth Group

Operates as a health care company in the United States and internationally.

Outstanding track record established dividend payer.

Similar Companies

Market Insights

Community Narratives