- United States

- /

- Healthcare Services

- /

- NYSE:THC

Why Tenet Healthcare (THC) Is Up 5.5% After Analyst Upgrades Signal Rising Industry Optimism

Reviewed by Sasha Jovanovic

- In recent days, Tenet Healthcare has received multiple analyst upgrades and raised ratings from major financial institutions, signaling increased industry optimism about the company's outlook and performance.

- This heightened analyst confidence comes at a time when the company is actively investing in expanding its healthcare footprint and operational capabilities across the United States.

- We’ll examine how the wave of analyst upgrades underscores investor confidence in Tenet Healthcare’s long-term growth story and prospects.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Tenet Healthcare Investment Narrative Recap

Investing in Tenet Healthcare means believing in the ongoing demand for hospital and outpatient services as demographic shifts and ambulatory expansion drive revenue growth, while policy stability and payer dynamics remain crucial wildcards. The recent wave of analyst upgrades and price target increases highlight short-term optimism, but the core near-term catalyst, volume stabilization in the hospital segment, remains sensitive to any sustained softness in admissions; the biggest risk is still sudden regulatory changes to Medicaid supplemental payments, which could materially alter forecasted earnings. These analyst actions mainly reinforce sentiment, rather than changing the immediate risks or catalysts facing the business.

One important company announcement this quarter is the significant increase in Tenet’s share buyback authorization, doubling it to US$3,000 million following recent buyback activity. While this capital return signals confidence, it primarily supports shareholder value against a backdrop where operational execution and hospital volume trends are likely to remain the focus for most investors.

However, investors should watch closely for any signs of regulatory uncertainty around Medicaid or supplemental payments, as this remains...

Read the full narrative on Tenet Healthcare (it's free!)

Tenet Healthcare is forecast to generate $23.3 billion in revenue and $1.4 billion in earnings by 2028. This outlook reflects an annual revenue growth rate of 4.0%, but a decrease in earnings of $0.1 billion from the current $1.5 billion.

Uncover how Tenet Healthcare's forecasts yield a $204.90 fair value, in line with its current price.

Exploring Other Perspectives

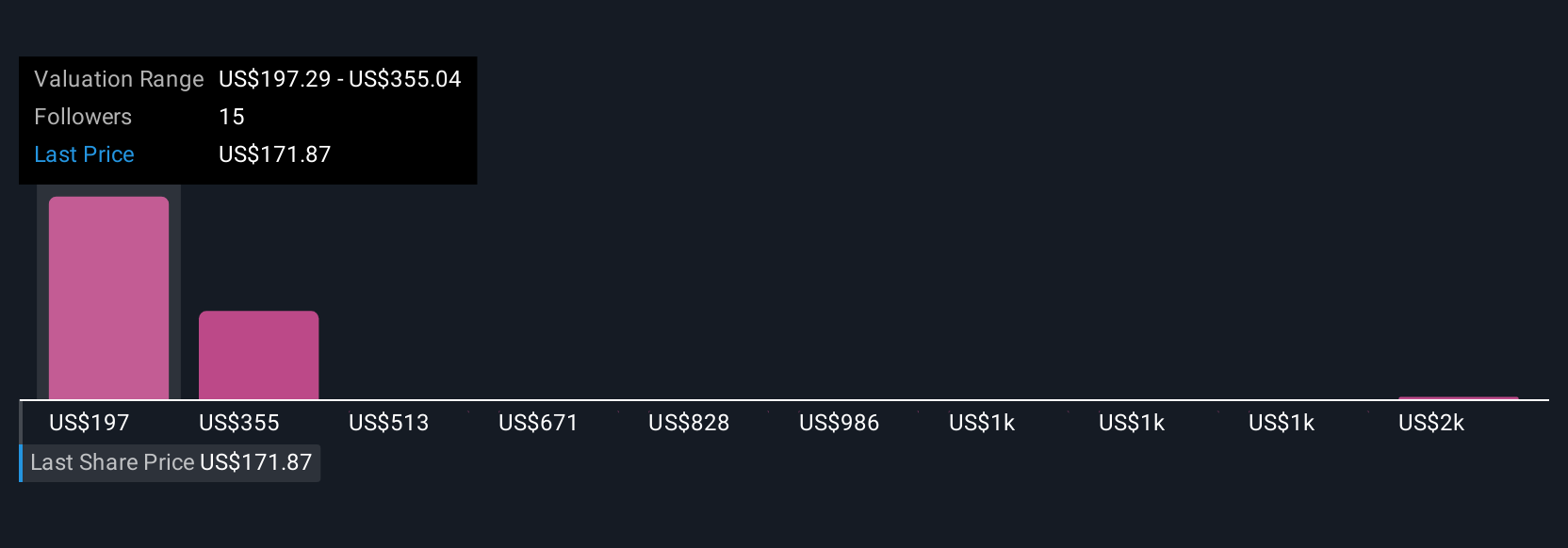

Simply Wall St Community members produced 3 distinct fair value forecasts, ranging from US$204.90 up to US$1,774.85 per share. While opinions vary widely, many are looking for growth to come from Tenet’s ambulatory and outpatient expansion, highlighting how broader industry shifts can shape divergent outlooks.

Explore 3 other fair value estimates on Tenet Healthcare - why the stock might be worth just $204.90!

Build Your Own Tenet Healthcare Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tenet Healthcare research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Tenet Healthcare research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tenet Healthcare's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tenet Healthcare might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:THC

Tenet Healthcare

Operates as a diversified healthcare services company in the United States.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives