- United States

- /

- Healthcare Services

- /

- NYSE:UHS

Universal Health Services (UHS) Profit Margin Improvement Reinforces Value Narrative Despite Growth Forecasts Lagging US Market

Reviewed by Simply Wall St

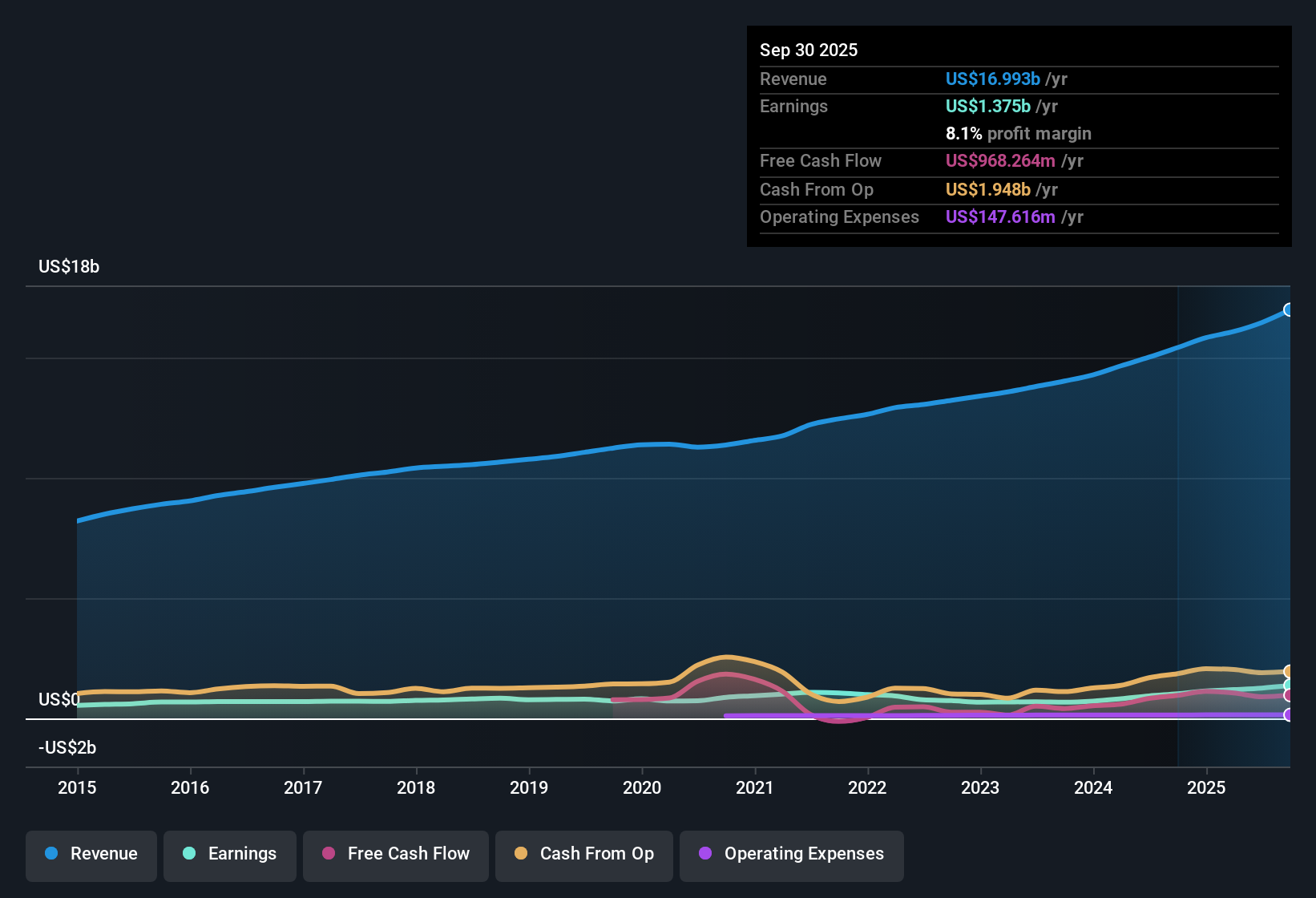

Universal Health Services (NYSE:UHS) delivered a standout year, with earnings climbing 34% over the past twelve months, well above its five-year average growth rate of 4.8% per year. Net profit margin improved to 8.1% from last year’s 6.7%, underscoring increasing profitability. While forecasts point to continued earnings and revenue growth ahead, both are expected to trail the broader US market. This keeps the stock’s position as a value play in the sector front of mind for investors.

See our full analysis for Universal Health Services.The next step is comparing these results with the prevailing market narratives to see which views stand up to scrutiny and which might get a shakeup.

See what the community is saying about Universal Health Services

Behavioral Health Expansion Drives Long-Term Growth

- UHS is building out outpatient behavioral health facilities to capture rising demand, which analysts expect will support revenue growth of 5.0% annually and keep profit margins steady at 7.7% over the next three years.

- Analysts' consensus view points to the company’s focus on expanding into higher-margin, lower-cost care settings as a clear catalyst for sustained top-line and EBITDA growth.

- The combination of new hospital openings and increased outpatient capacity is expected to benefit from societal trends toward mental health awareness. This will help UHS outpace structural shifts in healthcare demand.

- As payer mixes improve and digital health investments are rolled out, management anticipates additional margin gains and resilience in the face of reimbursement or labor cost challenges.

Regulatory and Labor Risks Could Cap Upside

- UHS faces projected annual reductions of $360 to $400 million in supplemental Medicaid payments by 2032 due to regulatory reforms. Increasing labor costs and workforce shortages threaten to compress margins and limit volume growth, especially in behavioral health.

- The consensus narrative flags these structural risks as the main factors that could blunt long-term revenue and earnings momentum.

- Persistent difficulty in recruiting specialized staff and rising nonprofessional labor costs may constrain the growth anticipated from the outpatient expansion strategy.

- Heavy exposure to government payors means that any change in Medicaid rates or coverage rules could result in swift impacts on UHS’s net revenue and pricing power.

Valuation Discount Remains vs Peers

- UHS trades at a P/E ratio of 10.2x, well below both its peers (21.8x) and the US healthcare industry average (21.6x). The current share price of $219.32 is markedly under the analyst price target of $230.69.

- According to the consensus narrative, analysts see this steep discount as reflecting both modest growth projections and investors' worries about profit headwinds. It is also seen as an opportunity for value-focused investors.

- Future earnings targets assume a steady margin of 7.7% and robust buyback activity, supporting the research team’s argument that even moderate improvement in investor sentiment could close part of the valuation gap.

- To reach the analyst target, the company would need to hold profit margins and deliver on forecasted top-line growth, which consensus believes is achievable if operational headwinds remain manageable.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Universal Health Services on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a fresh take on the figures? Share your interpretation and shape your investment insights in just a few minutes: Do it your way

A great starting point for your Universal Health Services research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite Universal Health Services’ undervalued share price, persistent regulatory pressures and rising labor costs may cap its long-term earnings and margin improvement.

If you’d rather target companies delivering consistent results through economic cycles, discover those with steadier financial track records through our stable growth stocks screener (2116 results) collection.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UHS

Universal Health Services

Through its subsidiaries, owns and operates acute care hospitals, and outpatient and behavioral health care facilities.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives